No one today makes even casual financial decisions in a vacuum. If you want to book a vacation, you check TripAdvisor. Before you invest in a restaurant, you fire up Yelp. Angie’s List is the go-to platform for when you want to find a babysitter, plumber or dentist.

But when it comes to evaluating prospective financial advisors, potential clients are still in the dark—for the most part. More and more investors turn to the Web for meaningful evaluations of specific advisors, and it’s the Wild, Wild West.

“The landscape is very much a work in progress,” according to Richard Eisenberg, Money Editor at PBS Next Avenue.org. “It’s very easy to access directories of financial advisors and to find out whether they’ve faced disciplinary actions. But what is still not easy to find is experienced-based evaluations from real investors about particular investment professionals and what they liked and didn’t like.”

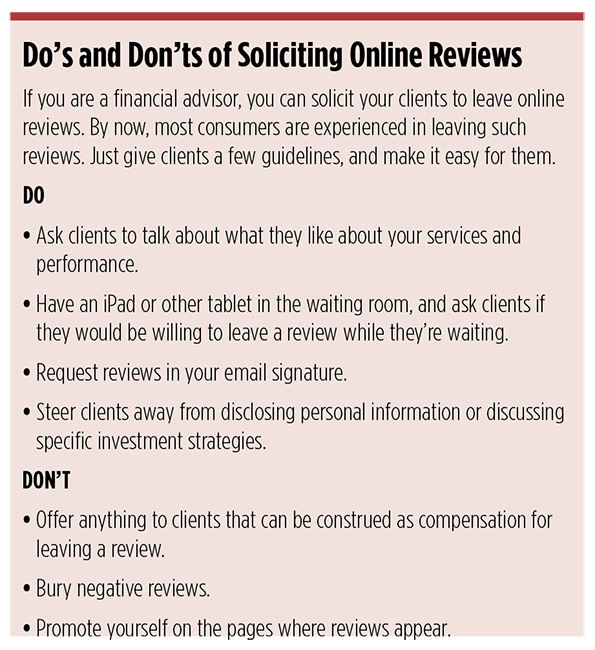

But financial advisor reviews are out there, and there will be more reviews of all kinds, not fewer. The SEC has basically blessed them. Financial advisors can see independent client reviews as hazards or opportunities.

Moving Pieces

Two factors ensure that we will see more independent customer reviews of financial advisors.

First, the Securities and Exchange Commission has relaxed its testimonial rule, which previously opposed everything from Facebook likes to online reviews. The agency recently released long-awaited guidance clarifying advisors’ use of testimonials on social media.

Recent Guidance on the SEC Testimonial Rule

The SEC’s Division of Investment Management issued a guidance to assist firms in applying section 206(4) of the Investment Advisers Act of 1940 and rule 206(4)-1(a)(1), the “testimonial rule,” to their use of social media. Basically, the guidance addresses questions concerning investment advisors’ use of social media and materials that feature public commentary about them that appears on independent, third-party social media sites. The bottom line: “an investment advisor’s or investment advisory representative’s (IAR’s) publication of all of the testimonials about the investment advisor or IAR from an independent social media site on the investment advisor’s or IAR’s own social media site or website would not implicate the concern underlying the testimonial rule.” It seems that if an advisor has no control over the content of the third-party review, the reviewer is not compensated in any way, the advisor publishes all reviews positive and negative, and refrains from promotion on the pages where such testimonials appear, then the advisor will be in compliance.

Second, while you can find the occasional review of advisors on Yelp, Angie’s List and Google, a number of sites focused on reviews of FAs are in various stages of evolution. One of these may well emerge as the go-to site for reviews of financial advisors.

Many Sites for Reviews

WalletHub.com, launched by Evolution Finance in 2012, aspires to be the Yelp of financial advisors. While the site claims to list about half the nation’s advisors, actual reviews from current and former clients are hit or miss. Wallet Hub didn’t list, much less review, five independent advisors I submitted on a random basis. Most advisors on the site have just one review.

Jill Gonzalez, an analyst at Wallet Hub in Washington, D.C., believes that the number of ratings will increase once potential investors realize a platform for such reviews exist.

Another site is NerdWallet, which scores advisors on how users rate their answers to questions they’ve posed. Tippybob is an online community of financial advisors with ratings and reviews from actual investors. Brightscope focuses on 401(k) providers and assigns rankings based on the quality of the contributions that advisors post on its site. Paladin Research and Registry vets, rates and documents the quality of financial advisors.

All of these sites have from a common problem: Few advisors have a big enough volume to make client reviews meaningful. Even if an advisor has a very large client base of say, 200 clients, he or she may get two to four reviews per year, given that only 1-2 percent of clients ever leave reviews.

The ultimate question for potential investors: Is one or two reviews better than no reviews?

“I incline to the school of thought that says some information is better than no information,” Eisenberg says. “I know these reviews represent a small sample. I certainly wouldn’t recommend a client use one review as a basis for a final decision. But as an extra data point, it has a place in the mix.”

Quantitative Reviews

Some advisors scoff at the idea that clients can reasonably evaluate their professional services. But that horse has left the barn. “Millennials and Gen Xers are more likely to consult these Yelp-like environments, and advisors who refuse to participate will be penalized,” says WalletHub’s Gonzalez.

But for those who question the whole value of qualitative, subjective reviews of advisors, there is now a site that seeks to aggregate quantitative reviews of specific advisors. GradeMyAdvisor.com rates advisors objectively based on portfolio performance and the risk taken to achieve that performance. In other words, it uses portfolio performance as the sole proxy for advisor excellence.

GradeMyAdvisor is free and confidential for clients. After a client registers, they can upload their portfolio, and the service analyzes if the person’s allocation matches up with their objectives. It then assigns the advisor a grade from A to D.

“GradeMyAdvisor.com is the only quantitative review out there,” says Norman Pappous, president of the Galveston, Texas-based company. “We provide nothing qualitative. We don’t care if the advisor is a nice guy or gives to charity. We believe that isn’t the way to choose a financial advisor.” The site will be available on a subscription model.

Currently, one can upload up to 90 days of history on GradeMyAdvisor for a free report. Pappous concedes that real confidence requires up to three years of data. “We believe a skilled advisor is the best asset in a client’s portfolio. We want GradeMyAdvisor to identify such advisors.”

No platform is anywhere near the critical mass that Yelp has reached for restaurant reviews, Angie’s List for consumer service providers, or TripAdvisor for vacations. For now, advisors have a number of options to choose from. But choose they should if they want to be discovered by the new generation of investors. Financial advisors cannot hide or resist the trend to maximize transparency. Success will go to advisors who not only ensure that their clients are satisfied with their service, but also encourage clients to share their experience.