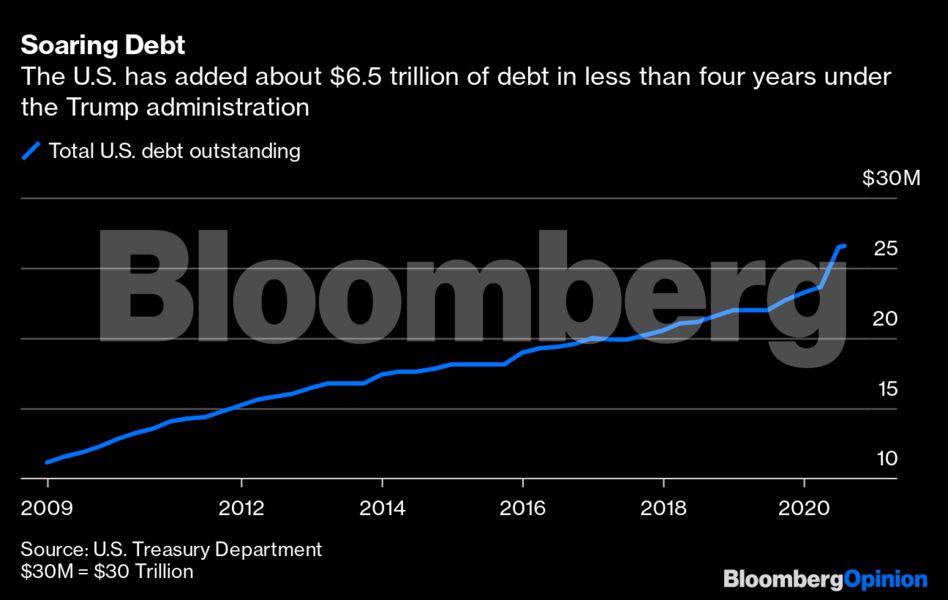

(Bloomberg Opinion) -- As the U.S. Treasury Department’s Deputy Assistant Secretary for Federal Finance during the Obama administration, I spent a lot of time talking to the major buyers of our nation’s debt. When I left my job overseeing the government’s finances in 2017, the unpaid tab for the first 240 years of the “American Experiment” was $20 trillion. In less than four years, that number has risen to $26.5 trillion, the result of essential outlays on pandemic relief and completely non-essential tax cuts for the wealthy.

When my team and I met with the biggest buyers of U.S. debt, our conversations centered on the way in which our government functioned. The cost of servicing the debt and the structure of our portfolio took a back seat to questions about how our government operated. After the debt limit crisis’ of 2013 and 2015, our creditors focused almost exclusively on how we would correct a problematic system that turned fulfilling our financial commitments into a domestic political bargaining chip.

How we spent their money mattered, too. Repairing the damage from the 2008 financial crisis, buttressing housing, building infrastructure and expanding access to healthcare were rightly understood by our creditors to pay dividends over the long haul. Borrowing costs are inversely proportional to the faith in the integrity and competency of the governments seeking cash, and it’s why America can borrow so cheaply, Argentina pays a steep price and Venezuela can find practically no lenders at all.

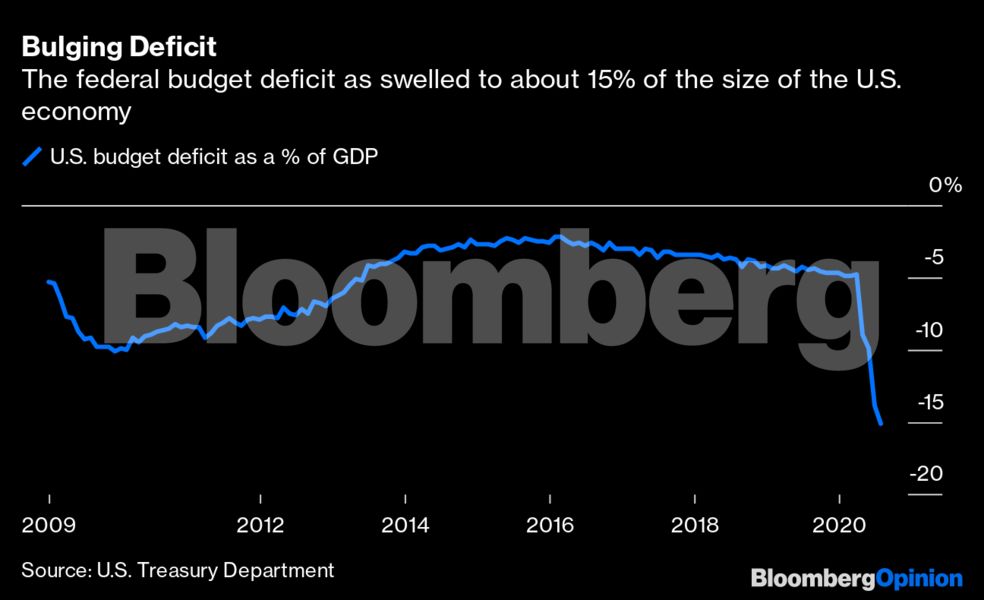

It’s for these reasons that I’m now worried. Creditors’ confidence in the U.S. government is being tested on an almost daily basis. President Donald Trump’s tax cuts were supposed to “pay for themselves” and help the middle class, but cost $1.9 trillion and contributed to greater income inequality. Although a few cases of fraud have been uncovered, the full extent of fraud and misuse of funds within the Paycheck Protection Program is unknown, as the vast majority of the recipient names have not been released. Of the data that has been made public, analysis shows that many recipient companies have “retained” far more workers than they even employ.

When the public reads about individuals who are profiting from the Trump administration’s programs, such as one Treasury official who doubled the value of his family’s investment company with the very program he designed, they lose trust in the system – and so do those who buy our debt. Given that we have a President who has fired numerous independent inspector generals tasked with oversight, refused to comply with Congressional inquiries, and refused to commit to accepting the results of the 2020 election, I fear that their trust is in short supply.

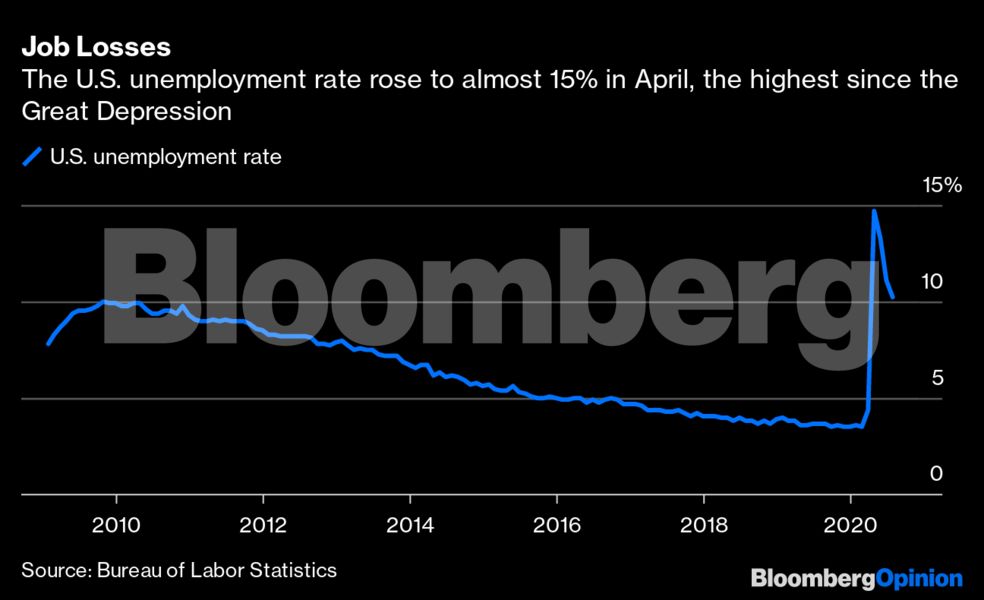

The Trump administration’s lack of leadership has not only resulted in tragic and unnecessary loss of life, but also prolonged our economic pain and placed a formidable burden of debt on future generations, leading Fitch Ratings to cut its outlook on the U.S.’s credit to “negative.” Still, with 5.5 million Covid-19 cases and 10.2% of workers unemployed, now is not the time for government austerity, just as belt tightening made no sense after the 2008 financial collapse.

More important than the size of our debt or our creditworthiness is the manner in which our political system operates. We must address the suffering and economic damage through fiscal policy while demonstrating the integrity, procedural safeguards and transparency that our lenders value. The political polarization that prevents an agreement on further fiscal support and the Trump administration’s lack of leadership, integrity and competency is far more problematic for U.S. creditworthiness than any additional debt.

Rebuilding confidence in our democratic institutions and transparently demonstrating that any stimulus package is used productively is the best way to ensure the sustainability of our national debt, no matter its size. Should the next round of fiscal stimulus be provided in the opaque and self-serving manner that has defined the Trump administration, Fitch won’t be the only institution with a “negative” outlook on U.S. credit.

To contact the author of this story:

James Clark at [email protected]

To contact the editor responsible for this story:

Robert Burgess at [email protected]

© 2020 Bloomberg L.P.