December is a season of giving and traditions. It’s also a time of reflection. We don’t have to reflect long to recall the turmoil of tax planning at the end of 2012 with the uncertainty of the “fiscal cliff.” Harkening a bit further back, we recall the year-ends of the financial crisis and the Great Recession. It’s good to refer to them in the past tense.

As 2013 comes to a close, we face the first season of year-end tax planning under the American Taxpayer Relief Act of 2012 (ATRA). Many of our clients find themselves in combined income tax brackets with cumulative tax rates in excess of 50 percent – a startling reality that might cause some to wonder what happened to the “relief” part of ATRA.

Here are a few thoughts on tax planning to consider as 2013 comes to a close:

Be Mindful of Thresholds

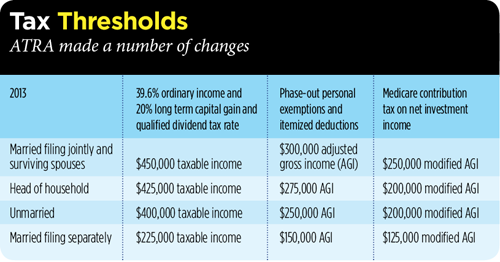

With ATRA, we have a number of tax changes for high-income taxpayers. Each change is implemented above a defined threshold, but the thresholds aren’t uniform. (See Tax Thresholds, below). Also, whereas tax brackets and phase-out thresholds are inflation adjusted, the thresholds for the Medicare contribution tax aren’t inflation adjusted.

Consider Timing Issues

With tax rate stability from 2013 to 2014, deferring income and accelerating losses and deductions can provide overall tax savings. Many taxpayers accelerated income and deferred losses and deductible expenditures at the end of 2012 in anticipation of higher tax rates in 2013. At present, we don’t the threat of higher individual or trust tax rates in 2014. So the conventional wisdom of taking advantage of deductions and losses sooner and recognizing income later has come back into tax planning.

Optimize Tax Benefit of Charitable Contributions

ATRA extended the ability to make direct transfers from a traditional individual retirement account to a qualified charity to Dec. 31, 2013. Taxpayers over age 701/2 can again direct their traditional IRA custodian or trustee to distribute directly up to $100,000 to one or more qualified charities before year-end. The distributions will count toward the required minimum distribution and won’t be taxable.

Accelerating Charitable Contributions

For individuals hoping to obtain the tax benefit of a charitable contribution under the current law, but who are uncertain about the specific recipient, year-end contributions may be made to a donor advised fund (DAF). Further distributions may be made from the fund to specific charities in the current year and in subsequent years. The taxpayer receives an income tax deduction (subject to applicable limitations) for a 2013 contribution to a DAF in 2013 under the tax law now in effect. If there are restrictions on charitable gifts under future tax laws, any current deduction won’t be affected.

Beware of Delayed 2014 Tax Season

The 16-day October government shutdown is expected to delay the government’s launch of the 2014 tax-filing season. About 90 percent of the Internal Revenue Service’s operations were closed during the shutdown. This put the IRS approximately three weeks behind its customary timetable for the 2014 tax season.

Medicare Contribution Tax

As of Dec. 2, 2013, we have the final, long-awaited regulations under Section 1411 of the Internal Revenue Code. We encourage you to review the many regulation provisions regarding the application of IRC Section 1411 to estates and trusts, including charitable remainder trusts.

Many questions have been raised around the question of the material participation of estates and trusts in business activity since active business income is generally excluded from the Medicare contribution tax. The comments to the final regulations acknowledge the complexity of this issue and offer that it “may be addressed” in a separate guidance project at a later date. The delay is troublesome for planners currently facing the issue of trust design, administration and tax reporting.

Year-end Wealth Transfer Planning

ATRA brought welcome guidance for gift, estate and generation-skipping transfer (GST) tax planning, and we continue to have the benefit of traditional gift strategies.

● Inflation-adjusted high level applicable exclusion. The gift and estate tax applicable exclusion amount and GST tax exemption in effect in 2013 is $5.25 million. This reflects inflation adjustments to the basic $5 million exclusion, which will be $5.34 million in 2014. For taxpayers who utilized the full exclusion of $5.12 million in 2012, prior to the wealth transfer tax relief that ATRA provided, the incremental inflation adjustment of $130,000 from 2012 to 2013 provides an opportunity to make additional tax-free gifts.

● Annual gifts. The annual exclusion gift remains a tried and true year-end tax planning “to do” item, with $14,000 available for 2013 gifts. Married couples who may take advantage of gift-splitting ($28,000) includes same-sex married couples for the first time in 2013 with the landmark United States v. Windsor, 133 S.Ct. 2675 (2013) decision and Revenue Ruling 2013-17. But, “marriage” is required – civil unions and other similar relationships aren’t sufficient. This is but one of the many tax changes under Windsor and Rev. Rul. 2013-17 for same sex married couples.

Values That Endure

Times have changed. They always do. The tax environment this year is quite different from the one we were navigating just a year ago. Yet, in this season of giving and reflection, traditions and values endure. The value of wealth is tied to the principles underlying its creation and transmission. For many, that value is that tomorrow may be even better than today.

LEGAL, INVESTMENT AND TAX NOTICE: This information is not intended to be and should not be treated as legal advice, investment advice or tax advice. Readers, including professionals, should under no circumstances rely upon this information as a substitute for their own research or for obtaining specific legal or tax advice from their own counsel.