Move over estate planners, it’s time for "estate advisors" to take the lead. At least that's what Steve Lockshin and Vanilla hope.

Estate planning tech leader Vanilla announced Tuesday the launch of what it calls the first fully integrated estate planning platform—The Vanilla Estate Advisory Platform.

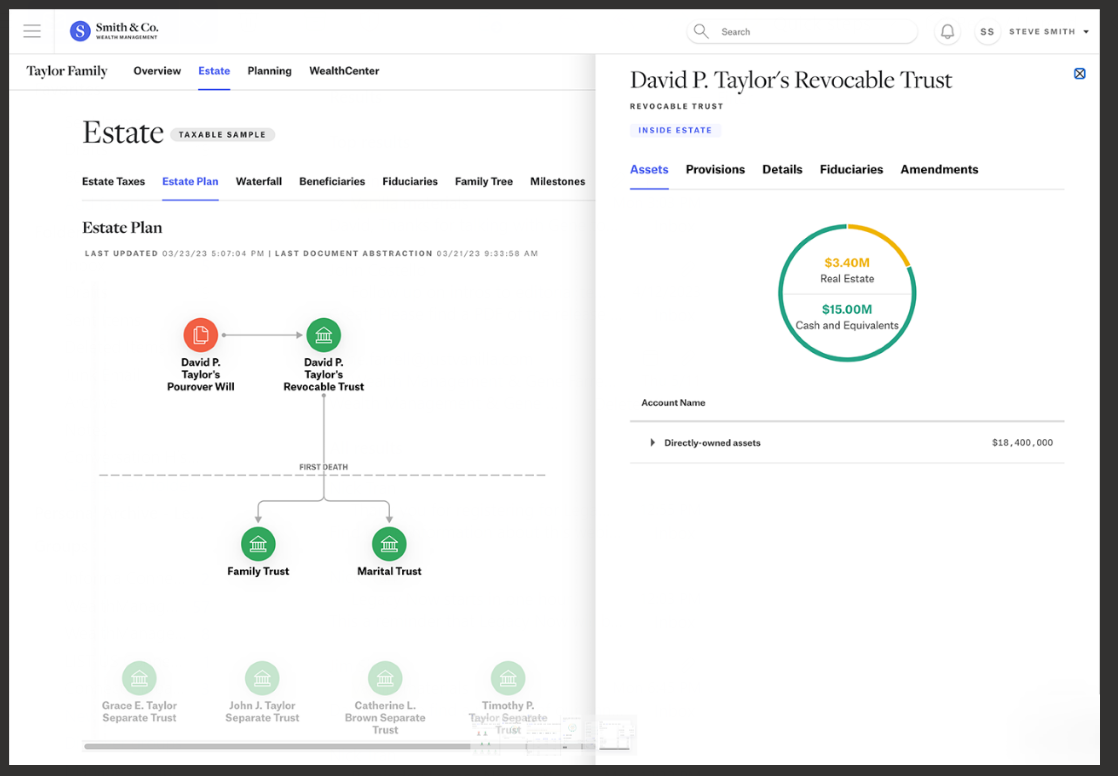

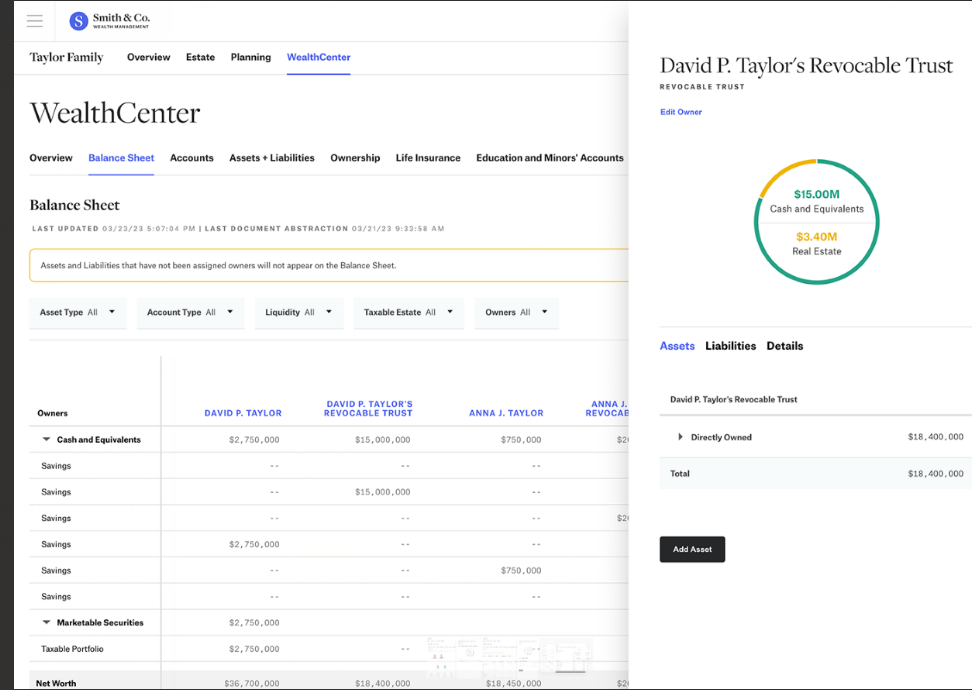

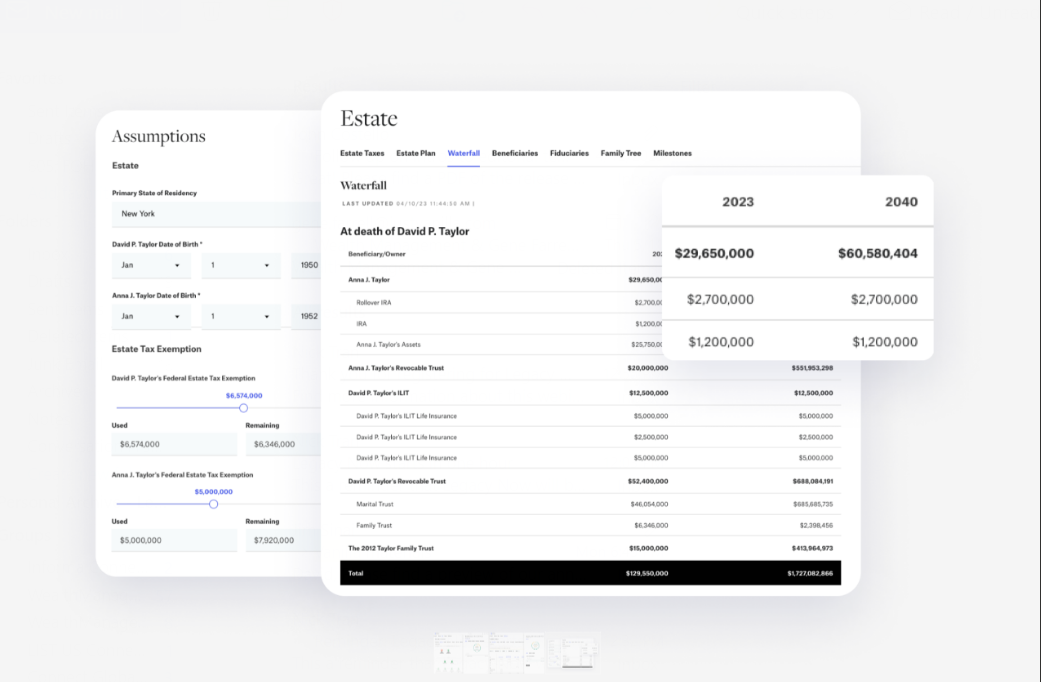

The product purports to offer advisors visualizations of the estate, beneficiary summary and projections, estate tax projections, a dynamic balance sheet integrated with the leading personal finance management tools and an on-demand report builder. Vanilla also offers estate-planning educational resources for both clients and advisors as part of its "Vanilla Academy."

Advisors enter key info about the client’s family structure, upload any existing planning documents, create a balance sheet (either manually, through CSV import or via Vanilla’s integrations with platforms like Orion, Black Diamond and others) and either create or let Vanilla design a diagram of the desired plan. The end result is a compact (by estate planning standards at least) visual overview of the clients’ estate and current plan. The newly announced "projections" feature allows advisors some ability to look to the future and show how manipulating certain variables (such as growth rates, order of passing, life expectancy, etc.) will change the waterfall calculations demonstrated in the docs to show their potential impact on the plan to clients in a more visual manner.

According to long-time advisor and Vanilla founder Steve Lockshin, in financial advisors’ never-ending search for ways to differentiate themselves and add value, the field of estate planning represents a vast untapped resource. “Estate planning is the last frontier of wealth management,” he said. Lockshin's belief is that financial advisors are uniquely positioned to take the lead in the estate planning process—hence estate advisors—which previously has been attorney-driven.

“Estate planning is loaded down with the history of being lawyer-driven, document forward and episodic in nature,” Vanilla CEO Gene Farrell said. “We’re looking to shift [estate planning] to be more advisor-led because advisors are better positioned to drive the process end to end—from education to advice to follow up.”

That Farrell calls out being document-forward as a tough sell is particularly interesting, as Vanilla, at its founding in 2019, was itself very document-forward. In fact, the release of the Estate Advisory Platform represents a significant pivot on the company’s part away from document production (although it still retains a role) toward this new concept of a platform to empower "estate advisors."

When asked about the change in tack, Farrell admitted the initial Vanilla approach was "a somewhat suboptimal structure, because it required an attorney for every engagement. Many users just wanted an easy, flat fee experience, not another law firm.”

And that client desire, as well as the company’s document production experience, was taken firmly into account in the creation of the Estate Advisory Platform.

At launch, in addition to the base planning, visualization and projection functionalities, for which advisor members will pay a flat subscription fee, there also will be a basic document package available, via Vanilla Document Builder, for an additional flat fee that includes meat-and-potatoes documents like a pot trust, healthcare proxy, power of attorney, etc. Advisors invite their clients to fill out a self-guided questionnaire curated by leading estate and trust experts. That info then populates document templates, created in partnership with estate planning firm Accelerant and reviewed and approved by attorneys in local jurisdictions, to produce the client's core estate planning documents, without the need for attorney engagement.

There are plans in the future to add additional document packages intended to service more advanced estates that also include consultation with an attorney recommended by Vanilla and a premium option for extremely complex taxable estates (of which there are very few).

The implication here is that most estates really aren’t that complex, and successfully creating a plan for the average client is far more an exercise in communication and figuratively herding cats to make sure things get done at all rather than hardcore number crunching and application of arcane legal knowledge. As an attorney, I should object to this somewhat reductive view, but for the most part, they aren’t wrong.

It's important to note at this point that Vanilla claims to be, as Farrell puts it, “attorney agnostic.” The platform is designed to empower advisors, not necessarily disempower lawyers. If an advisor needs a lawyer recommendation, then Vanilla can give one. But if they, or the clients themselves, have trusted professionals they work with already, then they can easily be incorporated into the process by sharing the dashboard.

But if estate planning represents such a potential bonanza for financial advisors, why has it remained untapped for so long? According to Lockshin, reasons range from the perceived complexity and necessity for attorney involvement, to the fact that estate planning services don’t directly increase an advisor’s AUM, which has for too long held outsize importance as an industry measuring stick in his eyes.

Bob Oros, chairman and CEO of Hightower (a Vanilla partner) agrees, adding that “A lot of advisors think they’re already doing estate planning. But if you ask them one question further beyond ‘does your client have a will,’ it quickly becomes clear they’re only doing the bare minimum.”

Both Oros and Lockshin said offering estate planning services gives advisors the opportunity to forge more meaningful relationships with their clients, and—perhaps even more importantly—maintain relevance.

“So many aspects of the financial advice industry are becoming commoditized, and it's harder to differentiate oneself,” Oros said. “Estate advisory is a form of ‘sophisticated advice’ where a smart advisor can still make a difference.”

As the implacable march of technology continues, Lockshin maintains that advisors can no longer afford to ignore this potentially fertile ground.

“Someday there will be a reckoning,” he said. “And if you’re not scared, you should be.”