By Paul Kenney

High-net-worth clients are increasingly looking to direct investments, a strategy gaining popularity with institutional investors.

Direct investments appeal to wealthy individuals and family offices not only because they eliminate the management fees charged by investment firms, but also because the investments can align more closely with the values and mindset of the investor.

In the context of a family office, a direct investment represents an investment in a company or asset that is a stand-alone investment or a co-investment. This compares with an indirect investment where the family office is relying on the expertise of an intermediary (commonly known as a general partner) to make an investment in a diversified fund structure, typically charging management and performance fees.

About 67% of high-net-worth-focused practices expect to increase their allocations to direct investments over the next two years, according to a recent study by Cerulli Associates, underscoring the prevalence of direct investing; this compares with only 22% who plan to increase investments to private equity funds managed by third parties.

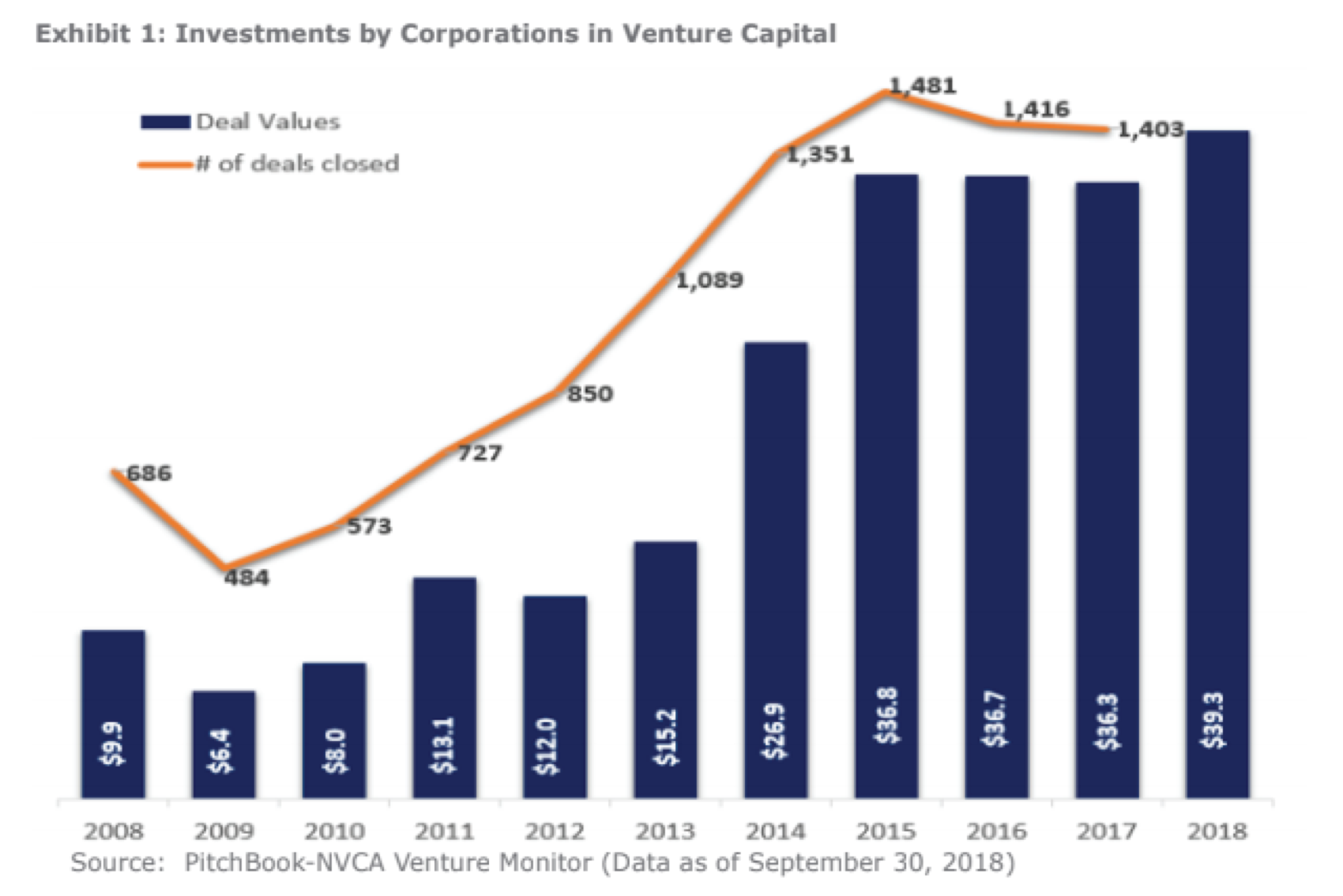

It is worth mentioning that while direct investing is showing an increase in popularity, money into this space has ebbed and flowed for decades; CB Insights notes that corporate venture capital is now in its fourth wave (the four distinct eras are: Conglomerate Venture Capital, 1960–1977; Silicon Valley, 1978–1994; Irrational Exuberance, 1995–2001; and the Unicorn Era, 2002 to present).

The most obvious motivation for direct investing is to save on the substantial fees paid to intermediaries. Other significant incentives include:

- Concentrating dollars into high-conviction investments;

- Capitalizing on family domain expertise;

- Career opportunities for the next generation;

- Better alignment with family values, i.e., pursuing opportunities with greater emphasis on environmental, social and governance (ESG) factors, and socially responsible investments (SRI);

- Greater control and transparency over investments;

- Ability to time entry and exit points for the investment;

- Enhanced ability to customize risk exposure; and

- Avoidance of distractions faced by general partners such as fundraising or dealing with client issues.

To be sure, direct investing also has its fair share of detractors who point to the risks associated with family offices investing in individual companies and competing head-to-head against well-resourced general partners and corporations. While venture capital and private equity direct investments can generate high returns, we advise caution and encourage a well-developed strategy to underwrite and monitor these investments and to integrate their allocation with overall client objectives.

Family offices should also be aware of the motivations of institutional investors that are involved in direct investing; in some cases, this could create opportunities for investment as well as competition for deals.

Institutional investors engaged in direct investments include large endowments, health care systems and corporations and, like family offices, they have ramped up their efforts. Corporations, as an example, have increased their percentage of venture capital deal value from roughly 27% in 2008 to 45% in 2018. Venture capital investments made by corporations (CVC) through the third quarter of 2018 are estimated at $39.3 billion (Exhibit 1).

In addition to enhancing returns, incentives for institutional investors may include:

- Monetization of intellectual property;

- Application of new technologies;

- Improvement in patient outcomes and experience for health care organizations;

- Tools to facilitate operating efficiencies and resource management;

- Professional growth of employees and ability to recruit talent; and

- Enhanced investment reputation.

Potential fee savings are the primary driver of enhanced returns within direct investing. When the typical 2-and-20 private equity fee structure is applied along with other expenses, the total annual cost of these investments is estimated to be 5% to 7%. Studies indicate that internal rates of return for private equity funds historically have been around 18% gross but only 11% when layering in fees. Theoretically, if a direct investment by a family office underperforms on a relative gross basis, on a net basis it still has the potential to outperform given the magnitude of general partner fees.

Paul Kenney is a partner at NEPC Private Wealth.