Social Security has become such a major source of retirement income for this country's elderly that even many high net worth individuals rely on it heavily. However, they aren't talking to their advisors about it.

The degree to which America's affluent have come to depend on Social Security and the extent to which advisors are failing to properly initiate the planning conversation about it are highlighted in recent Spectrem Group research entitled Social Security: When and Why. The study surveyed 634 affluent American investors age 55 and over and divided them into three wealth segments based on investable assets: Mass Affluent ($100,000 - $999,999); Millionaire ($1 million - $4.99 million); and Ultra High Net Worth ($5 million - $25 million).

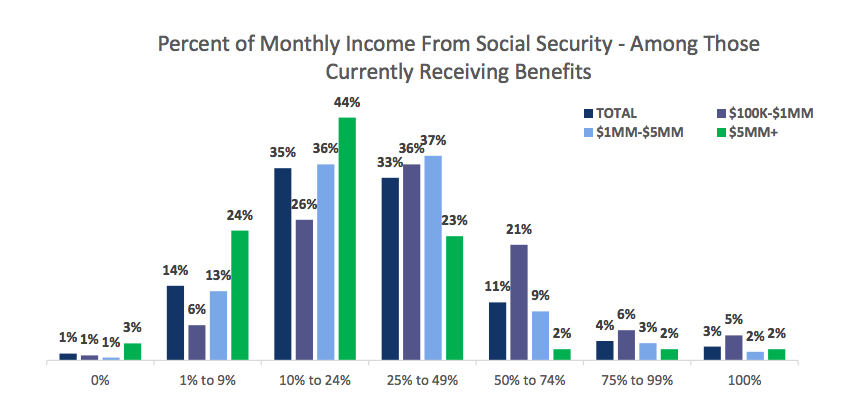

According to the survey, roughly 18 percent of the total respondents currently receiving benefits (again, all of whom have at least $100,000 in investable assets) rely on the checks for at least half of their income. Among the mass affluent respondents, that number climbs to nearly one-third at 32 percent.

If you expand the parameters to those for whom Social Security benefits represent at least 25 percent of retirement income, the results actually encompass the majority of the respondents. Fifty-one percent of the affluent individuals surveyed currently receive at least 25 percent of their retirement income by way of Social Security benefits. This figure includes nearly one-third (29 percent) of ultra high net worth respondents, the wealthiest group surveyed by a significant margin, for whom you'd think Social Security would represent merely a drop in the bucket. Apparently you'd be wrong.

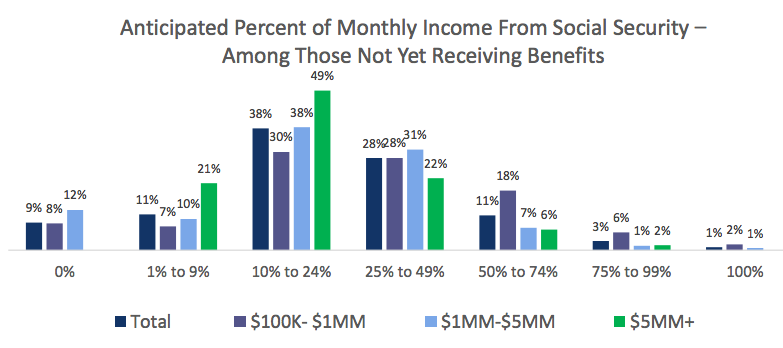

And, these figures don't appear to be a generational fluke. When investors who haven't yet started receiving benefits were asked what percent of their income they anticipate Social Security being, the numbers reflected a slight uptick in confidence, but stayed largely the same.

Based on these results, it doesn't seem as though the respondents were all too surprised that they either currently rely or will someday come to rely on Social Security benefits for a significant portion of their retirement income. But, knowledge is one thing and planning a quite another, and for such an integral retirement planning issue, very few affluent individuals actually broach this topic with their advisors. Only 31 percent of total respondents have discussed their Social Security plans with their advisors. Surprisingly, among the mass affluent, the group with smallest nest egg for whom Social Security checks would presumably have the largest benefit, only 24 percent have had this conversation, by far the lowest rate of the three groups.

Given the importance of Social Security income to affluent retirees, not to mention the dizzying array of options for how and when to begin receiving them, each with its own benefits and drawbacks, advisors need to be more proactive in initiating Social Security planning conversations with their clients.