By Andrea Wong and Alexandria Arnold

(Bloomberg) --So much for the "durable" volatility in financial markets that Wall Street CEOs cited for helping to revive almost every investment bank’s earnings last quarter.

Low volatility has crept through markets once again following a bout of gyrations that spread across bonds and equities in the last two months of 2016 and the first weeks of this year. While Donald Trump’s presidential victory has been credited as a catalyst for higher trading revenue in the fourth quarter, the follow-through has proved to be elusive for now. That’s in large part because some Trump-inspired market trends, such as higher bond yields and a stronger dollar, have faltered.

Bank of America Merrill Lynch’s MOVE index, derived from over-the-counter options on Treasuries maturing in two to 30 years, has dropped Wednesday to the lowest level since before the election and is now below its five-year average. The CBOE Volatility Index for S&P 500 is near a record-low.

Analysts from BNP Paribas SA and Credit Suisse Group AG say it’s hard to see a revival in volatility unless the Trump administration provides more concrete budget plans, or surprises in economic data and monetary policy force investors to change their outlook.

"We haven’t heard enough information about the fiscal policy out of the Trump administration, so I don’t think markets are willing to move things further than they already have gone," said Timothy High, U.S. strategist at BNP Paribas in New York, one of 23 primary dealers that trade with the Federal Reserve. "We certainly have maybe hit an eye of the storm situation at this point."

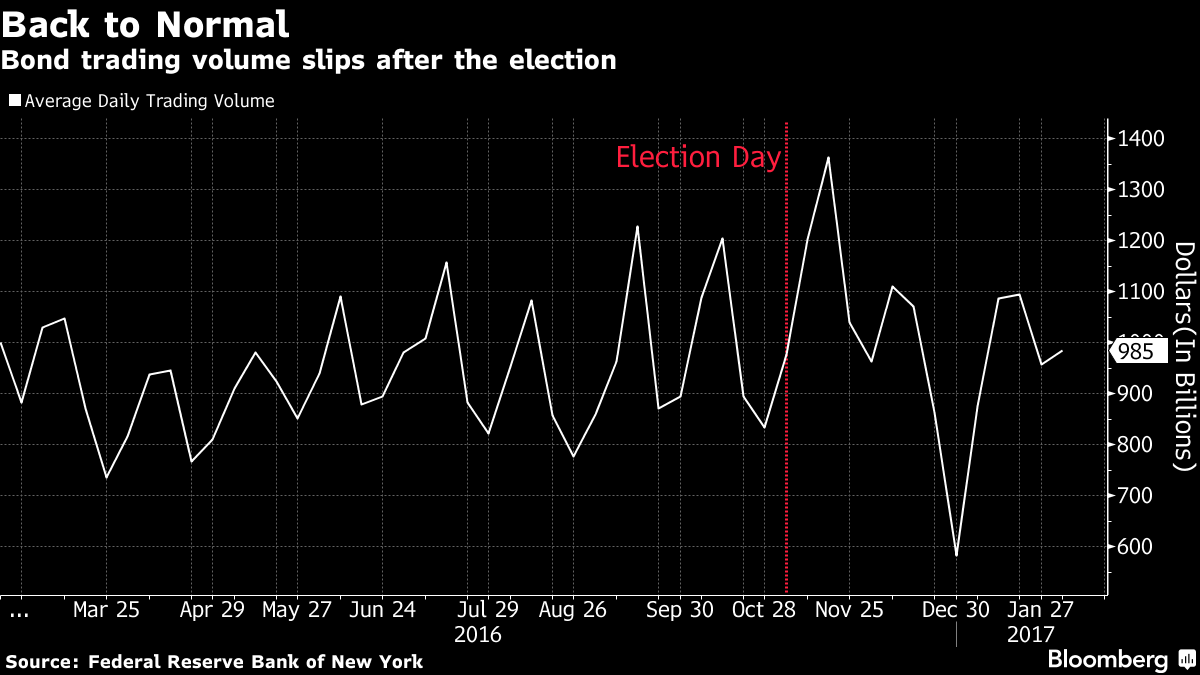

Trading volume in bonds, a key asset class that helped revive fourth-quarter profit at banks from Goldman Sachs Group Inc. to Citigroup Inc., has dropped back to pre-election levels, according to New York Fed data. In the first week of February, around $985 billion of Treasuries, corporate bonds, and other debt securities were bought and sold by primary dealers per day, down from $1.4 trillion at the peak in November.

That’s not to say that volatility won’t come back. To Goldman’s chief executive officer, Lloyd Blankfein, there’s "potential for more durable market trends and healthier levels of market volatility," and the rebound in profits isn’t "another false dawn," he said earlier this month. Blankfein could still be proven right before the quarter ends, with the president promising last week to reveal a "phenomenal" plan soon to overhaul business taxes.

Perhaps the one corner that’s still going strong for Wall Street banks is currencies, where volatility has held up. Even though U.S. politics haven’t provided much new information for investors to trade on, mounting euro-area risks centered on the French and Dutch elections are driving up the cost of hedging against price swings, as seen in the implied volatility for major currencies.

But market’s aren’t convinced. After initially rallying on stronger-than-forecast retail sales and consumer price data, the dollar traded lower Wednesday. It appears even the traditional catalysts need more help to keep the Trump-inspired rally going.

To contact the reporters on this story: Alexandria Arnold in Seattle at [email protected] ;Andrea Wong in New York at [email protected] To contact the editors responsible for this story: Jeremy Herron at [email protected] ;Boris Korby at [email protected] Dave Liedtka, David Scheer