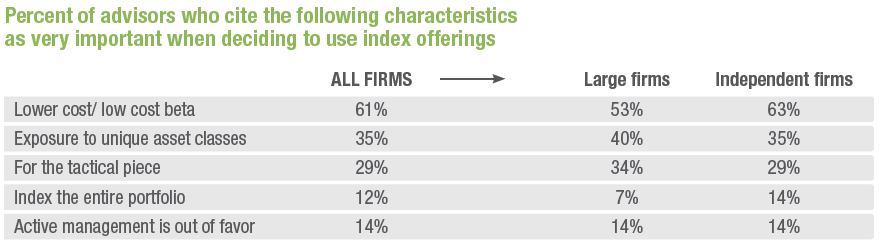

Despite a preference for active strategies, many advisors still find a place for passive strategies in their client portfolios. When they do opt for a passive strategy, lower costs tend to rank as the most important rationale among advisors polled; lower costs are very important according to 6 in 10 (61%) advisors. The next most important characteristic is exposure to unique asset classes, such as emerging markets (35%).

While low costs were the most important characteristic for all advisor channels, advisors from independent firms were more likely (63%) than those from large firms (53%) to highlight low costs as very important. This mirrors the findings tied to the selection process for active strategies, where independent advisors were more focused on an active fund’s expense ratio than were advisors from large firms.

One characteristic that held a consistent, albeit lower, level of support across all advisor channels was the belief that active management is out of favor (14% of advisors cited this reason for indexing). Says one RIA with 19 years of experience: “We don’t believe active management adds value above its costs, over time.”