Market volatility is scary enough for everyday investors; it’s doubly frightening for folks in or near retirement. Over the last year (and especially the past quarter) shakiness in both equity and fixed income securities has been magnified by fears of Fed action, trade tensions and myriad other dreads.

For the growing number of Americans using target-date mutual funds, the trepidation is palpable. These “set it and forget it” investments automatically adjust their portfolios to become slowly more conservative as the account owner ages. The glide path typically ends with an asset mix weighted more heavily in favor of bonds, in the hope of providing the investor with steady income and relatively stable value throughout retirement.

Given the markets’ present instability and the increasing likelihood of a recession, can these funds deliver the income and constancy investors will require during their golden years? What should investors reasonably expect of their “in-retirement” funds given the current market environment?

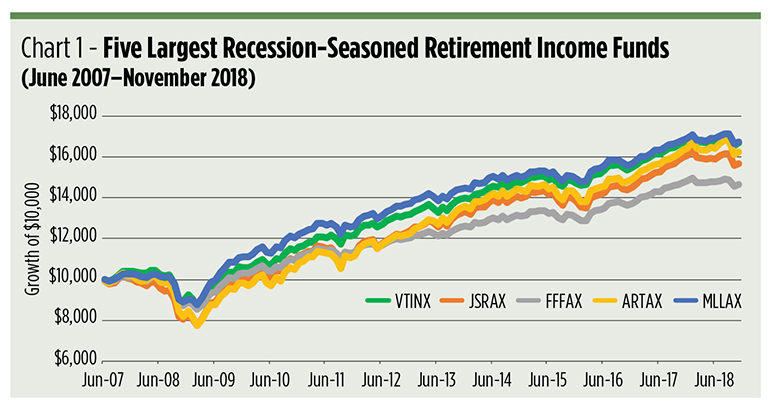

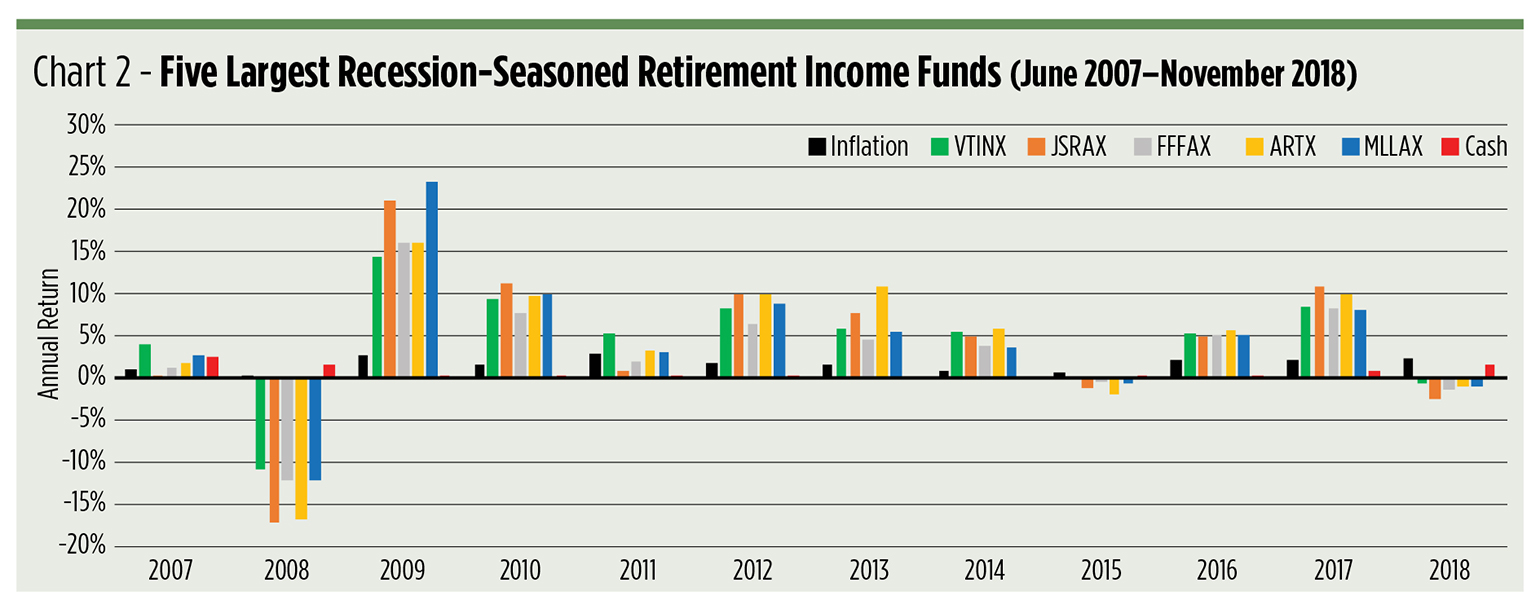

We looked to the past for an answer. We sought out retirement income funds that survived a major market upheaval, then traced their histories to the present. Our search brought us to a dozen portfolios that outlived the 2007 sub-prime mortgage crisis and its ensuing recession. Each of these funds offers a distinctive amalgam of risks and potential rewards, which are especially highlighted when benchmarked against a cash equivalent such as the one-month Treasury bill.

No single fund is likely to appeal to all retirees, of course, so we divvied up the funds into eight “best of” categories. Investors and advisors may wish to weight each of these factors in their own decision matrices to help identify those portfolios representing optimal combinations of their desired attributes.

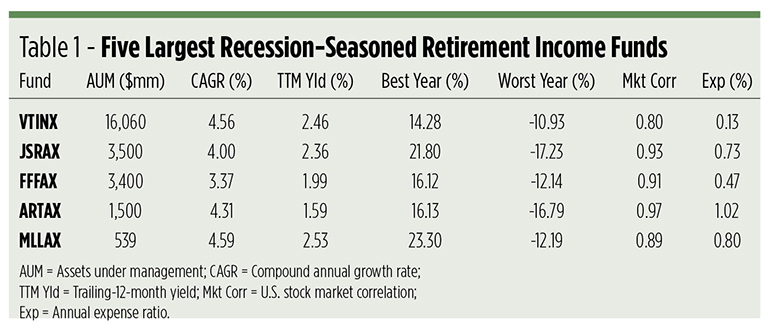

First, a little perspective. Some funds are bigger than others. Five funds, in fact, account for the vast majority of seasoned retirement income portfolio assets. These five appear in most of the “best of” groupings, so they’re worthy of some introduction.

The “Big Five”

The 800-pound gorilla is the $16 billion Vanguard Target Retirement Income Fund (VTINX). It’s easy to see why this is the biggest fund in the field. With an annual expense ratio of just 13 basis points (0.13 percent), VTINX is the cheapest, by far, to hold. Factorwise, this fund tilts definitively toward stability, or low volatility. At last look, the portfolio’s allocation to stocks was 29 percent, with 68 percent committed to bonds. Cash accounts for 3 percent. Nearly half of the fund’s equity exposure comes from domestic large-cap growth stocks and, at 36 percent, its largest fixed income allocation is to short-term Treasury securities.

Reflecting its 36 percent weighting in stocks, momentum, rather than stability, figures more significantly in the JPMorgan SmartRetirement Income Fund (JSRAX) allocation. That’s amply demonstrated by the fund’s best- and worst-year performance stats. With 5 percent kept in cash, JSRAX gives 59 percent of its heft to bonds.

Nearly equaling JSRAX’s asset base, the Fidelity Freedom Income Fund (FFFAX), like VTINX, aims for stability. FFFAX is, in fact, more conservative than the Vanguard portfolio. Fidelity’s managers keep 21 percent of the fund’s assets in cash and dole out just 17 percent to equities.

At 102 basis points, the American Century One Choice in Retirement Portfolio (ARTAX) is the most expensive fund of the lot. Keeping 13 percent of the portfolio in cash leaves the balance fairly evenly split between equities (42 percent) and bonds (45 percent). Large-cap growth stocks make up 19 percent of the portfolio’s capitalization, balanced by a 39 percent allocation to short-term Treasurys.

The $539 million MFS Lifetime Income Fund (MLLAX) may be the smallest portfolio in the table, but it punches above its weight. Fully 70 percent of the fund’s assets are in fixed -income securities, leaving 26 percent committed to stocks and 4 percent in cash. Short-term Treasurys make up 55 percent of the fund’s weight, while large-cap growth stocks account for 13 percent.

Table 1 highlights the standout performance of the MLLAX portfolio in two key metrics: annualized returns and current yield. The MFS fund, indeed, tops our universe for average returns, but two smaller funds currently offer higher payouts.

Eight key metrics

Highest returns – MLLAX edges out the Vanguard fund by just 3 basis points on gross returns as well as on an inflation-adjusted basis. The MFS portfolio racked up an average after-inflation return of 2.85 percent versus 2.82 percent for VTINX. The risk-free cash return over the period averaged just 61 basis points and, after adjusting for inflation, turns negative at –1.06 percent.

Highest yield – Among recession-seasoned funds, the best trailing-12-month yield is claimed by the $49 million Franklin LifeSmart Retirement Income Fund (FTRAX).

FTRAX clocks in at 4.08 percent, nearly a full point ahead of the 3.10 percent yield of the Putnam Retirement Income Lifestyle 1 A Fund (PRMAX). MLLAX comes in third, followed by VTINX. By comparison, the current yield on cash is 1.62 percent.

Highest Sortino ratio – This metric goes one step beyond the Sharpe ratio by revealing the degree to which a fund’s return exceeds its downside variation. A high ratio (over 1.00) signifies a fund that completely overcomes its harmful volatility. MLLAX does best with its 1.17 ratio. VTINX checks in at 1.07 while FFFAX posts a 0.88 reading.

Highest information ratio – This is typically the highest hurdle portfolio managers encounter. The ratio measures the payback earned for taking active risks. A fund earning a ratio between 0.40 and 0.60 is generally considered a good investment while exceptional funds pull down ratios between 0.61 and 1.00. Three retirement income funds earn exceptional credit: MLLAX is tops at 0.76 and VTINX, at 0.73, is close behind. Fidelity’s FFFAX squeaks into the top tier with a 0.61 ratio.

Highest alpha – Alpha reflects the excess return earned by a portfolio over its beta-adjusted benchmark. With cash as a benchmark, alpha coefficients for our universe can be expected to be relatively high. And indeed they are. At the top, with an annualized alpha of 6.49 is JSRAX. ARTAX and FTRAX, both at 6.40, are hard on the heels of the JPMorgan fund. Tipping the scale at 6.04, the $110 million BlackRock LifePath Dynamic Retirement Fund (LPRAX) follows, just ahead of the MLLAX portfolio with its 5.99 coefficient.

Lowest duration – Interest rate risk and volatility are interwoven in the duration metric. The higher a portfolio’s duration, the more sensitive it is to changes in prevailing rates. Duration’s a two-edged sword, of course. High duration would be a boon in a falling rate environment, but a drag when yields rise. Among the seasoned portfolios, the Putnam PRMAX fund, at 2.44 years, suffered the smallest loss when interest rates rose, followed by FTRAX at 2.84 years and MLLAX at 4.52 years.

Lowest expense ratio – As a retirement income fund is meant to be a long-term investment, holding costs matter mightily. After all, dollars spent to pay for management come directly out of returns. The Vanguard VTINX fund’s 13 basis point charge clearly makes it the low-cost leader. FFFAX comes in second at 47 basis points, followed by the $78 million Wells Fargo Target Today Fund (STWRX) with an annual cost of 65 basis points.

Lowest correlation to U.S. stocks – Diversifying away from equity market risk, to some degree or another, is the raison d’être of retirement income portfolios. In our universe, the fund that accomplishes this best is Wells Fargo’s STWRX, which earned a 0.69 correlation to the domestic equity market. Close by, with a 0.77 reading, is the Invesco Balanced-Risk Retirement Now Fund (IANAX). Vanguard’s VTINX 0.80 coefficient puts it in third place.

Putting it all together

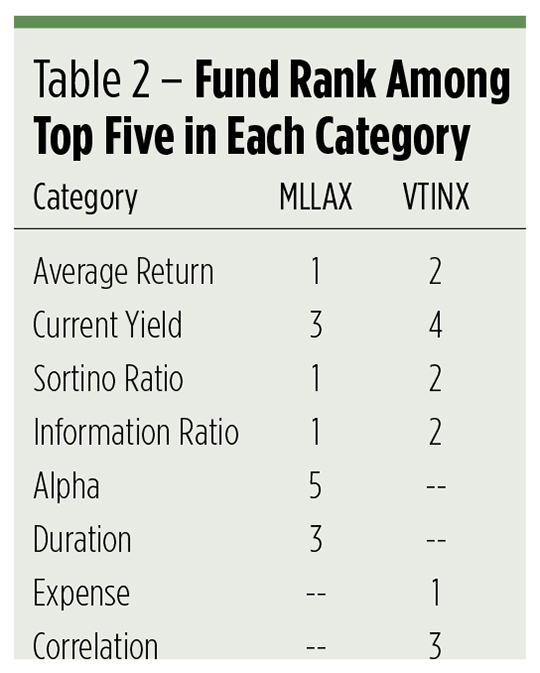

So, which fund is best? To answer that question, start by looking for leaders in each of the eight categories described above. You’ll find that no single fund ranks in the top of all eight. Neither does any fund lead in seven categories. But two funds – VTINX and MLLAX – appear in six “best of” groupings.

Head-to-head, these two funds seem evenly matched. Each notches the same average rank if you weight each category equally. Investors and advisors may have differing opinions on the importance of one factor or another, however, and may wish to weight each factor differentially. If annual expense is deemed most important, for example, an investor may assign a higher value to the Vanguard VTINX portfolio in the decision matrix. If inflation-adjusted returns are more significant in an advisor’s view, the MFS MLLAX fund might benefit with a higher weighted score.

Deciding on a suitable retirement income fund is an intensely personal process. Former Treasury Secretary Tim Geithner once said the most consequential choices involve shades of gray. Gauging the past performance of retirement income funds in times of extreme stress may not be a perfect way forward, but it could be the closest we can come to making a black-and-white decision for the future.

Brad Zigler is WealthManagement's Alternative Investments Editor. Previously, he was the head of Marketing, Research and Education for the Pacific Exchange's (now NYSE Arca) option market and the iShares complex of exchange traded funds.