Despite the worldwide prevalence of electric cars and the green revolution, production reality has finally set in. The long-term bear market in bonds, which is entering its sixth month, will likely persist for the foreseeable future.

Putin will go the way of Rasputin. The Russians will turn on their despot because that is where history always leads them. The comparisons between Putin and Rasputin (both villainous dangerous characters,) are evident as Putin’s invasion of Ukraine, a folly of historic proportions, will cause chaos and ultimate revolt in a country that spans eleven time zones.

Bold predictions? The brink of surrealism? Maybe. But mainstream thinking is rarely right. Leptokurtic distributions are statistical distributions resulting in a greater chance of extreme positive or negative events. Most of us know it as fat tails. We’ve already had more than a few this century. So, when we talk about a 4% 10-year treasury and a 6% or even 8% mortgage rate, (this year), it might be wise to add that possibility to your Monte Carlo simulations.

I started to reflect on what higher rates meant to me other than returning to a more “normalized” yield curve (with positive real yields) and bringing back a larger swath of American working family savers who have been shut out all these years. In 1978 my father, an immigrant, took out a $48,000 mortgage for his second home in Cleveland, Ohio. It sported an 8.5% coupon, and I remember that he told me he felt both proud and lucky to have had it. That, alongside his 12% 5-year CD a couple of years later, worked well for him. We didn’t have to pay for Wi-Fi, the internet, mobile phone bills, Netflix, Hulu or fancy $6 lattes. The only debt in our house was the mortgage, and it was manageable. Credit cards were not permitted, there was no third car, and we cooked at home with the occasional trip to McDonalds or Mama Santa’s on Mayfield Road for special occasions.

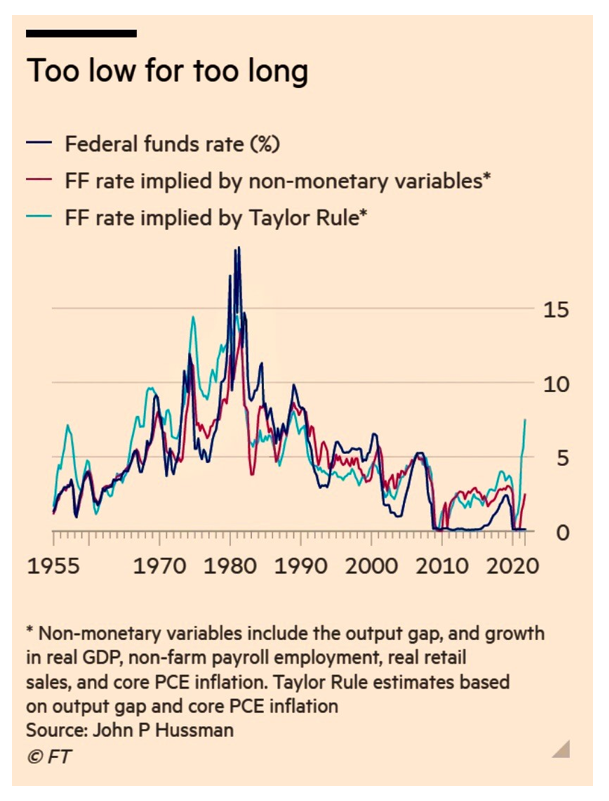

Today, we have a few similarities to the late 70s - when inflation reached double-digit levels followed by the most severe recession since World War II. Then, there were disruptions in the global oil supply caused by the Iranian Revolution. The Russian invasion of Ukraine is today’s global oil disrupter. The downturn then ended 16 months later, and in November 1982, the longest bull market in history started its 40-year run. We are at the beginning of a long-term bond bear market precipitated by a once-in-a-lifetime pandemic entering its third year and creating immense pent-up demand, and a politicized Federal Reserve holding rates too low for too long, keeping Wall Street fat, dumb and happy.

The previous long term bond bear markets were from 1899 to 1920 and from 1946 to 1981—not a short period of time—and there is not one economic pundit even dreaming of anything like that now because most of their clients are being “anchored”—defined as “the natural tendency of investors to attach their views to irrelevant, outdated, or incomplete information in making investment decisions.” What is your wealth manager telling you? Buy the dip? Think long-term? The Fed’s in control?

In his weekly Flow Show report, Michael Hartnett, chief investment strategist at Bank of America, astutely declared the big picture as one of “deflation to inflation, globalization to isolationism, monetary to fiscal excess, capitalism to populism, inequality to inclusion, and U.S. dollar debasement.” He said long-term yields will surpass 4% by 2024. An overly conservative prediction most likely mitigated by not wanting to C-Suite bosses.

We’ve warned about both rapid commodity price acceleration and the extraordinary increase in labor’s negotiating power for the last six months. Labor has already begun the long-term fight to keep up with inflation and make up for fifty years of lost wages that have mostly benefited investors.

Jason Furman and Wilson Powell, writing for the Peterson Institute for International Economics, noted “that inflation-adjusted wages fell by 2.1% in 2021, compared to the year before, and accelerated their decline in the last quarter. Looking at just the last three months of 2021—when inflation was breaking records—inflation-adjusted wages fell at an annualized rate of 4.3%.” No wonder labor has risen from the dead like a heavenly god. Look at the thousands of Southern California grocery workers who voted overwhelmingly to authorize a strike if supermarkets don’t meet their wage demands. As importantly, a grassroots campaign to create the first-ever union at an Amazon facility (Staten Island) has succeeded.

Finally, the United Food and Commercial Workers announced that 95% of those voting at seven local unions approved a potential strike. This is the tip of the labor iceberg.

Things are similar in the E.U., where wages were expected to catch up with inflation. Still, the economic fallout of Russia’s invasion of Ukraine leaves many E.U. workers facing even more significant pay cuts in real terms, according to union officials. Eurozone inflation surged to 7.5% in March, hitting another record high. As mentioned in previous monthlies, labor power will continue to re-emerge as a significant force in this country and Europe.

Western companies have slashed costs for the past 40 years by moving large parts of their production offshore using cheap (often child) labor. That has helped keep price pressures low, helped enable central banks to hold down interest rates, bizarrely compensated mediocre corporate CEOs with questionable options, and created massive investment in risky assets. Those days are gone.

U.S. jobless claims set a more than five-decade low a couple of weeks ago as the red-hot labor market showed few signs of cooling in the near term. In addition, the unemployment number for March was once again strong. On April 1st, the Labor Department reported that U.S. employers added 431,000 jobs in March (unemployment at 3.6%), beating expectations and keeping pace with the average gain in recent months. So why isn’t the Fed more aggressive? Surely they understand that we are a long way from a full-blown recession, given the vibrancy of the labor market and ever-increasing pent-up demand?

According to research from the Federal Reserve Bank of San Francisco, we know that yield curve inversion has preceded every single recession since 1955. (Presently, the 2-year Treasury yield is higher than the 10-year rate). No doubt higher rates are bound to cause some problems in the housing market, but the tax breaks investors receive in buying and renting single-family homes will keep the boom going, albeit not at the torrid pace of the last two years. Investor buying (hedge funds and private equity) of single-family homes accounted for 21% of sales in many regional markets. These regional markets also saw strong corporate buying as well.

Significantly higher rates encourage existing homeowners to cling to their current, cheap mortgages. It might also further limit the supply of existing homes despite massive cranes littering the skyline of almost every large and mid-sized city.

There can be no reliable progress against inflation without substantial increases in real interest rates, which might temporarily increase unemployment. But moving from a 3.6% to 4.5% unemployment rate isn’t an economy killer. Real short-term interest rates are currently lower than at any point in decades. They likely will have to reach levels of at least 4 or 5 percent for inflation to be brought under control. With inflation running above 8 percent, mortgage rates could also reach 8% once again— something market “experts” currently regard as almost unimaginable. Real positive yields are where the Fed’s demons lie. They know they cannot allow inflation to continue to erode the wealth of most Americans.

People notice when they pay more for groceries, rent, gasoline, pet food and diapers. It is painful and unsettling. Inflation affects a broader swath of people than does a change in the unemployment rate.

Finally, an unprecedented level of sanctions has been put on Russia, which will prove to be painful for them and the rest of the world. Ukraine and Russia are massive suppliers of things that the world needs. To list a few: nickel (over 11% of global production) used in tech and batteries, fertilizer, energy, neon gas used in chip manufacturing and a vast amount of wheat.

The cost of putting food on the table is the highest in 40 years. The biggest food price hikes are in meats, with pork and beef up 14% to 20% compared with a year ago. No wonder vegetarianism is on the rise!

For those old enough to remember the movie Wall Street and its most famous line, “Greed is good,” even more important was what Gordon Gecco said to finish his speech to Teldar’s board. He noted that the “other malfunctioning corporation” was called the USA. He also said, “The most valuable commodity I know of is information.” Well, you should have all the information you need to see the Fed panicking behind closed doors and feeling the ghost of Paul Volker in every dark hallway of that Beaux-Arts neoclassical building.

This much has been established:

The Federal Reserve will fail to control inflation if it delivers only six quarter-point rate rises this year as markets expect.

With Putin showing no sign that he is ready to pull back his troops, and the United States and Europe vowing to arm Ukrainian forces and wage unlimited economic warfare on Russia, there is no end in sight to the emerging duel between the West and Russia.

George Lucaci is Global Head of Distribution at FolioBeyond.