By Stacey Morris

With the 10-year Treasury yield recently touching highs not seen since 2011, with a candid commentary from the White House on Federal Reserve rate policy and tumultuous market activity last week, investors can’t help but be focused on interest rates. As a result, attention has also turned to yield-oriented investments and the impact of rising rates on their performance. For Master Limited Partnerships, rising interest rates can be a headwind in two ways: Fixed income investments become more attractive, increasing competition for investor dollars among yield vehicles and borrowing costs rise.

There are several factors that have historically allowed MLPs to mitigate the negative effects of rising interest rates, particularly in comparison to other yield vehicles such as REITs and Utilities.

MLPs have historically demonstrated a low correlation with Treasury yields. Using the Alerian MLP Index, the weekly correlation for the past 10 years between MLPs and the 10-year Treasury yield is 0.2, and the 15-year correlation is even lower. Given historically low interest rate levels over the past decade of less than 4 percent, the long-term correlation between the AMZ and the 10-year Treasury yield may be less meaningful than if we had experienced more volatility at higher interest rate levels over the same time period.

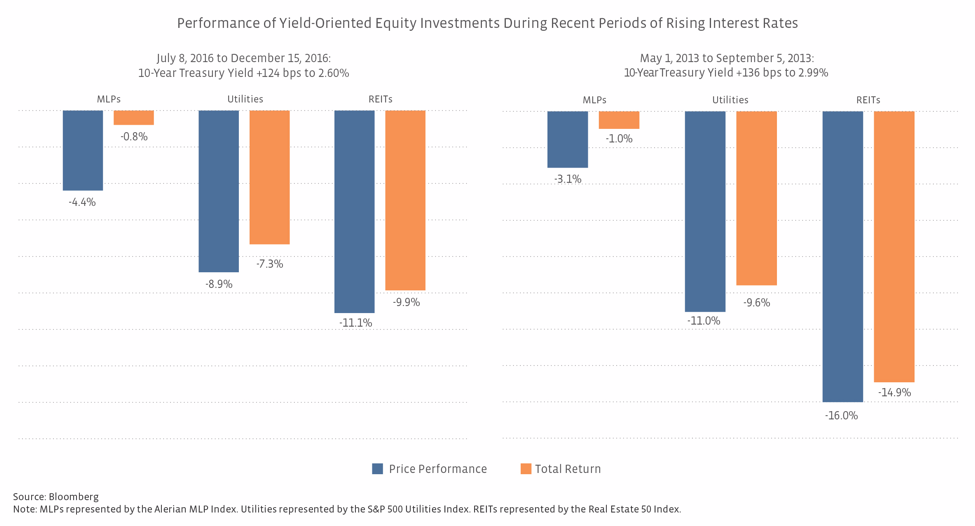

As an alternative, it’s informative to look at MLP price performance during more recent periods of rising rates. As shown below, MLPs significantly outperformed Utilities and REITs during both the taper tantrum in 2013 and when rates nearly doubled in the second half of 2016.

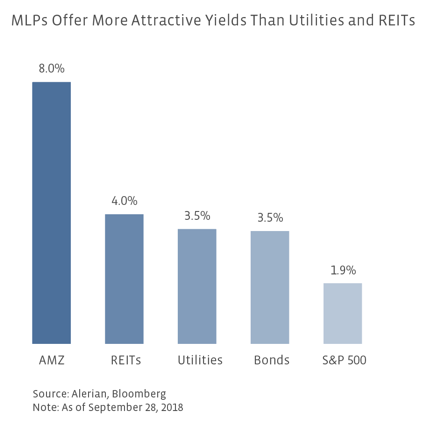

It’s important to point out that each scenario of rising interest rates will have its own nuances. Relative to the periods shown above, the 10-year Treasury yield today of more than 3 percent is at a higher absolute level, creating more potential competition for yield. On the other hand, MLP yields are also at higher levels today than they were for the time periods in 2013 (5.8 percent) and 2016 (7.3 percent). MLPs’ higher yield today may help insulate them from the impact of rising rates, as the yield advantage of MLPs versus the 10-year Treasury is nearly 5 percent compared to a long-term (15 years) average difference of 3.8 percent. MLPs also boast a more attractive yield than Utilities and REITs, as shown below.

Another contributing factor that helps MLPs offset the impact of rising rates is MLP distribution growth. The MLP space is generally leaving behind the old convention of 6 to 8 percent annual distribution growth in favor of more sustainable distribution growth and stronger balance sheets. Despite the fact that growth has moderated since 2013, most AMZ constituents grew their distributions paid in 3Q18, and more than 80 percent of AMZ constituents grew or maintained their distributions relative to 3Q17. In the wake of the oil downturn, many MLPs have reduced their leverage and balance sheet positions have generally improved. Stronger balance sheet positions should help mute the negative impact of rising interest rates on borrowing costs for MLPs.

From a fundamental standpoint, MLPs are also in a better position today with U.S. oil and natural gas production at record highs. As volume-driven businesses, higher energy production supports high utilization of existing pipeline and infrastructure assets and creates growth opportunities. MLP growth projects are built with customer commitments largely in place under long-term contracts and clear visibility to fee-based cash flows. Often, contracts will also include inflation adjustments, further protecting MLP cash flows.

If we look at price performance this year as rates have risen, the outcome is more mixed. MLPs (-3.3 percent) outperformed REITs (-10.3 percent) and Utilities (-7.7 percent), as the 10-year Treasury yield gained 54 basis points at the start of the year through Feb. 21. However, in the recent rate move, Utilities have provided better performance. Utilities were up slightly as the 10-year Treasury yield increased by 42 bps from Aug. 24 to Oct. 5, while MLPs were down 3.2 percent and REITs lost 4.7 percent. Utilities outperformed even before the flight-to-safety trade kicked in with the broader market pullback on Oct. 11. Utilities are more defensive and may hold up better in an environment of rising rates if the market embraces a risk-off trade.

Admittedly, past performance is only so helpful in evaluating how MLPs will perform as rates rise, and rates are reaching levels not seen in years. Balancing the higher level of interest rates with the advantages MLPs enjoy today, including a strong fundamental backdrop with record high U.S. oil and natural gas production, improved balance sheets, higher yields than in past scenarios of rising rates, and distribution growth at a more sustainable pace, the tailwinds seem to outweigh the headwind of rising rates.

Stacey Morris is the Director of Energy Research at Alerian Indexes.