(Bloomberg) -- Rising interest rates and the end of easy money are causing pain for vast swathes of the economy, but for the European real estate sector the drying up of central bank largesse threatens an entire way of doing business.

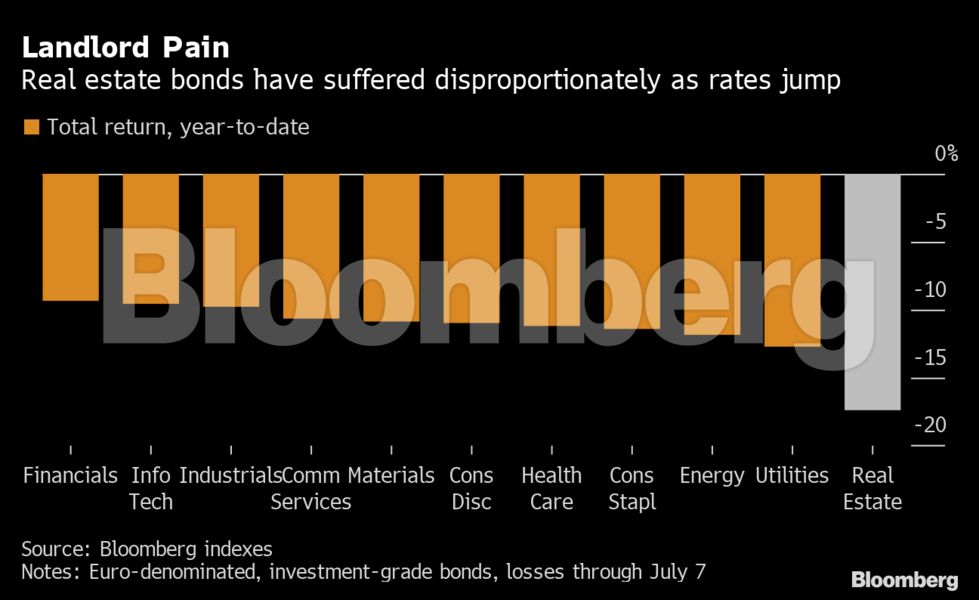

An index of real-estate bonds has lost more than 17% since the start of the year, the worst performing sector in the region’s high-rated debt market. The losses stand out even amid a wide selloff in corporate bonds, with an 11% drop in the broader index.

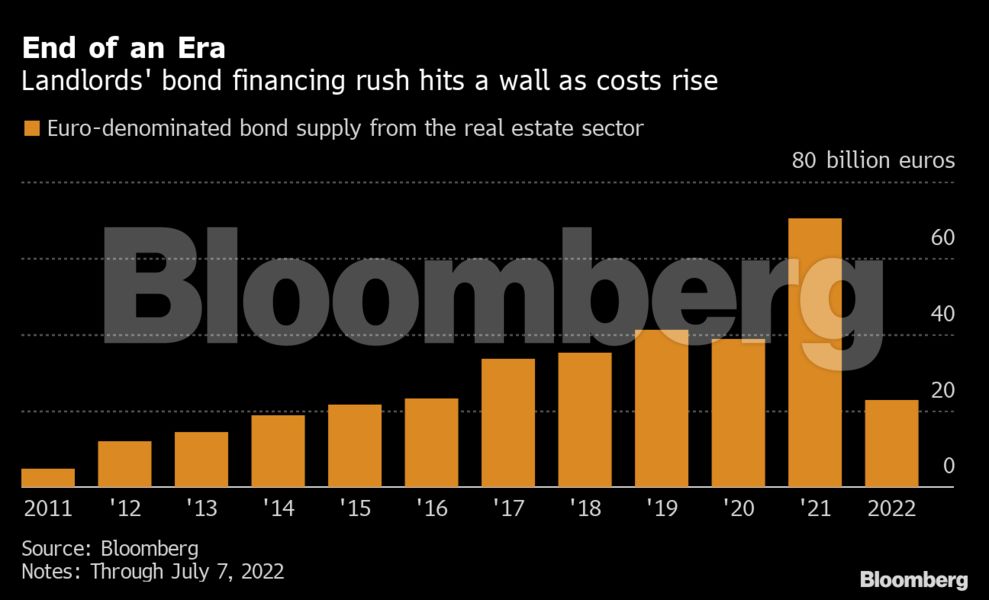

The historic pummeling sent European debt issuance off a cliff in recent months after an eight-year borrowing binge in which real estate companies sold 316 billion euros ($322 billion) of bonds. Investors are concerned that the companies have grown too dependent on cheap funding from the European Central Bank and that the end of quantitative easing could put a lid on a borrowing model that transformed the industry.

“It’s a sector that’s been growing far too much, far too quickly,” said Thomas Samson, a portfolio manager at Muzinich & Co., which oversees $37.3 billion. “The problem is the cost of funding is the number one driver of profitability. If that goes up, then the music stops.”

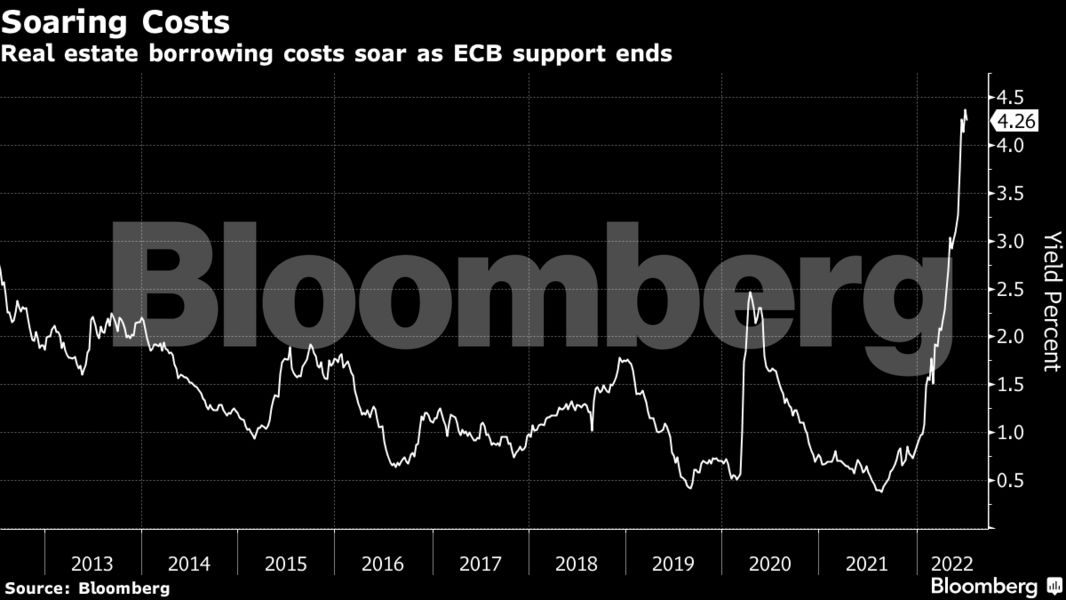

Average yields on euro real estate bonds surged to 4.58% last week from 0.4% last August, according to Bloomberg index data. That compares with about 2% in 2014, when the ECB launched its unprecedented asset purchase program.

The ECB’s efforts to help the economy recover from the euro area debt crisis drove down borrowing costs and gave these companies unfettered access to bond markets for the first time. Their borrowing binge since then compares with just 59 billion euros of issuance in the previous eight years, according to data compiled by Bloomberg.

Real estate investment trusts, which raise money to buy properties or improve existing buildings, had previously relied on bank loans in exchange for posting collateral. The ECB’s stimulus gave them access to cheaper and larger sources of unsecured debt, allowing them to expand rapidly.

This model is now in danger and investors are worried that the mountain of debt will become harder to refinance -- as rates rise -- or to repay as rental income declines in a recession.

To be sure, the companies have other sources of financing and credit lines with banks currently cost less than bond rates. But, they’d have to pledge assets, take on several loans instead of a single bond and might not be able to raise as much money.

“The REIT business model has been about the increased level of unsecured financing to get better returns at the company level,” said Tom Ross, a portfolio manager at Janus Henderson, which oversees 274 billion pounds. “Do they have access to tighter yields via secured financing? Yes, but that doesn’t really fit their model.”

After an initial flurry of issuance at the start of the year, real estate companies sold just 2.7 billion euros of debt in the second quarter. That’s down almost 90% from the same period the year before, making it the worst quarter of issuance since early 2014, based on data compiled by Bloomberg.

Hybrid debt from property developers is getting hit especially hard because it’s the first category to take losses. More than 40% of bonds sold by real-estate companies officially rated high grade are now trading at junk levels.

The property market, which was at the center of the global debt crisis in 2008, is once again looking like a driver of pain in bond markets.

“The big difference with 2008 is that the banks are still liquid and the secured lending market is still there,” said Thomas Neuhold, a real estate analyst with Kepler Cheuvreux. “But there’s no doubt that the interest rate shock has created some angst and fear.”

Elsewhere in credit markets:

EMEA

Covered bond offerings by DekaBank and Korea Housing Finance Corp. kick off a week when the SSA sector is expected to lead issuance for a sixth straight week thanks to a bond syndication by the European Union.

- Gazprom announced on Monday that it will supply to Eni volumes of gas for approximately 21 million cubic meters per day, compared to an average of about 32 million cubic meters per day for the last few days, Eni said

- Banks face big potential losses from about $80 billion in acquisition debt that they promised to raise to facilitate mergers and leveraged buyouts when financial conditions were better

- A shrinking corporate bond market in the coming months due to the high cost of issuance seems inescapable as it will take a sharp drop in yields to make such financing competitive to bank loans again

Asia

Holders of an Evergrande yuan-denominated note rejected a proposal to further extend payment past a deadline on July 8, throwing the distressed Chinese developer’s debt pile back into the limelight.

- Firm has so far avoided default on local bonds by securing delays on payment deadlines, even after it first failed dollar-note obligations in December

- Meanwhile, Japanese megabank MUFG is marketing dollar debt in an otherwise subdued session Monday for such deals from Asia

- A risk-off mood hung over most markets in the region as concerns about the global economy dragged down raw materials including oil

- Japan was the exception after the ruling coalition expanded its majority in an upper house election

- Spreads on Asian investment-grade dollar bonds, which have tightened about 2bps over the last fortnight, were little changed Monday, according to a trader

Americas

A key measure of US credit risk, the investment grade CDX, rose Friday after the monthly employment report beat estimates, signaling the Federal Reserve does not need to slow down rate hikes.

- Investors pulled money from US high-grade bond funds for the 15th straight week, according to Refinitiv Lipper, extending the longest losing streak on record

- As recession fears grow, it makes sense to focus on high-quality assets that are offering good value, including investment-grade corporate credit and collateralized loan obligations, said TCW Group’s Steve Kane

- For deal updates, click here for the New Issue Monitor

- For more, click here for the Credit Daybook Americas

© 2022 Bloomberg L.P.