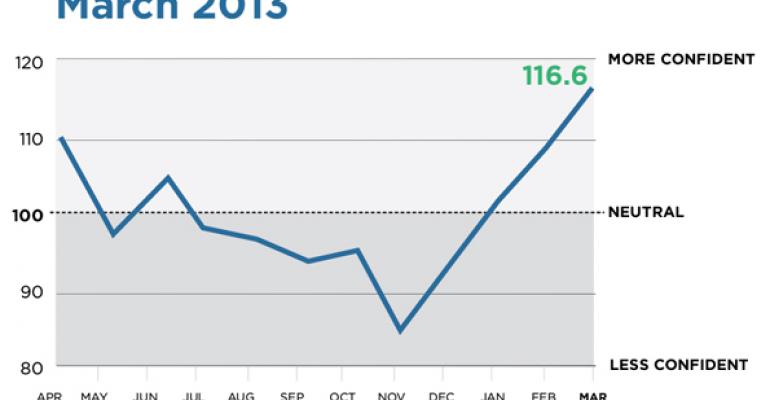

Penton’s WealthManagement.com Advisor Confidence Index (ACI), a benchmark of financial advisors’ views on the U.S. economy and the stock market, grew 6.31 percent in March. It is the slowest rate of growth since the end of last year as lowered optimism over the future of the U.S. economy and the stock market has dampened advisors’ overall outlook.

WealthManagement.com’s Advisor Confidence Index (ACI) is a monthly benchmark with an eight-year history that gauges registered investment advisor (RIA) views on the U. S economy and the stock market. ACI data is compiled from a survey 300+ panel members that work at leading RIA firms who are prequalified for their industry experience and assets under management. The survey asks advisors for their views on the outlook for the economy now, in six months, in twelve months, and on the stock market.

After a steady increase in confidence since the end of last year, advisors’ belief in the continued future improvement of the market and the economy has started to moderate. To be sure, March marks the fourth month in a row that the overall index has climbed higher, supported by increases in all four of the underlying components.

Yet looking closer, growth in the component of the index that gauges confidence in the economy in twelve months grew at a slower rate of only 4%; likewise, fewer advisors registered a positive outlook for equity markets over the next six months. That index has grown at a rate of 2.3%, its slowest rate in five months.

“Though the economy appears to be strengthening in the short-run, it may be illusory over the longer-term. Europe is still a major problem, sequestration will slow the economy, Government spending is out of control and unconscionable, and interest rates may be heading much higher, creating even worse implications for the deficit problem,” says ACI panelist Kevin Stockton, an advisor with Horter Investment Management.

Many WealthManagement.com advisory panelists were concerned that the stock market has gotten away from itself, in part the result of the continued low interest rate environment.

“I am uncomfortably pleased with the results from the equity markets. While the numbers are great, I am highly concerned that the markets have come too far, too fast. Watch out for falling numbers when the Fed changes its current monetary course,” says ACI panelist Harris Nydick, an advisor with CFS Investment Advisory Services.

Not all panelists agreed; many saw more fundemental improvements in the economy that they expect to last. “Reduced market volatility, as the result of establishing fiscal and tax policies, is providing a basis for improved business and consumer confidence in 2013,” says Paul S. King, of King Wealth Planning.

“People are tired of miniscule returns in their bank accounts and low bond yields. Stocks continue to offer a superior risk adjusted return for even the most risk averse investors,” Says Jon Kmett of SFE Investment Counsel.