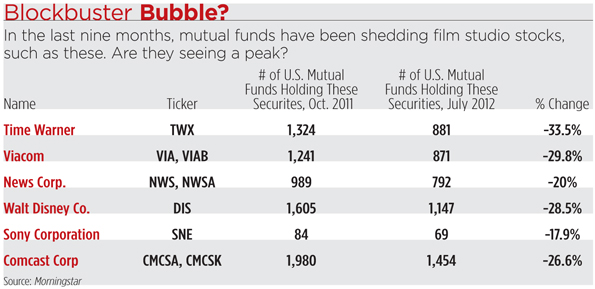

There’s no business like show business, except when it comes to investing. The number of U.S. mutual funds holding the stock of major film studios has significantly declined in the last nine months, according to data from Morningstar. The number holding Time Warner (TWX), for example, declined 33.5 percent since October 2011. In general, consumer discretionary stocks, the banner under which entertainment stocks tend to fall, have had a good run in the last couple years, so it would make sense for some managers to trim their exposure and rotate into other sectors that are undervalued, says Todd Rosenbluth, a mutual fund analyst with S&P Capital IQ. In July, S&P Capital IQ lowered its outlook for the consumer discretionary sector from overweight to marketweight, because they believe the sector is overvalued given the fundamentals. “I could certainly understand why someone who’s got a value slant to their portfolio would think that the group may have less upside potential,” Rosenbluth says. In fact, many of the mutual funds selling their holdings in these stocks are value-oriented, such as the Dodge & Cox Stock Fund (DODGX), which recently sold Sony, Comcast, Time Warner and News Corp., parent company of Twentieth Century Fox.