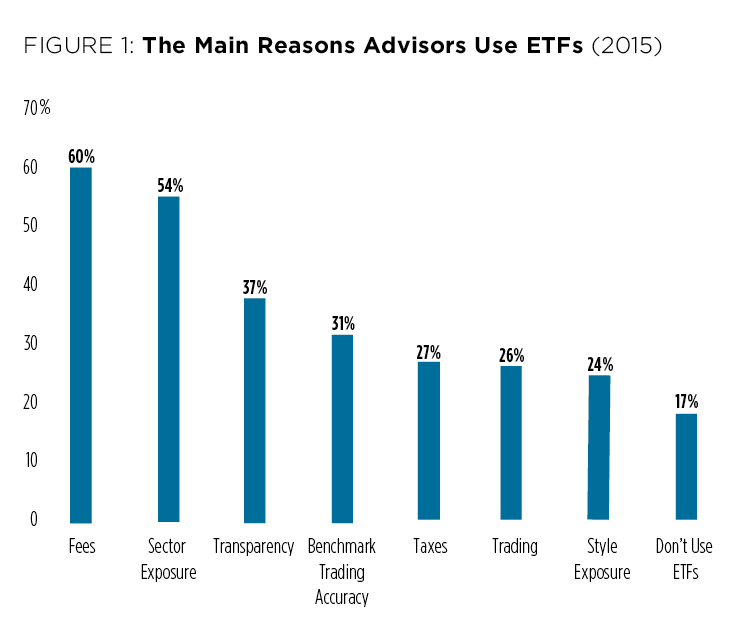

Only 2015 responses are displayed as the answer choices for this question changed slightly from last year. Overall, our survey indicates that exchange traded funds remain popular investment vehicles, with only 17% of advisors indicating that they do not use ETFs for their clients, a level consistent with survey results from the past few years. With 60% of respondents indicating fees as the main reason to use ETFs, advisors continue to emphasize to their clients the relatively lower cost of ETFs on average. Sector exposure, at 54% of respondents, was the second most important reason to use ETFs, indicating that RIAs value the ability to make sector bets for their clients in a liquid and efficient manner. Transparency, tracking error, taxes, and trading are also important to RIAs; each garnering the attention of between 26% and 37% of respondents. Style exposure is a new answer choice this year and its 24% response rate, taken in conjunction with the other results, indicates that increasingly ETFs provide a variety of ways for RIAs to customize the exposure that fit with their clients’ risk profiles and time horizons.

Next Part 2 of 6: Expected Change in the Use of ETFs in the Next Three Years