By Tim Duy

(Bloomberg Opinion) --Investors are rapidly headed to a sort of purgatory. On the one hand, the U.S. economy is in the midst of a record-breaking expansion, making it difficult to abandon riskier financial assets such as equities. But on the other, the strong economy is keeping the Federal Reserve leading toward ever higher interest rates and tighter financial conditions, sparking concern about a monetary policy error that sparks a recession and leaving market participants wary of holding onto risk assets ahead of a downturn.

As expected, the Fed left rates unchanged at the conclusion of Thursday's policy meeting. Central bankers made few changes to the accompanying statement, with the description of the economy changed to reflect incoming data in the context of activity that “has been rising at a strong rate.” There was no mention of the slowdown in housing activity, which is not terribly surprising given residential investment has already been a drag on growth for three consecutive quarters. The sector simply is not driving the economy now; that’s a story from last decade.

The Fed gave no reason to doubt their resolve to continue raising rates at a gradual pace. Another rate hike is coming in December as the Fed looks to cool the economy until it settles into something they believe is consistent with inflation stability over time. Growth remains far too strong to allow the Fed to signal they are considering a pause, especially given that the economy currently operates at a level that exceeds their estimates of full employment.

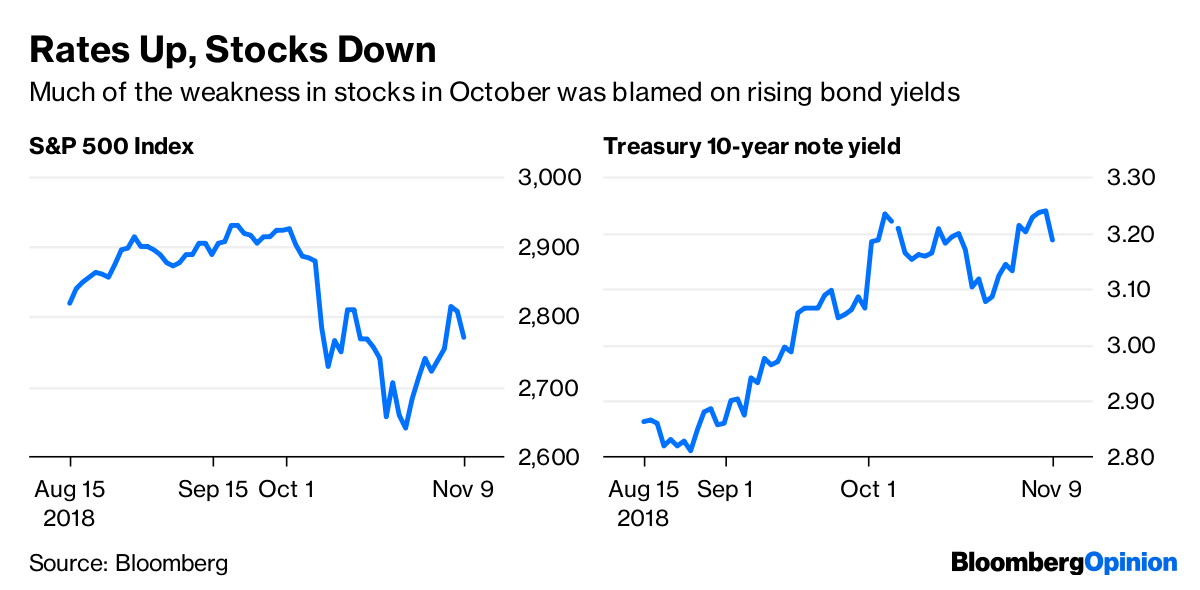

Moreover, rising longer term bond yields gives the Fed a green light to continue pushing up policy rates. If the long end of the yield curve starts moving up in lock step with the short end, concerns that the yield curve will invert -- a traditional sign that a recession looms -- become less salient. Bond markets are telling the Fed the economy needs higher rates to stay balanced. The Fed will be happy to deliver.

This creates an especially difficult environment for risk assets. The Fed would like to hold the economy to a slow simmer. That requires tighter financial conditions. That in turn keeps the risk of a policy error and recession alive. Moreover, a more normal economic environment will entail higher rates, which will weigh on equity valuations. Ultimately, that’s a situation in which it is difficult to fully embrace risk assets.

Yet at the same time, avoiding risk assets is equally difficult. Incoming economic indicators give no reason to believe a recession is imminent, so selling now on the basis of an expected policy error is likely premature. And if the Fed successfully keeps the economy at a slow simmer, the next recession might be years in the future. Hence selling now risks not being just a little premature, but a lot premature.

The situation is thus one where it is difficult to be all in or all out of risk assets. It’s purgatory -- neither heaven nor hell.

What breaks the cycle and releases market participants from purgatory? One way is if incoming information signals that the economy will cool sufficiently to alleviate overheating concerns absent further rate hikes. The Fed’s forecast suggests that time is still a far in the future. A slowdown that occurs more quickly than the Fed expects would accelerate the timeline to a pause, which would be positive for risk assets, but only as long as the Fed reacts before the slowdown turns into a recession.

Alternatively, the Fed could fail to hold the economy to a slow simmer and it boils over instead. In that case the Fed turns its attention to fighting inflation, and I believe the Fed would ultimately choose recession over inflation. Such a situation would be a negative for risk assets.

In other words, to break from the current space of caught between embracing and rejecting risk assets, we need the economy to break decisively one way or the other. Ironically, an economy holding to a slow simmer is really the best possible outcome for the Fed, but one that is likely to be uncomfortable for market participants as the flip between always looking for the next recession while being surprised by the continued growth.

Tim Duy is a professor of practice and senior director of the Oregon Economic Forum at the University of Oregon and the author of Tim Duy's Fed Watch.

To contact the author of this story: Tim Duy at [email protected]

For more columns from Bloomberg View, visit bloomberg.com/view