My ratings on ETFs are unique because they are based on my stock ratings for each of a fund’s holdings.

Ergo, the “Most Dangerous” ETFs allocate the most capital to stocks on March’s Most Dangerous Stocks list, which was available for non-subscribers as of 3/7. There are 40 stocks on the Most Dangerous list every month.

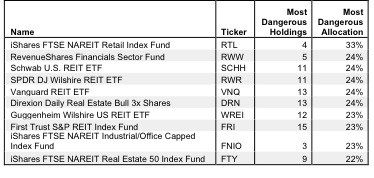

10 Most Dangerous ETFs as of

Sources: New Constructs, LLC and company filing

The figure above shows the number of Most Dangerous stocks held by the ETFs along with the percentage of the ETF’s portfolio allocated to stocks on March’s Most Dangerous Stocks list. There is a much larger range in the number of Most Dangerous stocks held by these ETFs than in the level of allocation. My series of 26 articles on the Best & Worst Funds highlights that the number of holdings in ETFs vary greatly and cannot be relied upon as an indicator of quality or lack thereof.

Naturally, most of these ETFs get my Very Dangerous fund rating because of their large allocations to stocks on the Most Dangerous list. Reports and ratings on all ETFs in the Figure above are here.

It is possible, however, for an ETF to have one of the top 10 largest allocations to stocks on the Most Dangerous stocks list and not get my Very Dangerous fund rating. This is possible only when the ETF allocates the remainder of its portfolio to enough Neutral-or-better rated stocks.

Such is the case with RevenueShares Financial Sector Fund [s: RWW], which gets my Dangerous rating. As shown in my report on RWW, it allocates over 26% of its portfolio to Neutral-or-better stocks, which earns it a Dangerous rating instead of the worst-case Very Dangerous.

For example, the largest holding in RWW is Bank of America [s: BAC], which gets my Very Dangerous rating and is a member of March’s Most Dangerous Stocks. The second largest holding is Berkshire Hathaway [s: BRK.B], which gets my Neutral rating.

Last week, I recommended investors take profits in BAC. As I wrote in “Time to unload Bank of America” and “Raising fees at BofA is a desperate move”, BAC is facing serious headwinds as a company and a stock. Regulatory restrictions have all but killed off their trading and investment banking profit centers. The company has been forced to resort to multiple accounting gimmicks (SFAS 159 and drawing down reserves by $13.3 billion) to prop up earnings while cash flows are on the decline.

At ~$8/share, the current valuation of BAC implies 20% compounded annual revenue growth for 18 years along with an improvement in ROIC from -2% to over 12% at the same time. Those expectations imply the stock is greatly overvalued. It is difficult to grow a business, especially at a high rate, when you are running off customers by raising consumer banking fees.

By comparison, BRK.B has very reasonable valuation. At ~$79/share, the current valuation implies the company will grow its after-tax cash flow (NOPAT) by 8% for five years. Over the same time, the company’s ROIC is expected to rise from 5.9% to 6.7%.

The economics of BRK.B’s business are meaningfully better than BAC as well. The company generated $826 million in free cash flow. Decent cash flows and a relatively cheap valuation earn this stock a Neutral rating.

RWW’s large allocation to BRK.B and several other Neutral-rated stocks earn the ETF a Neutral rating.

Note that Berkshire Hathaway is registered under the ticker BRK.A, not BRK.B, on my free stock screener, which provides my ratings on 3000+ stocks updated daily.

My free fund screener provides ratings and free reports on 7400+ ETFs and mutual funds, including all of the ETFs in the Figure above. All ratings are updated daily.

Disclosure: David Trainer owns GOOG, LO, INTC, ORCL, and WAG. He receives no compensation to write about any specific stock, sector or theme.

David Trainer is an investment strategist and corporate finance expert. He is CEO of New Constructs, a research firm. He specializes in analyzing stocks and markets based on the true economics of business performance rather than misleading accounting data. He is author of the chapter “Modern Tools for Valuation” in The Valuation Handbook (Wiley Finance 2010).

To read more from David Trainer, The Intelligent Investor click here.

Our Philosophy About Research

Accounting data is not designed for equity investors, but for debt investors. Accounting data must be translated into economic earnings to understand the profitability and valuation relevant to equity investors. Respected investors (e.g. Adam Smith, Warren Buffett and Ben Graham) have repeatedly emphasized that accounting results should not be used to value stocks. Economic earnings are what matter because they are:

- Based on the complete set of financial information available.

- Standard for all companies.

- A more accurate representation of the true underlying cash flows of the business.

Additional Information

Incorporated in July 2002, New Constructs is an independent publisher of investment research that provides clients with consulting, advisory and research services. We specialize in quality-of-earnings, forensic accounting and discounted cash flow valuation analyses for all U.S. public companies. We translate accounting data from 10Ks into economic financial statements, i.e. NOPAT, Invested Capital, and WACC, to create economic earnings models, which are necessary to understand the true profitability and valuation of companies. Visit the Free Archive to download samples of our research.

New Constructs is a BBB accredited business and a member of the Investorside Research Association.

DISCLOSURES

New Constructs®, LLC (together with any subsidiaries and/or affiliates, “New Constructs”) is an independent organization with no management ties to the companies it covers. None of the members of New Constructs’ management team or the management team of any New Constructs’ affiliate holds a seat on the Board of Directors of any of the companies New Constructs covers. New Constructs does not perform any investment or merchant banking functions and does not operate a trading desk.

New Constructs’ Stock Ownership Policy prevents any of its employees or managers from engaging in Insider Trading and restricts any trading whereby an employee may exploit inside information regarding our stock research. In addition, employees and managers of the company are bound by a code of ethics that restricts them from purchasing or selling a security that they know or should have known was under consideration for inclusion in a New Constructs report nor may they purchase or sell a security for the first 15 days after New Constructs issues a report on that security.

New Constructs is affiliated with Novo Capital Management, LLC, the general partner of a hedge fund. At any particular time, New Constructs’ research recommendations may not coincide with the hedge fund’s holdings. However, in no event will the hedge fund receive any research information or recommendations in advance of the information that New Constructs provides to its other clients.

DISCLAIMERS

The information and opinions presented in this report are provided to you for information purposes only and are not to be used or considered as an offer or solicitation of an offer to buy or sell securities or other financial instruments. New Constructs has not taken any steps to ensure that the securities referred to in this report are suitable for any particular investor and nothing in this report constitutes investment, legal, accounting or tax advice. This report includes general information that does not take into account your individual circumstance, financial situation or needs, nor does it represent a personal recommendation to you. The investments or services contained or referred to in this report may not be suitable for you and it is recommended that you consult an independent investment advisor if you are in doubt about any such investments or investment services.

Information and opinions presented in this report have been obtained or derived from sources believed by New Constructs to be reliable, but New Constructs makes no representation as to their accuracy, authority, usefulness, reliability, timeliness or completeness. New Constructs accepts no liability for loss arising from the use of the information presented in this report, and New Constructs makes no warranty as to results that may be obtained from the information presented in this report. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information and opinions contained in this report reflect a judgment at its original date of publication by New Constructs and are subject to change without notice. New Constructs may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect the different assumptions, views and analytical methods of the analysts who prepared them and New Constructs is under no obligation to insure that such other reports are brought to the attention of any recipient of this report.

New Constructs’ reports are intended for distribution to its professional and institutional investor customers. Recipients who are not professionals or institutional investor customers of New Constructs should seek the advice of their independent financial advisor prior to making any investment decision or for any necessary explanation of its contents.

This report is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation or which would be subject New Constructs to any registration or licensing requirement within such jurisdiction.

This report may provide the addresses of websites. Except to the extent to which the report refers to New Constructs own website material, New Constructs has not reviewed the linked site and takes no responsibility for the content therein. Such address or hyperlink (including addresses or hyperlinks to New Constructs own website material) is provided solely for your convenience and the information and content of the linked site do not in any way form part of this report. Accessing such websites or following such hyperlink through this report shall be at your own risk.

All material in this report is the property of, and under copyright, of New Constructs. None of the contents, nor any copy of it, may be altered in any way, copied, or distributed or transmitted to any other party without the prior express written consent of New Constructs. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of New Constructs.

Copyright New Constructs, LLC 2003 through the present date. All rights reserved.