In the span of a few months, the COVID-19 health crisis and the resultant adverse economic impact, which for certain industries such as travel and hospitality, retail, automotive, and energy has been acute, has significantly altered the way we operate personally and professionally. According to a COVID-19 disclosures post by Equilar on May 7, 2020, in light of these developments, several companies have elected to make changes to their executive compensation and incentive plans as a means to ease the burden that their employees are facing during this unprecedented time.

Award modifications were last popular during the Great Recession. Modifications can take the form of repricings, where the exercise price is reduced, or more complex exchange programs, whereby companies modify more than just the exercise price. Most commonly, this involves amending performance or market conditions, upon which awards vest.

What Constitutes a Modification?

Accounting Standards Codification Topic 718, Compensation – Stock Compensation (“ASC 718”) defines a modification as, “a change in the terms or conditions of a share-based payment award.” This definition is applied broadly and typically includes situations in which awards are cancelled and replacement awards are issued. Modification accounting is not required if all the following are unchanged immediately pre- and post-modification:

- the fair value of the award;

- the vesting conditions of the award; and

- the classification of the award (e.g., equity or liability).

Examples of changes to employee equity that we have seen classified as a modification under this guidance include:

- Reduction in equity award exercise price;

- Change to the contractual exercise term of an award;

- Adjustment to vesting criteria, such as (i) reduction in financial metric targets that impacts vesting or (ii) reduction to stock price target thresholds related to vesting;

- Reduction of exercise price of an award due to a one-time dividend (in a manner not contemplated in the original award agreement); and

- Addition or subtraction of companies from a competitor peer group that impacts vesting of the award (as in the case of a relative total shareholder return (“TSR”) award).

What Is the Accounting for Modifications?

First as a refresher, “performance conditions” generally include the attainment of specified financial performance targets (e.g., EBITDA or revenue), operating metrics, or other specified actions under the control of the company (e.g., liquidity event). Awards with performance conditions are recognized as compensation expense only when it is probable that the performance condition will be satisfied.

“Market conditions” typically include the achievement of a specified price of the company’s stock or a specified return on/increase in the company’s stock relative to an index or other benchmark. In contrast to performance conditions, awards with market conditions are recognized as compensation expense whether or not probable, with the market condition being factored into the fair value of the award.

The accounting for award modifications depends on both (a) the way in which the award is modified and (b) the type of award that is modified. ASC 718 classifies award modifications into the following four categories, based on the probability that the award will vest immediately pre- and post-modification:

- Type I, or probable-to-probable;

- Type II, or probable-to-improbable;

- Type III, or improbable-to-probable; and

- Type IV, or improbable-to-improbable.

Of these, Types I and III are the most common. Type I modifications typically occur when a company amends an award to reduce the exercise price, extend the exercise period, or adjust market conditions (e.g., reduce share price targets). In these cases, total compensation expense recognized for the award is the sum of the grant-date fair value and any incremental value created by the modification. To derive the incremental value created by the modification, the fair value of both the pre- and post-modification options must be measured. The difference in the total fair value between the pre- and post-modification options represents the incremental compensation expense associated with the modification.

Incremental compensation expense is recognized immediately for the portion of the award for which service has already been completed (i.e., the award is vested). Total compensation expense recognized for Type I modifications cannot be less than the original grant-date fair value of the award.

Type III modifications are typically the result of adjustments to performance conditions, such as reductions to EBITDA or revenue targets. When an improbable performance condition is adjusted such that it becomes probable, total compensation expense recognized for the award is based on the post-modification fair value of the award. As a result, expense is immediately recognized for the portion of the post-modification fair value for which service has already been completed. While expense is not typically recognized for awards with improbable performance conditions, any previously recognized expense would be reversed.

Type II and IV modifications are less common. Generally, the accounting for Type II modifications is in line with Type I modifications and the accounting for Type IV modifications is in line with Type III modifications. This means that total compensation expense recognized in Type II modifications is equal to the grant-date fair value plus the incremental value created by the modification, while total compensation expense recognized in Type IV modifications is equal to the post-modification fair value (assuming, in both cases, that any performance conditions ultimately become probable).

How Do We Calculate 'Incremental Value'?

“Plain-vanilla” employee stock options typically have the following basic economic structure at grant, where the primary variance among companies tends to relate to the length and structure of the time-vesting conditions.

- Exercise Price: Set equal to the company's stock price on the grant date (i.e., "at-the-money");

- Dividend Equivalents: No dividend equivalents paid prior to exercise;

- Time-Based Vesting: A certain percentage of awards vest for each month or year of service (e.g., 20% per year for five years);

- Contractual Term: 10 years.

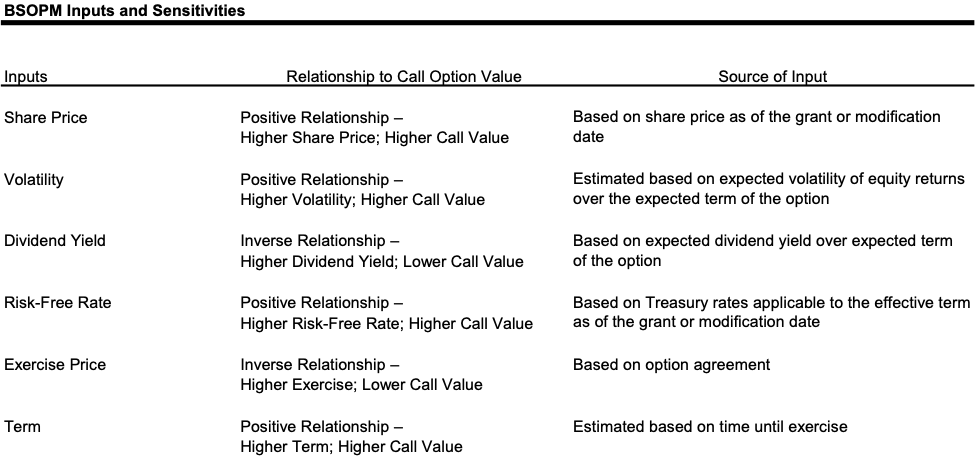

Because of its ease of use and verifiability, the Black-Scholes Option Pricing Model (“BSOPM”) is generally employed to value plain-vanilla employee stock options. A lattice model or Monte Carlo simulation can occasionally be required in the case of more complex structures that have market vesting conditions (e.g., TSR awards tied to relative peer group performance, options that vest once certain stock price thresholds are achieved, etc.). However, for the purpose of this example we will focus on a simple BSOPM calculation.

The BSOPM is an arbitrage-pricing model that was developed using the premise that if two assets have identical payoffs, they must have identical prices to prevent arbitrage. The BSOPM relies on six variables: (i) asset price, (ii) strike price, (iii) term, (iv) risk-free rate, (v) volatility and (vi) dividend yield. The chart below presents the directional impact to value of each input to the model as well as typical sources for each input.

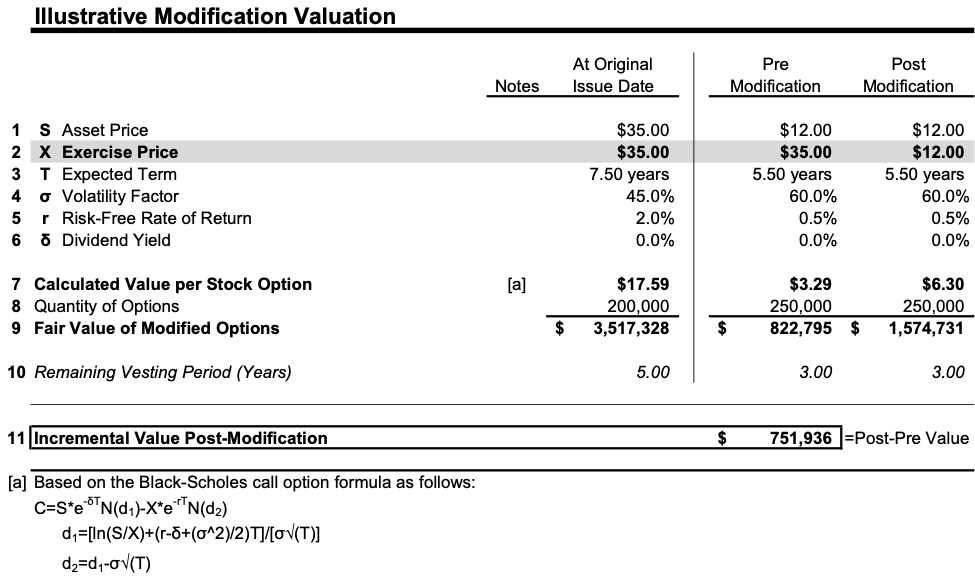

In the following example calculations for a Type I modification, we show the expense impact of a modification to the strike price of an option. We can think about this representative scenario as follows:

- Five-year time vesting (20% per year) plain-vanilla stock options were granted with an original, at-the-money strike price of $35.00;

- The company’s stock price declined significantly over the next two years, and the board of directors elected to modify the exercise price to at-the-money at the modification date; and

- Accordingly, we present the initial fair value analysis of the options as well as the pre- and post- modification values at the time of the modification event.

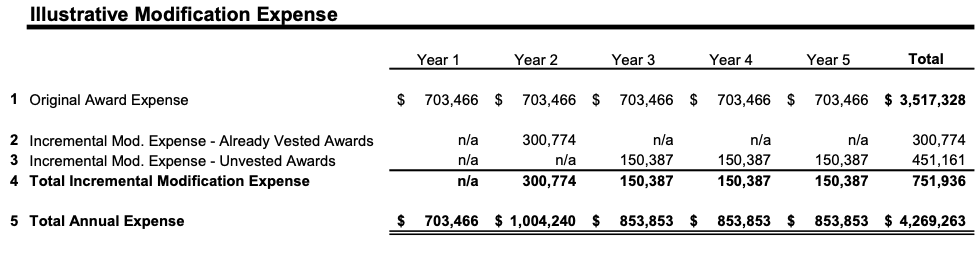

The above calculations give us the incremental value resulting from the modification, and we next present a representative discussion of the income statement expense implications based on this example:

- The original fair value of the awards has been expensed over the first two years ratably;

- At the modification date, an additional expense is incurred related to the previously vested award's incremental fair value; and

- The remaining incremental fair value, in additional to the original fair value, is expensed over the remaining vesting term.

Resetting outstanding options may become more prevalent as companies attempt to modify the terms of options to incentivize employees.

Because of the earnings impact, it is critical that key assumptions are supported with robust analysis when determining the fair value of the pre- and post-modification options.

Cory J. Thompson and Steve Hills are managing directors and Brendan R. Smith is a director, all with global financial advisory firm Stout.