• Many income-seeking investors have found municipal bond ladder strategies to be an attractive option.

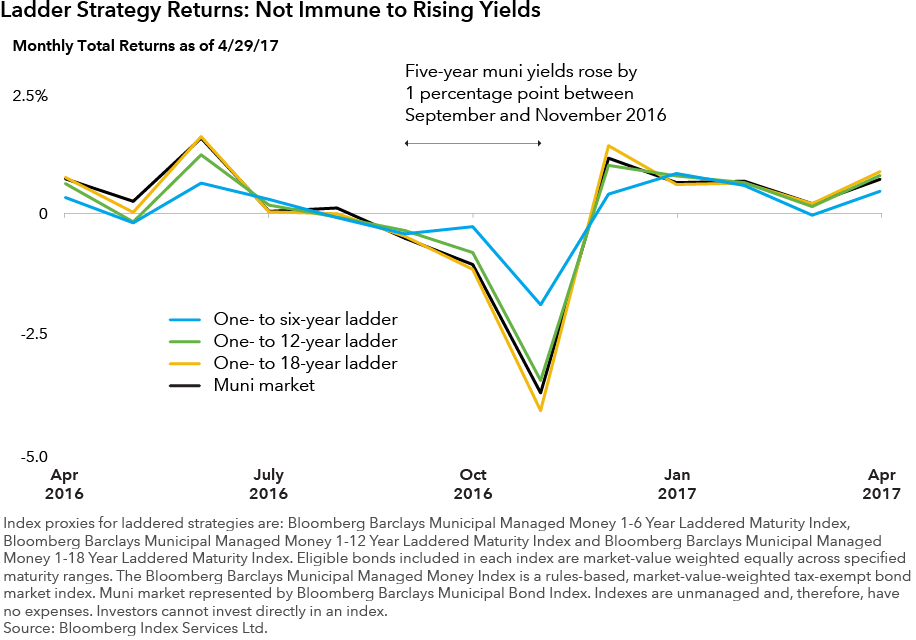

• Though bond ladders can have merit, recent market developments underscored that some strategies may be more exposed to interest rate risks than is widely appreciated.

• On the other hand, muni bond funds and separately managed accounts (SMAs) that have greater flexibility around management of duration, curve and credit exposures offer some distinct benefits.

2016 was a wake-up call for some investors in muni bond ladder strategies. Though ladders are widely viewed as a “stable” option for individual investors — especially amid rising interest rates — some ladder strategies suffered significant declines as muni yields rose.

Recent Slip Raises Questions

Bond ladder strategies typically lack flexibility around duration (a measure of a bond price’s sensitivity to interest rate risk) and yield curve positioning. Some of these strategies may, therefore, be unable to adapt as well to changing market conditions.

For 2017, how to invest amid higher interest rates is a key question. Ladder strategies may hold appeal for certain investors — though if rates move significantly higher, investors may be locked into lower yields for an extended period. In contrast, some muni funds can invest nimbly in an evolving environment.

What Are Bond Ladder Strategies?

Simplicity is one reason that ladder strategies remain popular with income-seeking investors. The basic idea of a bond ladder is to hold a portfolio of bonds that mature at regular intervals.

For example, a five-year ladder could consist of 10 bonds, with one bond maturing every six months. When the shortest tenor holding matures after six months, proceeds are reinvested in a five-year bond.

Then, after another six-month period, the second of the original holdings matures, and proceeds are reinvested in another five-year bond. In this way, maturing bonds are regularly rolled over, with all original holdings recycled after five years.

The Flip Side of Simplicity: Potential Limitations

Two “stability” arguments are typically cited in favor of individual investors using laddered portfolios. It’s often claimed that ladders give investors greater confidence that they’ll receive regular income and more control over bond selection.

On the question of confidence, it’s true that ladders are specifically constructed to generate regular income streams. That said, if a track record of consistent income generation is the goal, there are plenty of (non-ladder) muni funds that provide this opportunity.

Security selection for laddered portfolios is relatively constrained by the availability of bonds with the requisite maturities and credit ratings. For some laddered strategies, credit and other risks may not always be front and center:

• Credit risk. Seeking to enhance laddered portfolio yields by including bonds of lower credit quality without due regard to risks is not a good idea.

• Interest rate risk. Longer maturity ranges may increase volatility (five to 15 years, for instance, has become more popular, given lower yields in the one- to 10-year range).

• Lack of diversification. Laddered portfolios may include relatively concentrated exposures. This can also expose investors to greater volatility than anticipated.

Muni Funds and SMAs Have a Lot to Offer

Muni funds such as The Tax-Exempt Bond Fund of America® (our core muni bond fund offering), or the new suite of Capital Group Short, Intermediate and Long Municipal SMAs, are able to add value in three key ways:

• Security selection. The days of “buy and forget” are over. With munis now a credit- driven market, bond-by-bond and issuer-by-issuer research is crucial.

• Sector selection. Emphasizing different revenue bond sectors at different times can be a source of excess return.

• Duration and yield curve positioning. Managing overall interest rate sensitivity, and emphasizing bonds of certain maturities can also enhance returns. Different parts of the yield curve often move in distinct ways.

During the first quarter of 2017, for example, the five- to 10-year part of the muni yield curve steepened while the 10- to 20-year portion followed suit before flattening sharply. Resource recovery, leasing and housing bonds have outpaced broader muni market returns.

These are precisely the kinds of relative value opportunities that strategies lacking in flexibility are unable to tap into. Muni funds such as The Tax-Exempt Bond Fund of America, on the other hand, are able to invest nimbly and seek the most favorable risk- adjusted return potential.

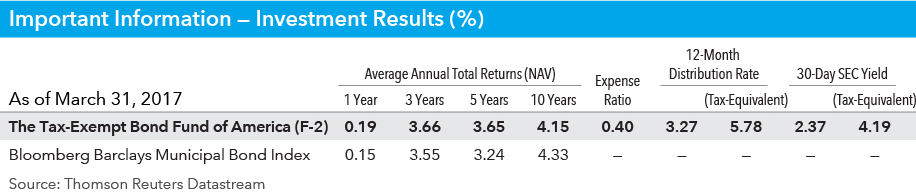

The Tax-Exempt Bond Fund of America Is a Muni Fund With a Compelling Track Record

The fund’s returns outpaced the muni market over one-, three- and five-year periods ended March 31, 2017. The fund’s investment objective is to provide a high level of current income exempt from federal income tax, consistent with the preservation of capital. Over the past five full calendar years, its average yield (12-month tax-exempt distribution rate) was 3.5%.

Figures shown are past results for Class F-2 shares and are not predictive of results in future periods. Current and future results may be lower or higher than those shown. Share prices and returns will vary, so investors may lose money. Investing for short periods makes losses more likely. Fund results shown are at net asset value with all distributions reinvested. Class F-2 shares are sold without any initial or contingent deferred sales charge. Results do not reflect annual asset-based fees charged by the sponsoring firm. For current information and month-end results, visit americanfunds.com.

Investments are not FDIC-insured, nor are they deposits of or guaranteed by a bank or any other entity, so they may lose value.

Investors should carefully consider investment objectives, risks, charges and expenses. This and other important information is contained in the fund prospectuses and summary prospectuses, which can be obtained from a financial professional and should be read carefully before investing. This material must be preceded or accompanied by a prospectus or summary prospectus for The Tax-Exempt Bond Fund of America.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and not to be comprehensive or to provide advice.

The Capital Group companies manage equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

The return of principal for bond funds and for funds with significant underlying bond holdings is not guaranteed. Fund shares are subject to the same interest rate, inflation and credit risks associated with the underlying bond holdings. Lower rated bonds are subject to greater fluctuations in value and risk of loss of income and principal than higher rated bonds. Income from municipal bonds may be subject to state or local income taxes. Certain other income, as well as capital gain distributions, may be taxable.

Bond ratings, which typically range from AAA/Aaa (highest) to D (lowest), are assigned by credit rating agencies such as Standard & Poor’s, Moody’s and/or Fitch, as an indication of an issuer’s creditworthiness.

The 12-month distribution rate for Class F-2 shares reflects the fund’s past dividends paid to shareholders. Class F-2 shares were first offered on August 1, 2008. Class F-2 returns prior to the date of first sale are hypothetical based on Class A share returns without a sales charge, adjusted for typical estimated expenses. Please see the fund’s prospectus for more information on specific expenses and the actual dates of first sale. Source: Thomson Reuters Lipper.

Methodology for calculation of taxable-equivalent yield: Based on 2016 federal tax rates. For the year 2016, there will be an unearned income Medicare contribution tax of 3.8% that applies to net investment income for taxpayers whose modified adjusted gross income exceeds $200,000 (for single filers) and $250,000 (for married filing jointly). Thus taxpayers in the highest tax bracket will face a combined 43.4% marginal tax rate on their investment income. The federal rates do not include an adjustment for the loss of personal exemptions and the phase-out of itemized deductions that are applicable to certain taxable income levels.

Annualized 30-day yield is calculated in accordance with the SEC formula and reflects the rate at which the fund is earning income on its current portfolio of securities. Accordingly, the fund’s SEC yield and distribution rate may differ.

Investment results assume all distributions are reinvested and reflect applicable fees and expenses. Expense ratios are as of each fund’s prospectus available at the time of publication. When applicable, investment results reflect fee waivers and/or expense reimbursements, without which results would have been lower. Please see americanfunds.com for more information. There have been periods when the fund has lagged the index.

Bloomberg® is a trademark of Bloomberg Finance L.P. (collectively with its affiliates, “Bloomberg”). Barclays® is a trademark of Barclays Bank PLC (collectively with its affiliates, “Barclays”), used under license. Neither Bloomberg nor Barclays approves or endorses this material, guarantees the accuracy or completeness of any information herein and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

The Standard & Poor’s 500 Composite Index is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2017 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

© 2017 Morningstar®, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results. These numbers were calculated by Capital Group based on underlying Morningstar data.

© 2017 American Funds Distributors, Inc.