Sponsored by BMO Global Asset Management

With the changes to the tax code last year, many investors are currently assessing exactly what their overall tax bill will look like for 2018. Most of the potentially beneficial changes in the code accrued to corporate rather than individual tax payers, keeping municipal bonds top of mind with investors seeking tax-advantaged income. While both corporate and individual rates were reduced, individual tax payers now face limits on historically deductible items such as mortgage interest and state and local taxes (the SALT cap), which so far has increased individual investor demand for municipal bonds in 2019.

We’ve put together a list of reasons why your clients might want to keep calm and carry on with their tax-exempt fixed income allocations.

- There is not a strong correlation historically between municipal bond prices and relatively small changes in income tax rates. Individual tax rates changed only marginally vs. the pre-2018 tax code, and limits to previously deductible items like the SALT cap have only increased demand for municipal bonds. In fact, so far this year (as of 3/6/19 per Lipper Analytical Services) municipal fund flows have totaled over $14 billion, the highest inflows on record for the period since the beginning of the data set in 1992.

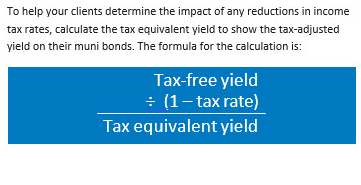

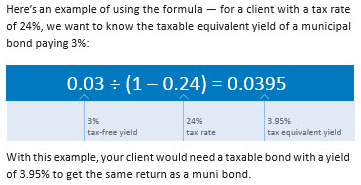

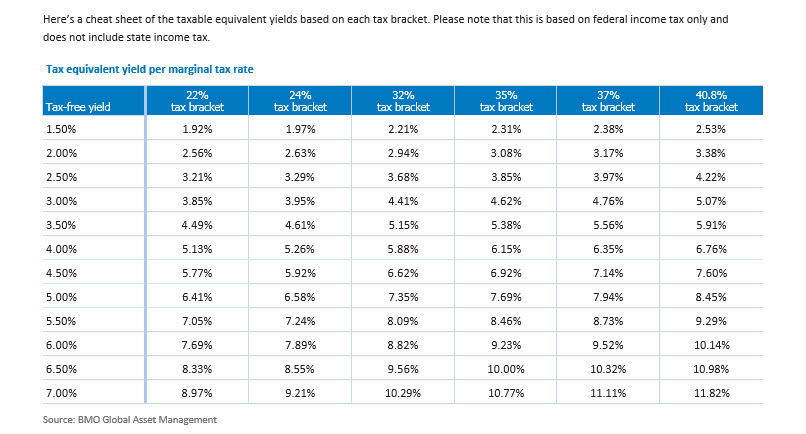

- Many municipal investors are not in the highest marginal tax bracket. The typical tax rate of holders of municipal bonds is in the 24%-32% range — much lower than the highest individual tax bracket of 37%. While the recent changes in the tax code did lower the top marginal rate by 2.6%, investors in brackets as low as 24% could still be subject to the additional 3.8% tax on net investment income. It is still possible that many investors in the middle tiers of the new marginal tax rates will see a benefit from holding municipal rather than taxable bonds.

- Lowering the corporate tax rate to 21% has had an impact on demand for long-dated munis, especially beyond 20 years, as the typical holders of these securities besides mutual funds have been banks and insurance companies. Banks have been net sellers of munis since the start of 2018, as their new effective tax rates make municipal bonds less attractive relative to other taxable fixed income instruments on an after-tax yield basis. However, corporations like banks and insurance companies, are estimated to hold only 20%-25% of tax-exempt bonds, and the income potential remains compelling on the longer end of the yield curve.

Continue the conversation

BMO Global Asset Management Better Conversation Guides provide insights into some of the biggest challenges to your success.

Visit the Advisor Resources section on the BMO Global Asset Management Viewpoints website at bmogamviewpoints.com for additional resources and information to help make your next client conversation a better conversation.

Contact us

1-844-BMO-Fund (266-3863)

bmo-global-asset-management

bmogamviewpoints.com

bmogam.com/betterconversations

The opinions expressed here represent our judgment at this time and are subject to change. This is not intended to serve as a complete analysis of every material fact regarding any company, industry or security. Information has been obtained from sources we consider to be reliable, but we cannot guarantee the accuracy.

This presentation is for general information purposes only and does not constitute tax advice. Individual investors should consult with their tax professional about their personal situation.

BMO Global Asset Management is the brand name for various affiliated entities of BMO Financial Group that provide investment management and trust and custody services. Certain of the products and services offered under the brand name BMO Global Asset Management are designed specifically for various categories of investors in a number of different countries and regions and may not be available to all investors. Those products and services are only offered to such investors in those countries and regions in accordance with applicable laws and regulations. BMO Financial Group is a service mark of Bank of Montreal (BMO).

BMO Asset Management Corp. is the investment advisor to the BMO Funds. BMO Investment Distributors, LLC is the distributor. Member FINRA/SIPC. Securities, investment advisory and insurance products are: NOT A DEPOSIT— NOT FDIC INSURED — NOT BANK GUARANTEED — MAY LOSE VALUE.

© 2019 BMO Financial Corp. (8352048, 3/19)