Many readers have heard about the 2018 case in which the U.S. Supreme Court ruled in South Dakota v. Wayfair that states could require businesses to collect and remit taxes for in-state online sales, even though the business has no physical presence in the state. While this is primarily a sales and use tax issue, it may also be relevant for net income, gross receipts and excise tax purposes.

It’s important to distinguish between the concepts of economic nexus and physical nexus. The rules of physical nexus have been enforced for decades. Wayfair changed the concept of economic nexus due to the growth of online selling.

Potential Tax Liabilities

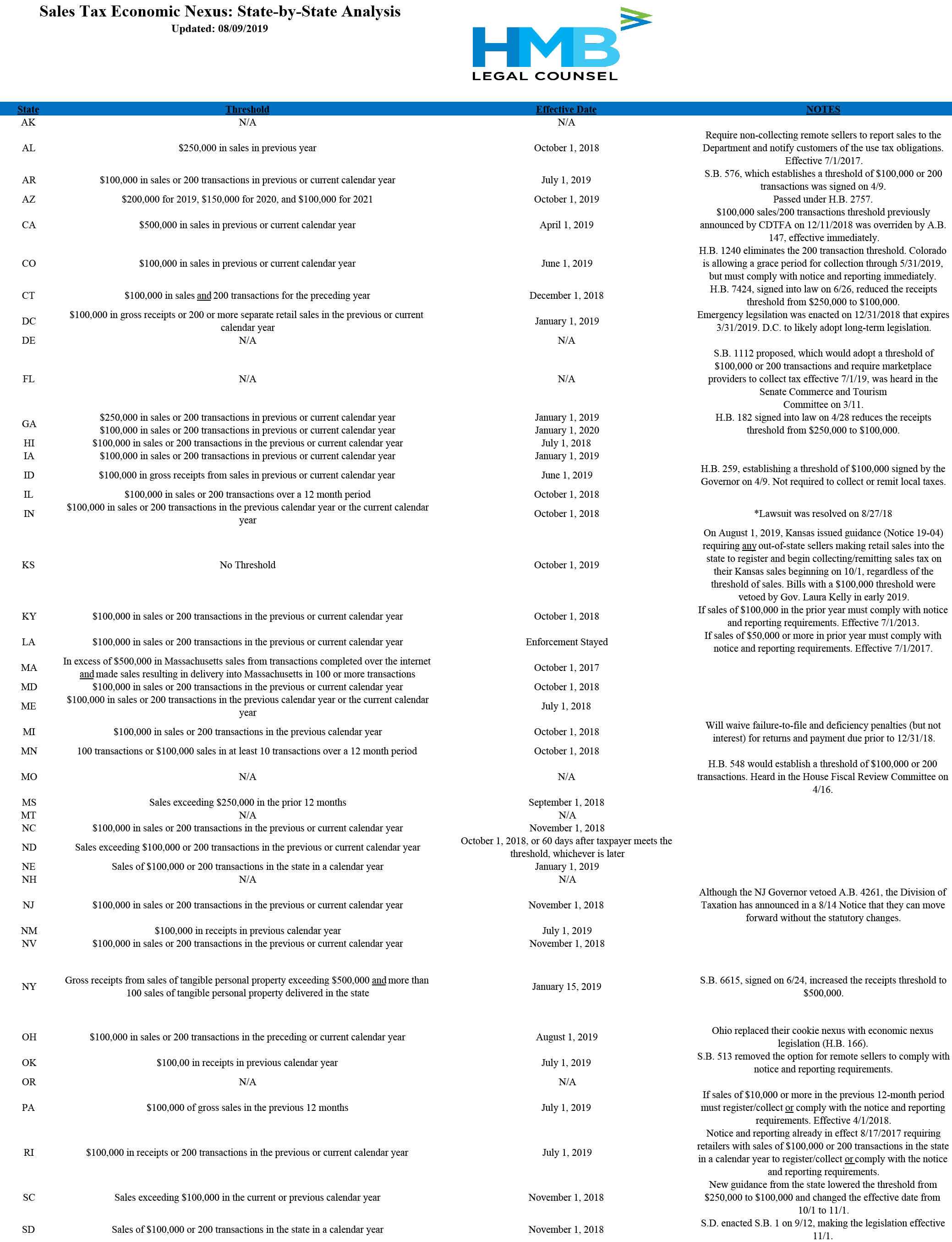

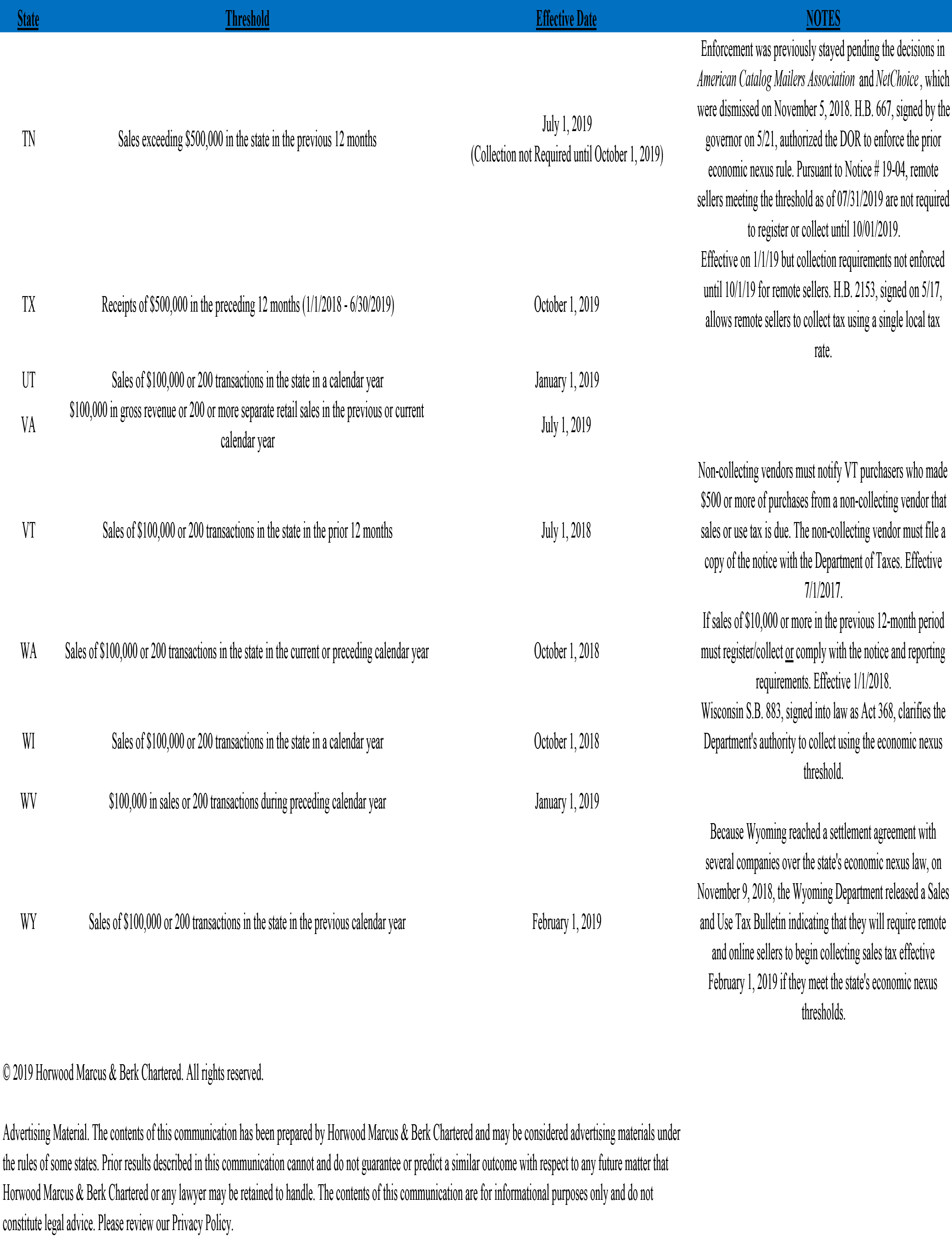

Businesses may be liable for certain taxes if they have an economic nexus in a state where the business has online revenue. The criteria vary by state, as you can see in “Economic Nexus,” below.

This creates a current tax liability for online revenue. If there’s a historic economic nexus and the taxpayer hasn’t filed taxes, there may be unlimited liability. The current interpretation of Wayfair is that states shouldn’t pursue retroactive taxes for economic nexus, but that’s subject to interpretation by each state.

There’s also a possible personal risk to officers and employees responsible for filing taxes; states may pursue them for outstanding taxes.

Most companies will need time to manage this transition, but if your client is planning to sell his business, today’s buyers are aware of the issue. Buyers don’t want any potential tax liabilities, so they’ll push responsibility back to the seller during the negotiating process.

States may pursue officers and responsible employees after a sale, even if the company no longer employs them.

Evaluating Risks

In a recent sale process, economic nexus became the major issue. Because we were working to close against a tight deadline, we needed a way to manage this liability without disrupting the sale process. We achieved this by evaluating the risks in a stepwise fashion:

- Where did the seller have economic nexus?

- How big was the potential liability in each state where there was economic nexus?

- Rate and rank the liabilities and group them into risk categories

- Discharge each category according the risk

Three Classes of Risk

The first two questions aren’t difficult to answer. Using the Economic Nexus chart and the seller’s sales data, we could determine the possible liability for each state in which there was online revenue. We then had a management review to set criteria for assigning the risks. This required some finesse based on what the seller might have to give up via unrecovered escrow. The three classes of risk were: (1) significant; (2) small; and de minimis.

For significant risks, the seller filed voluntary disclosure agreements (VDAs) with the relevant states. VDAs are a good tool to manage tax liabilities, but they need to be filed before the state notifies your client of the liability. Because of the ruling in Wayfair, this is a race sellers need to win.

For some states, the tax liability existed but was not concerning enough to file a VDA. In these states, the client filed and paid the relevant taxes, penalties and interest and just cleaned up the account. It was less expensive than getting lawyers and accountants involved.

For a few states, with very little revenue, the tax liability wasn’t worth worrying about. Any possible penalty or interest wasn’t a concern.

This analysis allowed the seller to quickly get comfortable with a liability he had but didn’t previously understand. However, the issue was still used by the buyer to reduce valuation, so we needed a way to counter this action. So we negotiated an escrow account, proportionate to the risk, to get both parties comfortable. The amount of the escrow was based on the seller’s analysis of the economic nexus. By executing and managing the VDAs, the seller expects to recover all of the escrow over time.

For most private business owners, the business is their primary asset and the vehicle to assure their financial security in retirement. Discussing Wayfair with your clients may help them prepare their business for sale, while reducing the risks when they still own their business.

Bruce Werner is the managing director of Kona Advisors LLC.