In a world facing challenges related to a changing climate and stark social inequalities, the concept of impact investing is compelling, powerful and frequently misunderstood. As a field of practice, impact investing builds on the long history of social investing and is rapidly evolving with an infusion of new ideas and participants.

Evidence of investor demand abounds. It’s estimated that the total of U.S. assets under management employing some degree of social and environmental considerations is $6.6 trillion, as of 2014.1 The trends among high-net-worth individuals (HNWIs) are robust, with a recent global survey estimating that over 40 percent of HNWIs under 40 years old have portfolios that integrate social and environmental criteria, with 64 percent expected to increase their allocation in the next two years.2

Sophisticated investors are pursuing impact strategies. A growing number of foundations are exploring impact investing as a means for optimizing and harmonizing their capital—intellectual, financial and philanthropic—in service of their missions. Some family offices are funding enterprises and technologies that offer benefits to society and are building teams or seeding funds to execute these strategies. Global leaders, from the Pope to the President of the United States, invoke impact investing as a means of combating climate change and poverty; fostering social justice; and cultivating inclusive economies.

Infrastructure

While expectations and trends are positive, impact investing infrastructure is still a work in progress.

The industry of providing data regarding impact investing is maturing, and organizations like the Sustainability Accounting Standards Board are advancing efforts for the reporting of financially material social and environmental factors, but investors have an almost unquenchable thirst for data, and the need for greater disclosure from companies is high. Large asset managers and banks are forging into impact investing seeking business growth, with many of their strategies and platforms still being nascent. The amount of compelling investment opportunities is growing, but it takes time to build track records. Many advisors are developing some capacity to engage with the market and service impact investors, but the degree of depth and skill varies widely.

For those responsible for portfolio execution and oversight, impact investing can introduce new tools for risk management, different frameworks for assessing the quality of an asset and an increased time commitment for learning and reflection. It doesn’t, as some skeptics believe, lead to the abandonment of rigorous standards.

Cambridge Associates, LLC (Cambridge) partners with over 150 institutional and family clients who are either exploring or implementing impact strategies. I’ll offer a practitioner’s perspective on the experience of seasoned impact investors and the most pressing questions we hear from those embarking on an impact investing path.

These questions include: What exactly is impact investing; why do investors pursue impact; what does the opportunity set look like; what about returns; and how can I learn more?

What’s Impact Investing?

Vocabulary often presents the first hurdle to those seeking to better understand impact investing. In many regards, all investments generate some degree of social and environmental impact. What makes impact investing distinct?

Among practitioners, there’s no consensus on a precise definition, but many agree on broad parameters. The Global Impact Investing Network (the GIIN) states that impact investments are those that deploy capital with the intention to generate social and environmental impact alongside a financial return.

Another common question is how impact investing is differentiated from socially responsible investing (SRI) or investments that consider environmental, social and governance (ESG) factors. All these approaches are related and share a common ancestry, but the distinction lies largely in the realm of investor motivations, intent and decision criteria.

A simple taxonomy is that SRI evolved from religious and social movements and follows the premise that investments are an expression of investor values and beliefs. A common implementation of these values in a portfolio is via exclusionary screens. Conversely, ESG investing is a fundamental exercise of enhancing risk management and identifying opportunities by assessing ESG factors of a given enterprise. ESG strategies will concentrate capital in enterprises with relatively high or improving ESG scores, which is more proactive than using an exclusionary strategy.

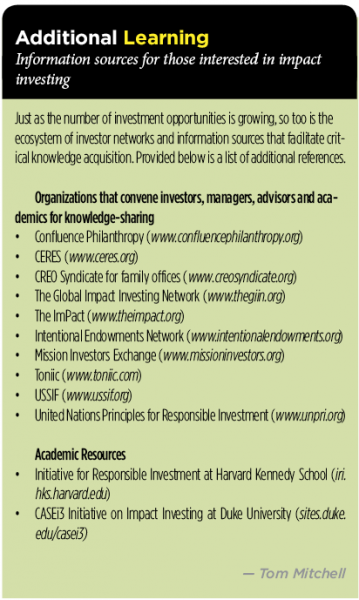

While SRI and ESG have their distinctions, they often intersect in the realm of social factors, which are subjectively evaluated and prioritized by different investors. It’s in this confluence where impact investing resides to some degree, and this creates discomfort for some who try to consider economic factors alone. In my view, a further nuance is that impact investments challenge the notion that critical environmental and social factors are totally distinct from economic benefits. For resources on impact investing, see “Additional Learning,” p. 22.

Motivations

A further distinction of impact investing is found through an analysis of investor motivations. At a high level, impact investors are motivated by some combination of the following factors, none of which are mutually exclusive:

• Change. Investors may leverage their role as asset owners to influence behavior of enterprises (corporations, nonprofits or governments).

• Solutions. Investors want to employ their dollars to catalyze direct solutions to key challenges or to shape and develop imperfect markets and industries.

• Alignment. Investors may emphasize investments that are consistent with values, principles, world view and organizational mission or strategy.

• Performance. Issues of concern to impact investors may be material to financial performance and risk management.

• Constituents. Impact investing can be a means for addressing the concerns of donors, students and family members regarding the social and environmental ramifications of investment decisions.

Another distinguishing and important trait of impact investors is that they want to know what they own and why. Furthermore, impact investors use pre-investment evaluation and post-investment measurement to understand how risks and benefits are distributed to investors, investees and society.

Developing Strategy

Entities (either institution or family office) that pursue impact investing ensure their motivations carry significant weight in their strategies and decision criteria. They translate these motivations into actionable policies by articulating their purpose, priorities and principles.

The purpose of an entity refers to its primary objectives. For a foundation, this may be its mission; for a family, it may refer to the long-term goals of its portfolio(s) and societal engagement. The statement of purpose should be supported by specific financial objectives, liquidity needs and systemic impact goals. Examples of the latter would be addressing climate risk and meeting social justice aspirations.

The statement of priorities helps define impact themes and map them to investment opportunities. While some impact priorities may not be immediately investable, the statement of these imperatives helps ensure that an entity proactively seeks opportunities that align with its priorities.

For example, fostering a healthy environment and sustainable communities is a priority for many investors. In our recent paper framing risks and opportunities associated with climate change, we articulated several solutions-oriented themes that are endemic to many clients’ strategies, including: renewable infrastructure, clean transportation, smart energy management, energy efficiency in buildings and water and agricultural efficiency.3 In effect, the articulation of priorities can serve to widen the lens used to define the investment opportunity set.

The articulation of impact principles facilitates the integration of priorities with existing investment criteria. This doesn’t require the obviation of rigorous investment standards, but does typically expand the list of key decision criteria. For example, impact investors assess risks beyond those affiliated with their financial capital alone and consider risks to their investees and how their capital may either mitigate or elevate such risks. These principles also may allow for some level of investment with emerging strategies, which may have limited track records but close alignment with investor priorities and high impact potential.

Impact Investment Strategies

Clients engaged in impact investing employ a wide range of strategies. They deploy capital across all asset classes, geographies, impact themes and distinct investment structures such as funds, co-investments and direct positions.

In public equities, many investors employ passive strategies that integrate impact and ESG criteria. The aforementioned rise in data and asset manager activity has increased the number of investable opportunities. Increasing adoption of these strategies has also reduced costs historically associated with the additional ESG research.

There are a growing number of actively managed strategies that integrate ESG or offer concentrated, thematic portfolios expected to outperform over the long term. Examples of the latter include strategies focused on the sustainability of water, clean energy and agriculture. As with any active strategy, alpha isn’t a given, and careful manager selection is critical for success.

Whether employing passive or active strategies, many investors seek to drive impact as active owners of assets. They may engage with management, vote proxies or try to influence greater ESG disclosure from companies.

Impact investors are also active across the expanse of private capital markets. They’re committing capital to venture and growth equity opportunities across a range of resource efficiency, clean technologies and sustainable enterprises that offer quality employment to historically marginalized communities and populations.

While equity investments tend to dominate portfolios with long-term growth objectives, debt markets offer diversification from equity risk, income and an increasing number of impact opportunities thanks to improved information flow. For example, Morgan Stanley Capital International is one of the largest providers of capital markets and ESG data, and its analysts provide ESG ratings for over 6,000 publicly listed equities and more than 350,000 fixed income securities.4

Our impact clients employ managers that integrate ESG and impact considerations into both corporate and municipal bond portfolios offering quality credits and positive impact, particularly for investors focused on community development. Several also use private markets to engage in direct lending to small- and middle-market enterprises, as they feel the magnitude of impact tied to their specific capital is greater in these strategies.

Impact investors are also facilitating the development of sustainable hard assets that offer a blend of impact, cash yields, asset appreciation and diversification. Examples include conservation finance strategies such as sustainable timber, wetland mitigation and carbon credits. There are real estate opportunities in efficiency retrofits and deployment of renewable energy. Finally, as global infrastructure is upgraded or installed, there are opportunities to enhance water management and transportation systems that facilitate more robust communities and regional economies.

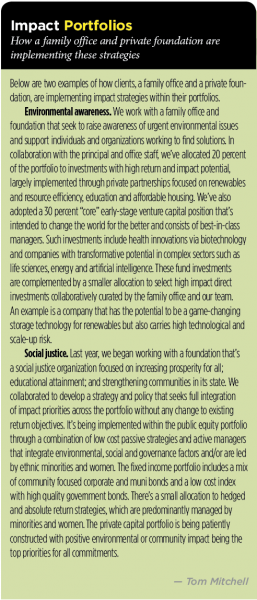

For examples of clients that are implementing impact investing strategies into their portfolios, see “Impact Portfolios,” p. 25.

Performance

Questions about performance of impact investments are quite common. While some believe the integration of impact criteria must lead to lower financial return expectations, I don’t believe this is a necessary condition.

Realizing investment success in the form of excellent financial returns is a difficult endeavor on its own, and integrating impact criteria can introduce new complexities or resource requirements for an investor. Nevertheless, engaging in the study and implementation of impact priorities can also enhance knowledge, risk management and long-term success.

When addressing impact performance expectations, it’s important to put the field in context. Generally, only a small number of investments of any type consistently deliver excellent performance over time. When investing in funds, the ability to identify and invest with high quality managers is crucial for the pursuit of superior returns regardless of investment objectives.

The supply of impact investing opportunities is growing, but still small relative to the larger marketplace. Cambridge tracks almost 30,000 funds across all asset classes in our proprietary database. Just over 1,000 of these are impact investments as of the end of 2015, a number that has almost tripled since 2008. Even though only a small percentage of these managers have received client capital, logic follows that as an opportunity set grows, so should the percentage of high quality investments. In addition to the increase in quantity of opportunities, we also see an increase in quality, particularly as more established investment firms develop strategies, or their talent leaves to focus on impact.

There have been numerous academic studies of public markets’ SRI and ESG performance, with few offering conclusive results to support either enhanced or reduced returns as a given. While exclusionary screens may lead to divergence from broad market benchmarks over different time periods, there’s also evidence to support tilting toward positive ESG factors for enhanced downside protection. As for active managers, the average ESG manager isn’t compelling, but neither is the average “conventional” manager. Rigorous diligence and selection criteria are paramount.

In 2015, we partnered with the GIIN to create the first private market Impact Investing Benchmark (IIB), using the same methodology we use for our longstanding private equity and venture capital benchmarks, all of which are publicly available.5 The IIB is currently comprised of 56 private investment funds that pursue a range of social impact objectives, operate across geographies and sectors and were launched in vintage years 1998 to 2012. The current sample set is small, but is expected to increase over time, making the benchmark more robust.

Despite a perception among some that impact investing necessitates a concessionary return, the IIB exhibited strong performance in several of the vintage years studied. In aggregate, impact funds launched between 1998 and 2004—those that are largely realized—have outperformed funds in a comparative universe of conventional funds. Over the full period analyzed, the benchmark has returned 6.3 percent net to investors versus 8.6 percent for the comparative universe, but much of the performance in more recent years remains unrealized.

Notably, impact investment funds that raised under $100 million returned a net internal rate of return of 8.8 percent to investors. These funds handily outperformed similar-sized funds in the comparative universe (4.9 percent). While some larger impact funds are entering the marketplace, many remain near or below

$100 million, which often reflects their focus on deploying capital into smaller markets and enterprises. As these managers mature through successive funds, we expect to continue seeing positive results.

If one seeks to identify the largest concession associated with impact investing, I suggest it’s the concession of time required to study the field, cultivate strategies, develop investment resources and measure impact.

A Worthy Challenge

It feels premature to draw a conclusion on impact investing when there’s so much yet to be written. The field is drawing talent, capital and serious enterprises in steadily increasing numbers. As the infrastructure and information flow continue to bloom, I expect impact investing will have significant influence on how organizations and individuals leverage all of their resources to drive social, environmental and financial benefits.

Engaging in impact investing presents investment organizations with worthy challenges. It asks investors to consider both the financial and societal characteristics of an enterprise to identify the most material indicators of quality and risk. For foundations, impact investing isn’t an isolated activity, but can be a tool for accomplishing larger organizational goals and serve as a bridge between conventional programs and investment silos. For family investors, it can deepen ties to communities, causes and industries aligned with personal interests. For all investors, impact investing provides an opportunity to widen their lens for optimal capital deployment.

Endnotes

1. USSIF, “Report on US Sustainable, Responsible, and Impact Investing Trends 2014,” at pp. 12-13, www.ussif.org/Files/Publications/SIF_Trends_14.F.ES.pdf.

2. Capgemeni, “World Wealth Report 2016,” at p. 23, www.worldwealthreport.com.

3. “Risks and Opportunities From the Changing Climate: Playbook for the Truly Long-Term Investor,” Cambridge Associates (November 2015), at pp. 12-26, www.cambridgeassociates.com/our-insights/research.

4. www.msci.com/esg-integration.

5. “Impact Investing Index & Benchmark Statistics,” www.cambridgeassociates.com/our-insights/research/introducing-the-impact-investing-benchmark.