Creating content isn’t solely for building a following and reaching new people. Our latest study of 1,002 investors found that social media content plays a significant role in referral flow. There's a strong connection between an advisor's content marketing efforts and an affluent client’s willingness to refer.

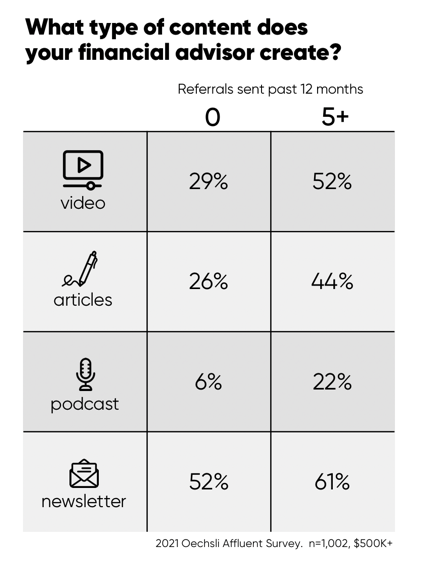

We divided affluent respondents into two groups. The first group sent zero referrals over the past 12 months and the second group sent five or more. Those in the high-referral category were more likely to be working with an advisor who creates videos, articles, podcasts or newsletters.

The question then becomes...why would a client be more willing to recommend an advisor based on their social content? We believe it occurs for three reasons:

1. Ease of Sharing. When a service provider creates content, it’s easier to pass them along to others. Forwarding a video, engaging with a post, texting an article or tagging a friend is quick and simple. The more social networks you leverage, the simpler you are to share.

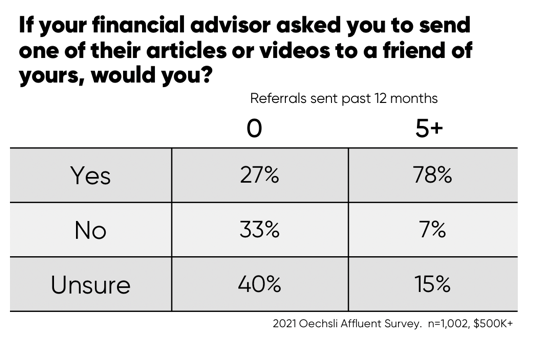

While most sharing will happen organically, you can also proactively ask clients to distribute your content. Seventy-six percent of those in the high referral category would send their advisor’s content to a friend upon request. So, the next time you create a video specific to a particular niche, ask one of your clients who has connections in that area to share it with a friend. It’s an easy way to introduce yourself.

2. Opportunity to Share. Imagine you have two service providers: a housekeeper and a landscaper, and they both do a great job for you. The housekeeper isn’t much of a marketer and doesn’t have a website or social presence. The landscaper, however, offers weekly landscaping videos through Facebook and Instagram. All else equal, who would you be more likely to refer? We’d argue it’s the landscaper as you’re seeing him much more often.

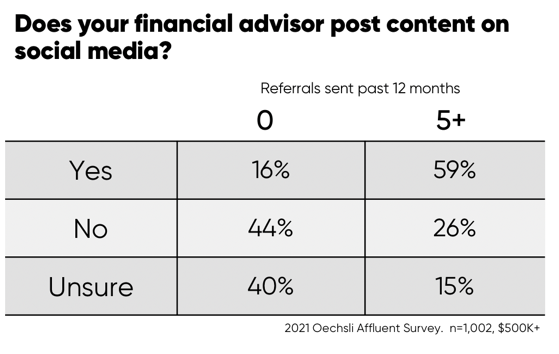

The value of being top-of-mind cannot be overstated. You want to be on your consumer’s mind when they have a friend in need. In our study, the high-referral category was much more likely to have a financial advisor who posts on social media.

3. Desire to Share. During my college years, there was nothing more exciting to me than sharing the newest underground musician that had yet to “sell-out.” I wanted to be seen as someone who was “in the know” and I felt having this knowledge was a reflection of my passion for music.

Think about a podcast you’ve turned someone onto, a Netflix series you’ve shared or a winery you recommended. Because you felt like it was unique, special or trendsetting, it increased your desire to share it.

Think about this from your clients’ perspective. What could you put out that they’d be excited to share? Hint—it’s likely not basic or boilerplate financial posts. It’s probably content that features you (podcast, videos or articles for example). When you create great content that clients and COIs actually find valuable and entertaining, they tend to share it more often with others.

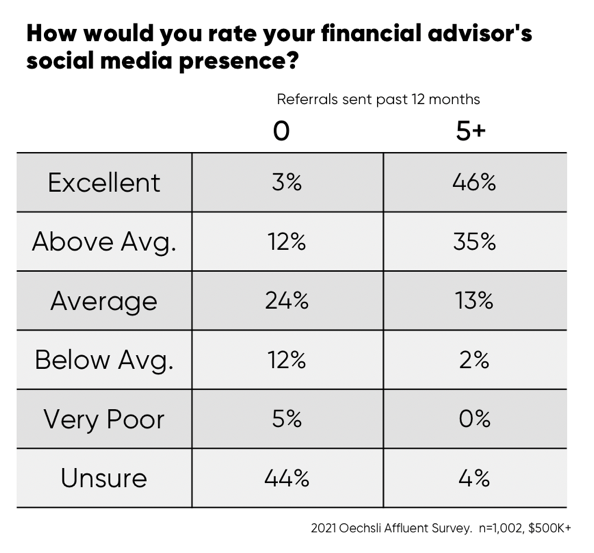

Our study also found that the high-referral category was much more likely to rate their advisor’s social media presence as “excellent” or “above average.”

When asked, most financial advisors report “referrals” as their primary source of new business. However, tracking referral attribution can be nearly impossible. In reality, there are numerous factors that surmount to an advisor receiving more referrals. That said, our research clearly indicates that content marketing plays an influential and irreplaceable role.

Kevin Nichols is a partner with The Oechsli Institute, a firm that specializes in research and training for the financial services industry. @KevinANichols www.oechsli.com