Encouraged by the Federal Reserve’s policy of financial repression (suppressing interest rates) since the Great Financial Crisis, the central bank’s measure of the nonfinancial business debt-to-GDP ratio grew from about 69% at the end of the fourth quarter of 2007 to more than 78% by the end of the second quarter of 2022—a relative increase of about 13%. Over the same period, the ratio of household debt-to-GDP fell from about 98% to about 75%, a relative decrease of about 23%. It’s also worth noting that at the end of 1992, the ratio of nonfinancial business debt-to-GDP was only about 55% and the household debt ratio was only about 61%. The result is that over the past 30 years, the Fed’s measure of business debt-to-GDP has increased by 23 percentage points and household debt has increased by 14 percentage points.

This is not a U.S.-only phenomenon. Business debt has risen markedly around the world, especially in emerging markets. While U.S. households have improved their balance sheets since the GFC, business debt burdens have increased amid a growing likelihood of a global recession prompted by the war in Ukraine and tight monetary policies to fight inflation. This amplifies the risks from a debt overhang as business earnings could come under pressure.

Empirical Research Findings

Òscar Jordà, Martin Kornejew, Moritz Schularick and Alan Taylor, authors of the October 2021 study “Zombies at Large? Corporate Debt Overhang and the Macroeconomy,” collected data on nonfinancial business liabilities (primarily bank loans and corporate bonds) for 17 advanced economies over the past 150 years in order to examine the impact of increasing business and household debt on the economic cycle. Given the disagreement on how to measure the business cycle, they concentrated on assessing how leverage buildups in expansions relate to the severity of subsequent recessions. Following is a summary of their findings:

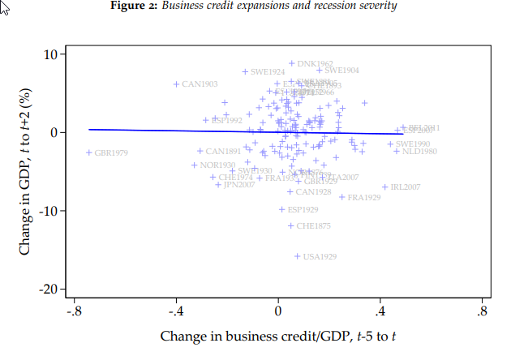

- Business debt booms in an expansion say next to nothing about how the subsequent recession will play out. It does not seem to matter whether the economy experiences a financial crisis or not, nor whether the level of debt relative to GDP was high or low. For example, a 10 percentage point increase in the business credit-to-GDP ratio in the expansion—a considerable rate of growth by historical standards—was not associated with a slower recovery.

- Recessions preceded by household credit expansions were not only deeper but were followed by significantly slower recoveries—a 10 percentage point increase in household debt in the expansion was associated with dire consequences, as five years later the economy barely recovered to its level at the start of the recession—business credit booms were rarely followed by such macroeconomic hangovers.

- Household credit booms were followed by a long period of household deleveraging alongside lower aggregate spending, resulting in higher unemployment and lower inflation than in the average recession, though the inflation response was less clear-cut. Thus, a recession that follows a boom in household credit appears to require stronger monetary support. These same features were not apparent in business credit booms.

- Both house and stock prices were more negatively affected after household credit booms as compared to business credit booms.

- Finding no effects at the mean, they also investigated the connection between business debt and slow growth in the worst-case scenarios and again found no connection. This is in sharp contrast with how household debt booms increase risks of deeper and longer recessions, as households take years to restore balance sheets.

- Using legal traditions as an instrument for debt renegotiation costs, where institutions encourage efficient restructuring and liquidation, the drag from business debt booms was small. However, in countries where frictions due to renegotiation costs were high, the recovery from a business debt overhang could be just as sluggish as household debt overhang.

- Frictions to debt resolution make recessions deeper and longer. For example, inefficient liquidation increases the survival probability of zombie firms (excess capacity reduces investment and productivity).

- Frictions are much greater for household debt. Coordination frictions among many dispersed creditors, hold-out problems, asymmetric information, weak contract enforcement and other frictions can make renegotiation difficult or even prevent it altogether—an important factor in explaining the differences in the impact from household credit booms and business credit booms.

To help explain their findings, Jordà, Kornejew, Schularick and Taylor noted that the possibility of underinvestment provides an incentive for owners and creditors to restructure debt. Underinvestment pushes the value of the firm below its potential so that both sides gain from implementing an efficient investment policy. In addition, “running down assets” through underinvestment constitutes a credible and effective threat to bring creditors to the negotiation table. They also cited prior research that found that differences in bankruptcy law regimes affect the investment behavior of firms near default and thus highlight the role of frictions to debt renegotiation.

Because household debt has much greater frictions, household credit booms have had much greater effects on the economic cycle. The authors explained: “Individual banks have no interest in restructuring household debt as such policies are beneficial only at the macro level. But this is clearly different for businesses. Such frictions are a natural mechanism that could explain the contrast between household and business debt overhang.” They added: “Frameworks that efficiently facilitate the restructuring or liquidation of debt reduce the macroeconomic fall-out of corporate debt booms. Conversely, legal and regulatory frictions will precipitate debt overhang and corporate zombification, thus impairing productivity growth and slowing down the recovery after recessions.”

Jordà, Kornejew, Schularick and Taylor’s findings were consistent with those of the authors of the 2012 study “Macroeconomic Effects of Corporate Default Crises: A Long-Term Perspective,” who found that default events were only weakly correlated with business downturns over 150 years of U.S. history.

Investor Takeaways

The Federal Reserve’s aggressive raising of interest rates while also engaging in quantitative tightening (reducing their holdings of financial assets) has investors worried about the risks of recession and its heightened risks to corporate earnings and credit. While the business debt-to- GDP ratio has increased significantly over the past 30 years, the good news for investors is that the empirical research findings demonstrate that at the aggregate level, business debt overhang does not play an economically or statistically significant role unless frictions to renegotiating debt impede the process. Debt overhang can lead to underinvestment by firms—when institutions are high-cost and inefficient, investment tanks and does not recover for many years after debt booms. This highlights the importance of limiting frictions (inefficient legal processes and institutions) in resolving a debt overhang.

The other good news is that while household debt (which cannot be easily restructured) remains high relative to its level 30 years ago, it remains well below levels reached prior to the GFC, and the labor market is about the tightest it has ever been; the unemployment rate is at 3.5%, and there are more than 10 million job openings and only 5.8 million unemployed. The result is that even in a recession, the shortage of labor could cause businesses to be reluctant to lose employees who might be difficult to attract once a recovery has begun. That should help the economy but be a drag on corporate profits.

One source of concern is that the combination of tight labor markets (creating pressure on wages) and the fact that the U.S. has a housing shortage of about 4 million homes (putting pressure on housing prices and especially rentals) could make it more difficult for the Fed to bring inflation down to its target of 2%. The result could be that the Fed will have to raise interest rates more than the market currently expects and keep rates higher for longer. That would not be good for either traditional stocks or bonds. Forewarned is forearmed.

Larry Swedroe has authored or co-authored 18 books on investing. His latest is Your Essential Guide to Sustainable Investing. All opinions expressed are solely his opinions and do not reflect the opinions of Buckingham Strategic Wealth or its affiliates. This information is provided for general information purposes only and should not be construed as financial, tax or legal advice. LSR 22-399