As the entrepreneurial business community has flourished in the Bay Area and beyond, a myriad of engineers, programmers and executives have benefited from the stock options they received along the way. Many of these high-growth tech companies have moved from early-stage ventures to thriving businesses with significant cash flow, profitability and rising valuations. For employees, shares in the business have great value on paper but are often offered as restricted shares, providing very limited liquidity. The liquidity restriction many companies place on shares constrains secondary transactions, leaving little-to-no market value, and inhibiting a shareholder’s ability to borrow against the value from traditional lending institutions.

From a planning perspective, illiquid shares provide a challenging dilemma. Restricted shares can generate a high balance sheet net worth and high estate value, but oftentimes without the corresponding liquidity to fund the shareholder’s estate tax liability. So why not transfer the shares into a trust? While a trust may seem like an ideal solution to exclude the valuation from the shareholder’s estate, companies often limit the ability to transfer shares. If a transfer is allowed, there may be significant gift taxes associated with gifting the shares to a trust outside the shareholder’s estate.

Let’s imagine an engineer named Jordan, a U.S. citizen who has $3 million in a brokerage account, earns $250,000 per year and has $100 million in restricted shares. She is married to Ross, and they have two children.

It may make sense to move some of the shares off Jordan’s balance sheet, but that may not be possible or prudent until she has more financial security in the form of liquid investments. What if she had gifted her shares to a trust and then the share value collapsed from $100 million to $10 million? Jordan would have used a substantial portion of her and her husband’s lifetime gift tax exemption while, ultimately, delivering significantly reduced value to the trust.

If Jordan were to die while still retaining the shares on her balance sheet, ownership of the shares would transfer to Ross, but he may not be able to liquidate the shares to support the family’s annual living expenses.

If both Jordan and Ross were to die, their estate would be subject to a heavy tax burden with no clear mechanism for generating liquidity to fund the tax liability. They might be forced to sell the shares at the wrong time and end up with a small fraction of the original value.

Generating liquidity is a critical step in the wealth transfer planning process. Liquidity can support the lifestyles of shareholders and their heirs, and can also fund potential estate tax liabilities. What solutions offer low cost liquidity protection? More and more shareholders are turning to Guaranteed Term Life Insurance (“Term Insurance”) as a key component in their wealth transfer planning to manage liquidity needs.

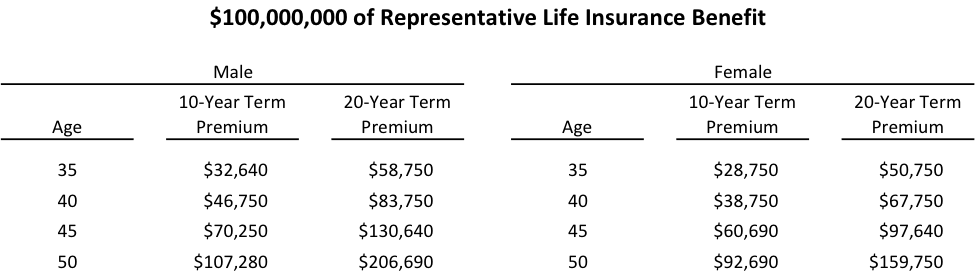

The sample pricing below illustrates $100 million of Term Insurance for a California resident (who qualifies for a preferred non-smoker life insurance risk, the second best classification) at ages 30, 35, 40, 45 and 50. Each year, the insured has the option to continue paying the premium or cancel the policy. Note that the annual premium for $100 million of 10-Year Term Insurance on a healthy 40-year-old male is $46,750; he also has the option to stop paying this premium if the shares become liquid through an Initial Public Offering (IPO) or other transaction and he has no further need for the policy. As long as the premium is paid on time, the insurance benefit and annual premium is guaranteed for the selected Term duration.

While liquidity is a primary reason Term Insurance is used as a solution for many restricted shareholders, another benefit often overlooked, and equally valuable, is the “conversion option.” A Term conversion option allows a policy owner to convert the Term Insurance policy to a Permanent Life Insurance (“Permanent Insurance”) policy at the same risk classification pricing they qualified for at the time of the initial Term Insurance acquisition.

Permanent Insurance policies typically generate between a 4 percent and 5 percent income tax-free IRR (8 percent - 10 percent taxable equivalent) at actuarial life expectancy (often with guaranteed premiums and insurance benefits). Let’s imagine Brad, a 35-year-old entrepreneur, purchases $100 million of Term Insurance. In the years that follow the Term Insurance acquisition, he experiences a change in health that renders him uninsurable or severely impaired from an insurance company’s risk classification perspective. On revisiting his estate plan, Brad takes advantage of the Term conversion option in his Term Insurance policy. Brad, now 40, converts the Term Insurance policy to a Permanent Insurance policy at the same risk classification pricing he qualified for at age 35. The Term conversion option, for most insurance companies, costs nothing and provides the insured with additional flexibility and optionality by locking in their risk classification status, from the time of the initial Term Insurance acquisition.

In sum, Term Insurance provides those with restricted illiquid shares an inexpensive wealth transfer tool that can offer some breathing room until an IPO or some other value-realizing event occurs for the shares. Once the shares become liquid, the insured can take a step back, meet with her financial advisors and devise an estate plan that achieves the long-term goals of her family with her new net worth.

Winged Keel Group does not engage in the practice of law; nor does it give legal, accounting, tax, investment, or asset allocation advice. Readers are advised to seek counsel in these areas from appropriate advisors. Winged Keel Group is independently owned and operated. Securities offered through M Holdings Securities, Inc., a Registered Broker/Dealer, Member FINRA/SIPC. #0232-2017