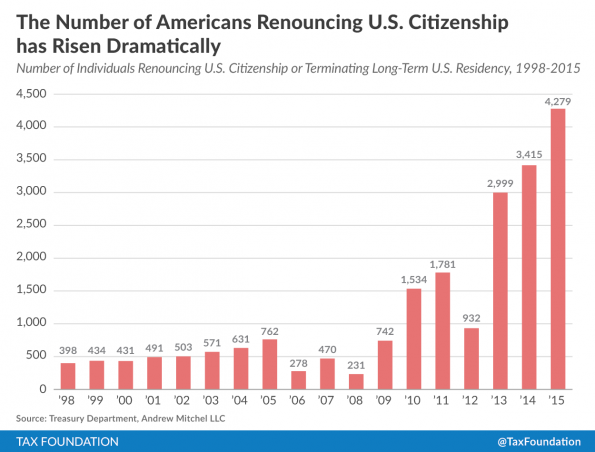

In 2015, 4,279 American expats renounced their U.S. citizenships, according to the U.S. Treasury. This figure represents a roughly 25 percent increase from 2014 and continues a trend that has seen the number of renunciations rise nearly 500 percent since 2009 (742).

A recent blog post by The Tax Foundation offers compelling data that suggests a strong correlation between the recent spike in U.S citizenship renunciations and the 2010 passage of the Foreign Account Tax Compliance Act (FATCA), which introduced stricter reporting requirements for foreign institutions with U.S. citizen clients and U.S. citizens living abroad. It’s a topic that we’ve postulated about on this site before, but having the hard numbers in front of you really drives the point home.

Though FATCA was initially conceived as a means to combat tax avoidance by wealthy expats (consistent with a larger series of tax grabs by a revenue hungry IRS in the past several years—the acronym was originally supposed to be FATCAT), which it appears to have been at least fairly successful in doing, it has also had an unintended and outsized effect on the average American living overseas.

Because of the increased scrutiny from the U.S. and the fairly onerous paperwork and potential penalties involved, a large number of foreign financial institutions have begun to consider all U.S. citizens, not just the wealthy, as liabilities and not being worth the reporting hassle and have increasingly been denying them service, some even going so far as to close existing accounts.

To throw the entirety of the responsibility for the increase in renunciations at the feet of FATCA is likely a stretch. U.S. citizens living abroad have long borne the burden of one of the most oppressive foreign tax regimes of any country, providing them ample incentive to renounce their citizenships. Since the U.S. taxes its citizens on all income no matter from where it was derived, expats are effectively taxed twice: once by the government of the country in which they live and once by the U.S. This tax regime is purposely punitive and based on the outdated notion that Americans living abroad are doing so for unsavory reasons (draft dodging, tax avoidance, etc.). Needless to say, this is overwhelmingly not the case. FATCA is less likely the root cause of the exodus and more likely the straw that broke the camel’s back.

That being said, the correlation between FATCA and the renunciation rate is undeniable. The article specifically points out that:

- “FATCA was passed in early 2010. In that year, the number of Americans that renounced their citizenship doubled, from 742 to 1,534.”

- “The final FATCA regulations were issued in early 2013. In that year, the number of Americans that renounced their citizenship tripled, from 932 to 2,999.”

- “FATCA’s penalties on banks went into effect in mid-2014. Since these penalties went into effect, 6,119 Americans have renounced their citizenship—more than the total number of Americans that renounced their citizenship during the entire first decade of the century.”

Regardless of what the root cause of the recent spike in U.S. citizenship renunciations is, FATCA, and the reaction to it’s passage by foreign financial institutions, is undeniably an important factor in expats’ decisions. It’s time to revisit whether the revenue created by this program is worth the grief it’s causing.