Community property trusts can save your clients tens of thousands of dollars in capital gains taxes, and that is just one of their many benefits. This lesser-known strategy is not necessarily the best fit for all couples either because of their assets or state of residence. However, for households you work with that can make the most of them, it is a planning tactic that could have a significant impact on keeping more of the value of their estates in the family.

These concepts offer huge benefit to advisors who take advantage of them. Thanks to the double step-up for property held in this type of trust, your clients will retain a significant amount of wealth that would otherwise go to the IRS because of capital gains tax. So, it is a solution that provides better cash flow for your clients and more assets under management for you — a win-win for all parties.

However, before we get into the details, let’s start with a few quick and easy definitions:

- Community property — Assets a married couple acquires by joint effort during marriage if they live in one of the nine community property states: Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington, and Wisconsin.

- Community property trust — A special type of joint revocable trust designed for couples who own low-basis assets, enabling them to take advantage of a double step-up. Tennessee or Alaska are the two places you can form these trusts, even for clients who do not live in those states.

Note: Differentiating between community property states and states in which community property trusts can be created can be a bit tricky. To put it simply, assets acquired jointly during marriage within those nine states are automatically considered community property. However, in Tennessee and Alaska, married couples can create a special trust called a community property trust. This trust effectively opts your clients into the same benefits that couples automatically enjoy in those states, at least for assets transferred into these trusts.

Assets are given a new basis when transferred by inheritance (through a will or trust) and are revalued as of the date of the owner’s death. If an asset has appreciated above its basis (what the owner paid for it), the new basis is called a stepped-up basis. A stepped-up basis can save a considerable amount of capital gains tax when the new owner later sells an asset. After implementing a community property trust, the entire value of the property gets a basis step-up when one of the spouses dies, hence the term double step-up (rather than only one-half of the property receiving the adjustment, which is what usually happens with jointly owned assets). So if a surviving spouse sells community property, the double stepped-up basis on the entire property can significantly reduce or even eliminate the capital gains tax.

CPTs in action: Max and Sophia

Imagine Sophia and Max, a couple who’ve been married for decades, each with their own fulfilling and lucrative careers. Early on in their marriage, they decided to invest and build assets, eventually jointly buying a commercial property.

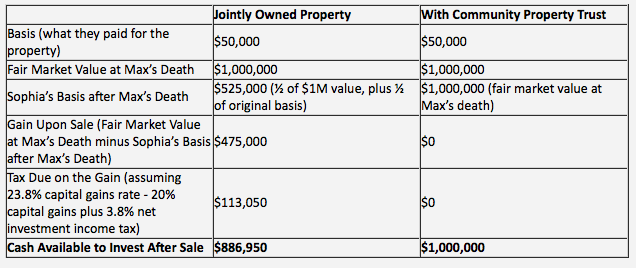

The value of the commercial property had appreciated substantially since the time they bought it. They kept the property up-to-date and were able to lease it to quality tenants, contributing to the value of the building. Because of the increase in value, Sophia and Max’s basis was low compared to the current value. If either spouse passed away and the surviving spouse opted to sell the property, a significant portion of the sales profit would be lost to capital gains taxation, as you can see from the example below.

Sophia and Max met with their estate planning attorney and learned that they could create a community property trust. The commercial property became one of the assets owned by the trust. Upon Max’s death, the basis of the entire property is stepped up to its current market value. Without the community property trust, only Max’s half of the property would have received a step-up. However, with the trust, both Max and Sophia’s halves are stepped up, saving a considerable amount of income taxes. As a result, Sophia can sell the property to diversify with potentially no capital gains tax payment.

Now when Sophia decides to sell the property, the capital gains tax will only be drawn from the appreciated value since Max’s death, which if the sale is consummated quickly enough will be minimal or even zero. As you can see in the example above, Sophia saves $113,050 in capital gains taxes when she and Max use a community property trust rather than joint ownership. This tax outcome applies to all the community property managed under the trust, leaving Sophia with significantly more money to make the most of her golden years and pass along to her children, charities, or other intended beneficiaries.

This is a strategy that can work incredibly well in the right circumstances, but it does not fit all clients at all times. It is appropriate for married clients that have low basis assets that they are comfortable holding onto until one of them dies.