• Emerging markets (EM) debt has rallied since the beginning of the year.

• This has been driven by a combination of improving economic expectations, ongoing demand for yield, an absence of events compelling investors to demand more risk compensation and a reasonable starting point for valuations.

• I broadly expect this environment to persist for EM for the rest of the year for several reasons.

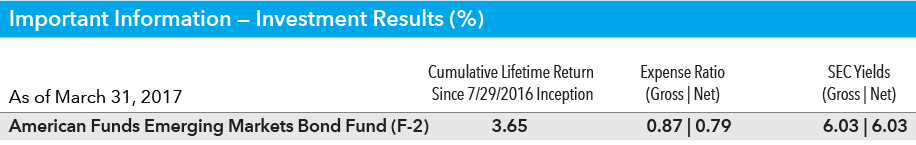

Figures shown are past results for Class F-2 shares and are not predictive of results in future periods. Current and future results may be lower or higher than those shown. Share prices and returns will vary, so investors may lose money. Investing for short periods makes losses more likely. For current information and month-end results, visit americanfunds.com

Emerging Markets Benefit From Better Global Growth and Mitigated Risks

One of the main causes for the selloff in EM assets following the U.S. election last year was the possibility that President Trump would impose trade restrictions on some EM countries, including China and Mexico, and that we might see faster interest rate increases in the U.S. Both of those risks seem to have faded.

In Europe, the U.K.’s process of exiting the European Union, Brexit, has now begun, and I don’t expect anything tangible to happen for some time. French elections have resulted in the election of a market-friendly president-elect in Emmanuel Macron. EM-specific risks remain relatively muted, although the recent political events in South Africa provide a reminder of how quickly EM political events can develop.

Meanwhile, recovering pickup in growth rates in the U.S., Europe and Japan should continue to provide a reasonable backdrop for emerging markets. In China, the government appears to be managing the deceleration of the economy to a slower growth rate. I expect the U.S. Federal Reserve to continue to raise interest rates steadily and to over-communicate its intentions. In a gradual rising-rate environment accompanied by growth, EM (and other higher yielding products) tends to outperform other fixed income asset classes.

Bond Valuations Look Reasonable While Exchange Rates Are Starting to Look Attractive

While valuations are not cheap, I believe that current spread levels (the difference in EM bond yields and Treasury yields) compensate for known risks. If spreads remain broadly stable, as I expect they will, then they offer a reasonable yield. For example, the average yield to maturity of American Funds Emerging Markets Bond FundSM was 6.7% at the end of March. Meanwhile, steeper EM yield curves and positive real rates (nominal yield minus inflation) make EM local currency bonds look particularly attractive. While inflation is generally picking up in EM, some markets (e.g. Russia and Brazil) are also experiencing disinflation.

In an environment of stronger global growth and slowly rising U.S. interest rates, many EM exchange rates look more attractive. On a real effective exchange rate basis, this has been the case for some time. Now, however, they are also supported by positive real rates and a more constructive global environment. In the absence of other dynamics, I expect many EM currencies to strengthen.

Investments are not FDIC-insured, nor are they deposits of or guaranteed by a bank or any other entity, so they may lose value.

Investors should carefully consider investment objectives, risks, charges and expenses. This and other important information is contained in the fund prospectuses and summary prospectuses, which can be obtained from a financial professional and should be read carefully before investing. The material must be preceded or accompanied by the American Funds Emerging Market Bond Fund prospectus.

Securities offered through American Funds Distributors, Inc.

Investing outside the United States involves risks, such as currency fluctuations, periods of illiquidity and price volatility, as more fully described in the prospectus. These risks may be heightened in connection with investments in developing countries.

The return of principal for bond funds and for funds with significant underlying bond holdings is not guaranteed. Fund shares are subject to the same interest rate, inflation and credit risks associated with the underlying bond holdings. Lower rated bonds are subject to greater fluctuations in value and risk of loss of income and principal than higher rated bonds.

Investment results assume all distributions are reinvested and reflect applicable fees and expenses. Expense ratios are as of the prospectus available at the time of publication. Investment results reflect reimbursements, without which the results would have been lower. The investment adviser is currently reimbursing a portion of other expenses for American Funds Emerging Markets Bond Fund. This reimbursement will be in effect through at least January 1, 2018. The adviser may elect at its discretion to extend, modify or terminate the reimbursement at that time. Please see the fund’s most recent prospectus for details.

SEC yield is an annualized 30-day yield calculated in accordance with the SEC formula.

For current information and month-end results, visit americanfunds.com

Past results are not predictive of results in future periods.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and not to be comprehensive or to provide advice.

© 2017 American Funds Distributors, Inc.