The 90-day clock started ticking on the last day that Sally worked for the late-stage startup. Sally, an early-stage employee at a well-known firm who did not want her real name used, was vested with 800,000 options. To exercise them, she would have to come up with $112,000, and the second she pulled the trigger she would be hit with a $1.2 million tax bill on the securities she was prevented from selling and on income that she couldn’t access.

Welcome to the financial quicksand that can hit many paper-rich entrepreneurs. No money to exercise the options, nor the ability to finance using the options as collateral. In many cases, these entrepreneurial employees have to walk away from the equity stakes in the startups they help grow, just like Sally did.

The cash requirements and other hurdles are so substantial that 76% of startup employees never exercise or sell the pre-IPO stock options they have earned, according to a 2019 study from Charles Schwab. About half (48%) also reported that they delayed tapping their options for fear of making a financial mistake. This landscape of uncertainty begs for expertise.

It’s critical to understand the challenges of the pre-wealthy with vested options in today’s pre-IPO environment. Particularly harmful: Most startups give employees a 90-day window to exercise those options once they part ways with the company that granted them.

Startups are just following the IRS’s regulations that a former employee must convert incentive stock options (ISOs), which qualify for special tax treatment, into nonqualified stock options (NSO). Lately, companies such as Pinterest are extending the exercise windows.

Even if employees manage to raise the funds to buy the options, the IRS treats it as an immediate taxable event, often triggering the dreaded alternative minimum tax (AMT).

“Taxation at exercise is bad public policy,” says Sam Altman, an entrepreneur and chairman of Y Combinator. “I wish the U.S. government would move taxation to a liquidity event.”

There are thousands of paper-rich entrepreneurs working at late-stage startups. They are prospective clients dubbed HENRYs: High Earners Not Rich Yet. A growing number of financial advisors are targeting these prospects and helping them find a way to exercise their options with the hope that will lead to long-term client relationships.

Personalized Pre-Wealth Advising

There is a real market in startup millionaires out there, entrepreneurs laboring under promises of future wealth. They are generally young, with a high tolerance for risk, and who may soon come into huge pots of money. In short, ideal clients. Advisors who have success in the market establish relationships with these prospects before they become wealthy and are courted by the competition.

“The time you spend pre-planning [with a prospect or client] is so worth it,” says Helen Dietz, a Partner at Aspiriant, an RIA based in Mountain View, Calif. “It’s all very nuanced on what company is involved and what’s the trajectory of the stock.”

Above all, Dietz encourages prospects to remember that, even more than the options or shares in play, their careers are their own best investment. Dietz has worked with clients in Silicon Valley who have two, three or more liquidity events in their short time in the job market. “The more prospects think of themselves as leveraged IPOs and preplan accordingly, the more opportunities they have and the fewer surprises they face.”

Advisors have their sights on young entrepreneurs in places other than Silicon Valley. Adam Sansiveri, managing director at Bernstein Private Wealth Management, shuttles between New York and Nashville, the hub of the country music industry where a significant number of young singers, song writers and music producers sell their catalogs to investors, sometimes for millions of dollars. (It’s worth noting that Taylor Swift’s father was a financial advisor for Merrill Lynch in Nashville, where the pop superstar got her start.) For these potential long-term clients, Sansiveri leads a team that helps the artists understand the implications of their new liquidity.

The key to converting these prospects into long-term clients comes down to pairing the artist who’s about to have a liquidity event with an advisor who is seen as a peer, speaks their language and ideally shares some demographic features. “The wealth advising business needs to evolve with the needs of the client,” Sansiveri says. “Ideally, advisors need to be cut from the same cloth.”

As the youngest managing director at Bernstein Private Wealth Management, Sansiveri seeks to hire advisors that look like the clients, often recruited from the ranks of former founders who have had exits. “Because many of the artists have put their hearts and souls into a concentrated position, the trick is to create conversations about diversification, risk and the implications of future cash flows,” he says.

Aspiriant partner Helen Dietz

Pre-Exit Liquidity

Until about five years ago, there were few, if any, options for large numbers of private company stockholders to get pre-exit liquidity for private company shares. The problem didn’t pinch employees so much when startups were routinely acquired or went public within a few years of founding. But recently, the pace of IPOs has decreased as many startups stay private longer. Technology companies in 2018, for example, took an average of 13 years to go public, versus an average of three years in 2001, according to figures compiled by Goldman Sachs.

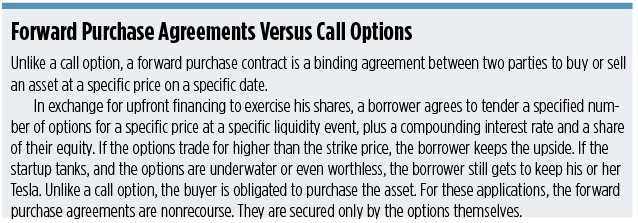

The fintech world saw a need and, as is their wont, created solutions. Secfi, for example, pairs paper-rich shareholders with financial advisors and investors to help potential clients navigate complex financial decisions and unlock equity positions. Its secret sauce takes the form of forward purchase agreements (see sidebar, below) that provide startup employees with cash to exercise stock options in exchange for proceeds from future share sales. These instruments allow employees to participate in their employer’s success without risking their savings. Clients make no payments against the nonrecourse financing until IPO, exit or another liquidity event. In other words, Secfi accepts all the risks of a downside in exchange for a share of the upside. Secfi, which until recently acted as a matchmaker between clients and multiple investors, recently partnered with New York hedge fund Serengeti Asset Management, locking down a $550 million debt facility.

A number of players such as Section Partners, Troy Capital Group’s Quid and ESO Fund are active in providing discounted back door financing into the future paydays of IPO-destined startups. Nasdaq Private Market, which arguably was a pioneer in the space, partners with advisors and provides transaction software to private companies and investment funds looking to do tender offers or share buybacks.

The case of an early employee in pre-IPO Pinterest is representative of the difficulties that employees face in accessing the real wealth that they have earned, and how those difficulties often pinch lifestyle choices. Some employees want to change jobs but feel they are trapped by the incentives. In one case, an employee, who did not want to go on record, wanted to buy a home and set up domicile in a state with no state income tax. By hiring an advisory with tax expertise, the client was able to sell pre-IPO shares on the secondary market and make the purchase knowing that all the tax bases were covered.

“Twenty years ago, he would have had to wait for the IPO,” says Marcus Dusenbury, an advisor at Bothell, Wash.–based Viridian Advisors. “Now these marketplaces exist and, with good advice, that’s fantastic.”

Taxes and Emotion

Beyond emotion, taxes color every decision that the pre-wealthy have to make, so it makes sense for advisors to have access to deep tax expertise, says Peter J. Greco, founder and chief tax strategist at The CSI Group. The Red Bank, N.J.-based team of financial advisors and CPAs guides pre-wealthy prospects through the most tax-efficient transactions to gain the liquidity they have earned. Greco notes that many clients are hesitant to sell assets. “As a rule, they dismiss the idea that the company will ever fail, and thus they are often resistant to diversification,” Greco says.

A conversation about the risks of concentrated wealth is a duty that advisors owe clients, especially clients who are emotionally invested in the assets that created their wealth in the first place. “The advisor needs to be an expert in concentrated positions,” says Sandy Galuppo, managing director of Boston Private Wealth. “The goal is to help clients set life priorities and understand how the equity in their company fits into it. We want them to look at the matter [of diversification] holistically in the context of the life goals they set.” On a case-by-case basis, Boston Private can offer its clients liquidity solutions.

Section 83(b) Election

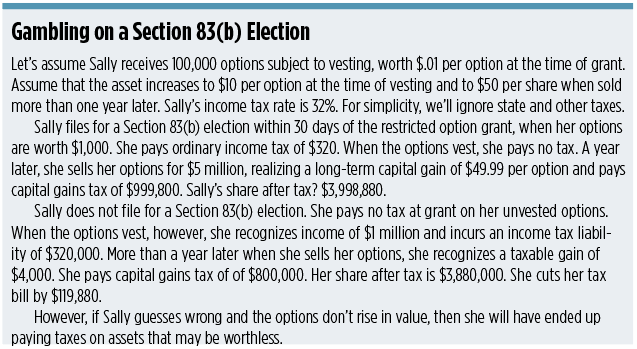

Advisors with expertise in tax efficiency all recommend taking advantage of a Section 83(b) election whenever appropriate. The election is made by sending a letter, putting the IRS on notice that the client wants to be taxed on the date the option was granted instead of when the option vests. The goal is to get as much of the client’s gains taxed at long-range capital gains rates rather than an ordinary income tax rate. The election makes perfect sense as long as the value of the asset goes up. Timing is critical. The election must be made within 30 days after the grant date of the restricted stock or option. (See sidebar, above.)

“Working with paper-rich, pre-wealth entrepreneurs can be very exciting,” says Dillon Ferguson, head of product at Zoe Financial. In New York, the trick is to engage as early as possible to head off reckless spending and avoid ugly tax surprises. “Entrepreneurs, much like soon-to-be physicians, know there is a hefty paycheck at the end of the tunnel. The issue is that future mindset dictates their current spending habits, often with disastrous results.”

“Advisors find it very hard to identify pre-wealth prospects and build a relationship with them,” says Wouter Witvoet, founder and CEO of Secfi. “By and large, millennials with few liquid assets to invest have little reason to trust financial advisors who have no solutions or products to offer. What advisors need is a set of products and solutions to onboard these wealth-bound clients, and they can do the rest.”