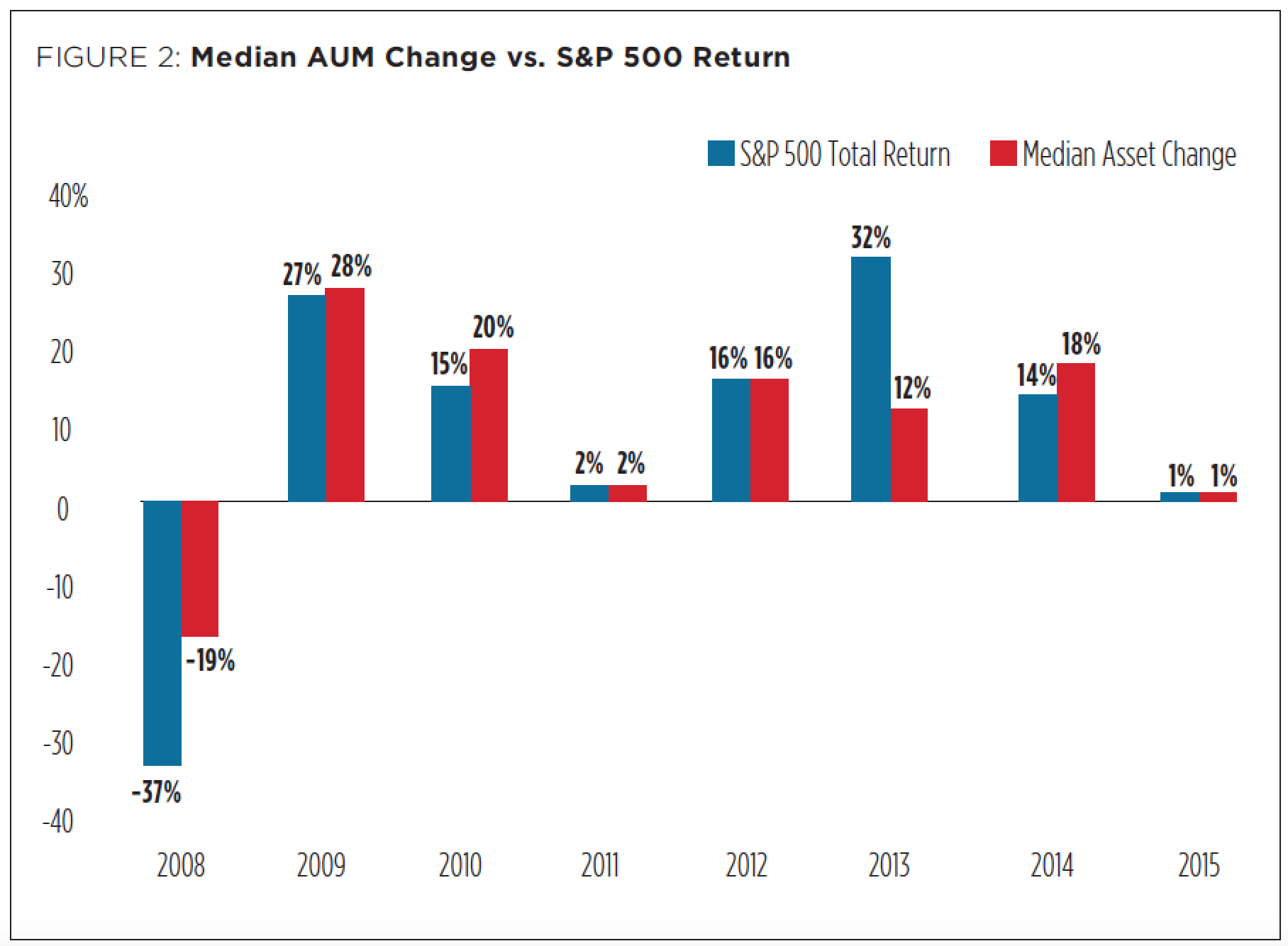

When we segregate assets under management into ranges, we observe a projected upward movement in general, consistent with the forecasted values in Table 1. With 31% of respondents, the lowest range, less-than-$25 million, represents the plurality of advisors. However, this cohort is expected to drop to only 23% in 2016. The shift away from the lowest AUM range appears to move into the next range, with the $25–$50 million group project to rise to 22% of advisors in 2016 from 19% in 2015. We observe similar shifts between the $50-75 million and $75-100 million groups. It appears that advisors are optimistic about their organic growth prospects looking forward.

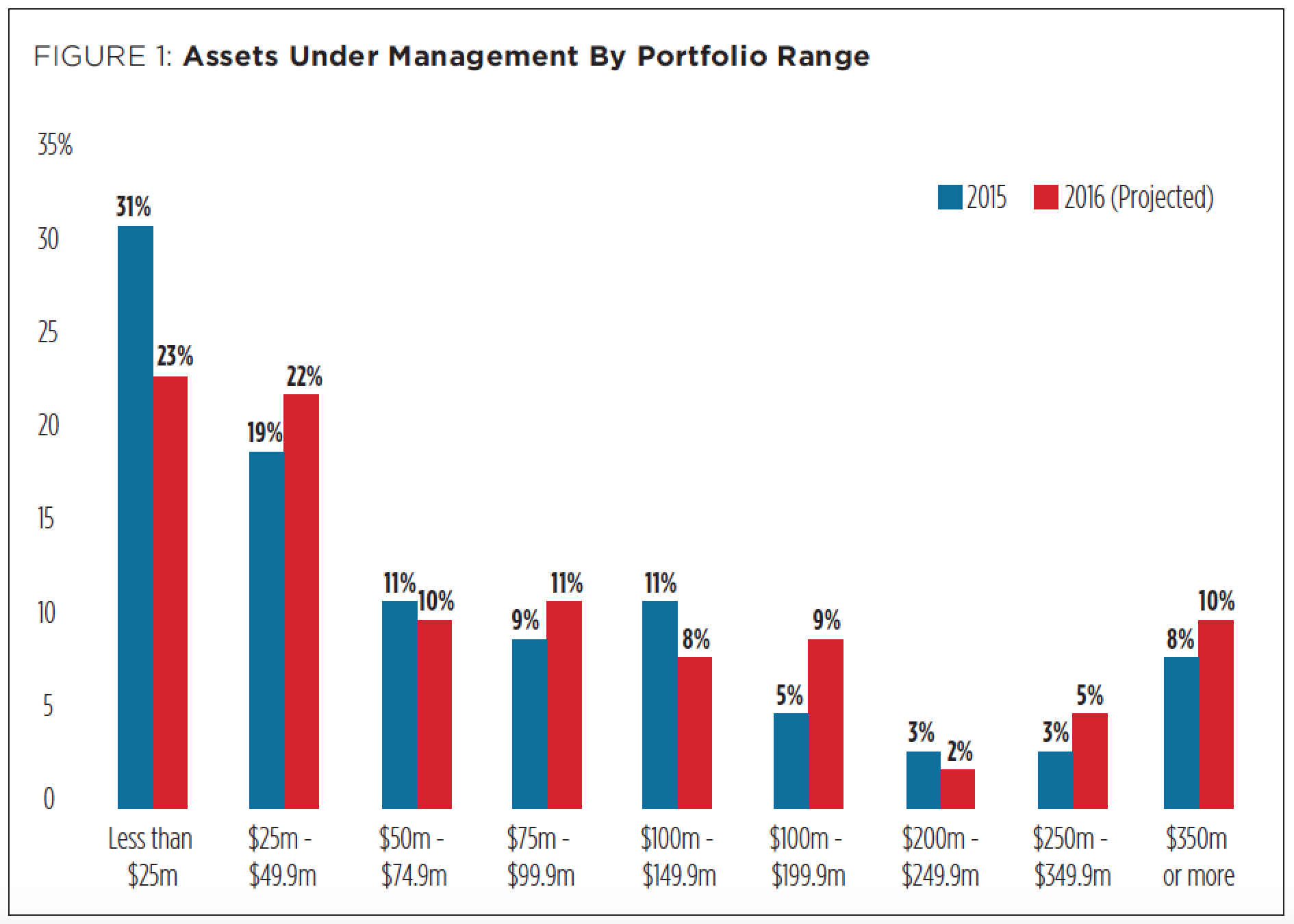

We also compared the median reported one-year change in assets under management to the total return of the S&P 500 for each of the past five years. In 2015, the median reported AUM is 1% higher than last year’s survey, in line with the total return for the U.S. equity market. This result is consistent with three of the four prior years’ observations; the notable exception being 2013, in which average AUM growth lagged a very robust 32% total return for the S&P 500.