On Nov. 3, 2021, the House of Representatives released new draft legislative text updating the Oct. 28, 2021, version that followed the release by the White House of the Build Back Better framework, identifying the priorities and revenue raisers that would make up the $1.75 trillion version of the Build Back Better Plan. This text was further amended on Nov. 4, 2021, and the legislation cleared a key procedural vote the following day. It’s expected that the House takes up further consideration of the legislation after they return from recess. If it clears the House, it still must be approved by all 50 Democrat Senators and could return to the House if the Senate were to make changes to the text. While the legislation remains subject to change, here are some of the highlights that impact estate and trust planning that advisors should be aware of when advising their clients:

Increased income taxes impacting fiduciary income taxes: The following surtaxes will be effective for tax years beginning on or after Dec. 31, 2021:

- Surtax of 5% on the modified adjusted gross income of a trust or estate above $200,000

- Additional 3% surtax on the modified adjusted gross income of a trust or estate above $500,000

The Nov. 3 version of the legislation included an important update to clarify that modified adjusted gross income would be determined after reduction for charitable deductions under Internal Revenue Code Section 642(c). The absence of this language in the Oct. 28 version was notable and a cause for concern particularly for certain split-interest charitable trusts. While this addition brings some consolation, the thresholds are significantly below the thresholds for individuals at $10 million and $25 million, respectively.

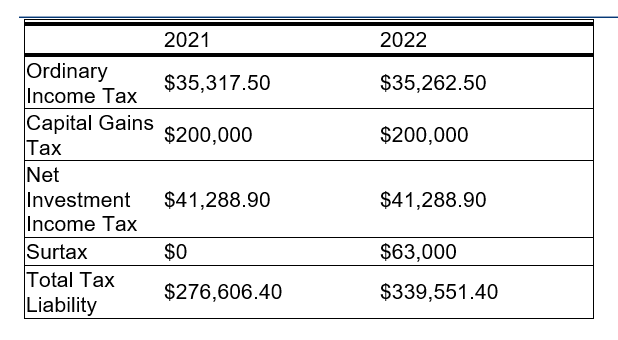

Example on the impact of the surtax: Assume your client has a trust with $1 million in capital gains and $100,000 of ordinary income.

State and local tax (SALT) deduction adjusted: Under the Tax Cuts and Jobs Act (TCJA), the deduction for state and local taxes was capped at $10,000 for individuals as well as trusts and estates. Certain Democratic legislators in high-tax states have been pushing for a repeal or modification of this cap because of the impact on their constituents. Prior versions of the Build Back Better Act didn’t contain a modification to the $10,000 cap, but the Nov. 3 version introduced an increase to the cap, with a slightly higher increase in the Nov. 4 amendment. Effective for tax years beginning in 2021, the $10,000 SALT deduction cap is increased to $80,000 for individuals who are single or married filing jointly and $40,000 for estates, trusts and married individuals filing separately. This increase is only temporary and won’t apply for tax years beginning on or after Dec. 31, 2030, with a reversion to the $10,000 cap for tax years beginning in 2031. In addition to increasing the cap, this provision also extends the duration of the cap, which under current law would go away in 2026.

Qualified small business stock (QSBS): The gain exclusion for QSBS will be reduced to 50% of gain from 100% where the taxpayer is a trust for sales and exchanges occurring after Sept. 13, 2021, unless further to a binding contract in effect on that date and not materially modified after that date. In addition, the excluded gain would be an alternative minimum tax preference item.

What Didn’t Make It In

Many of the revenue raisers from the previous legislative text that originated from the House Ways and Means Committee were dropped from the latest version that contained:

- No change in estate, gift and generation-skipping transfer tax exemption amounts;

- No change to applicability of valuation discounts;

- No change to estate inclusion of grantor trusts; and

- No change to the treatment of sales or exchanges with grantor trusts.

Observations on the Framework

While the legislation continues to progress, it’s still just a bill and is subject to further change. As a result, advisors need to caution clients that this legislation may not pass at all or may be modified again (and again). Estate planners may observe the latest versions with relief as transfer tax planning techniques haven’t appeared in the most recent versions and don’t appear to be a current topic of conversation. The increase in the SALT cap while modest for high-net-worth individuals will be immediately felt. However, the various versions of the legislation continue to highlight the “paradigm shift” away from the emphasis on estate taxes to planning techniques driven by income tax considerations for estates and nongrantor, complex trusts.