On Dec. 26, 2013, the Internal Revenue Service released Revenue Procedure 2014-13 regarding foreign financial institutions (FFIs) entering into an FFI Agreement (participating FFIs) and FFIs and their branches that are treated as reporting financial institutions under an applicable Model 2 intergovernmental agreement (IGA) (reporting Model 2 FFIs). The final Foreign Account Tax Compliance Act (FATCA) regulations regarding the FFI Agreement don’t pertain to Model 1 FFIs or any branch of a Model 1 FFI, unless the reporting Model 1 FFI has registered a branch located outside of a Model 1 IGA jurisdiction such that the branch may be treated as a participating FFI or reporting Model 2 FFI.

Background

Chapter 4 of the IRC (Sections 1471-1474) was added by FATCAas part of the Hiring Incentives to Restore Employment Act of 2010. FATCA’s goal is to limit offshore tax evasion by compelling foreign banks and other financial institutions to either report foreign accounts beneficially owned by U.S. persons or face hefty withholding taxes.

Under FATCA, if a foreign payee of U.S.-source income can’t verify to the U.S. payor that it fits into one of FATCA’s 23 foreign entity categories, the results could be disastrous: in addition to the regular 30 percent nonresident alien withholding on dividends, FATCA implemented a new 30 percent withholding tax on portfolio interest and a new 30 percent gross-proceeds withholding tax on sales of U.S. stock (or other U.S.-sitused assets).

A U.S. account holder can avoid this withholding if the FFI holding its account agrees to report to the IRS certain information with respect to its U.S. accounts and account holders by entering into an FFI Agreement. For FFIs in foreign jurisdictions that have entered into an IGA, the FFIs have alternate means of implementing FATCA while addressing difficulties with FATCA compliance under the local jurisdiction’s law.

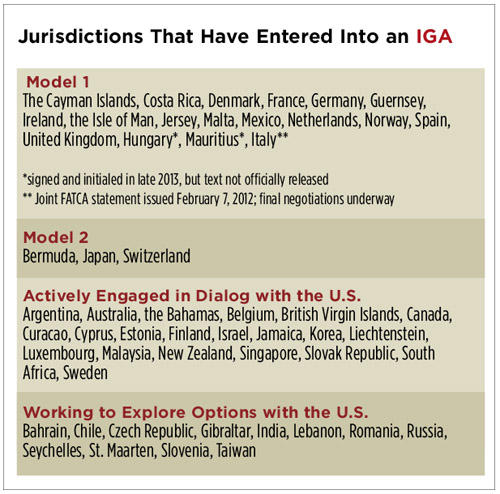

Two Types of IGAs

Thus far, there are two types of IGAs: the Model 1 IGA and Model 2 IGA. Model 1 IGAs allow an FFI to satisfy its FATCA requirements by reporting information on its U.S. accounts to the local tax authorities, which, in turn, exchange that information at a governmental level with the IRS. In contrast, under Model 2 IGAs, FFIs would provide specified information directly to the IRS, supplemented by governmental exchange of information on request. Thus, FFIs in Model 1 IGA jurisdictions generally won’t need to sign FFI Agreements with the IRS, while FFIs in Model 2 IGA jurisdictions must agree to comply with the terms of the IRS’s FFI Agreement as modified by the applicable Model 2 IGA.

FFI Agreement

In very broad terms, under an FFI Agreement, the participating FFI agrees to: (1) perform due diligence and to identify accounts held by U.S. persons; (2) report those accounts on Form 8966; (3) withhold and remit 30 permit tax on accounts for which withholding is required (and file the appropriate Forms 1042, if required); (4) report income on Form 1099 if it elects to perform full reporting (rather than 30 percent withholding) for an account holder that is a U.S. person; (5) retain certain information on U.S. accounts and comply with IRS requests for additional information; (6) furnish valid withholding certificates to each withholding agent from which it receives a withholdable payment; and (7) close certain accounts of “recalcitrant” account holders.

An FFI may register as a participating FFI on Form 8957 (the FATCA Registration form) via the FATCA registration website (www.irs.gov/fatca), thereby entering into an FFI Agreement on behalf of itself and one or more of its branches so that each of its branches will also be treated as a participating FFI. Upon registration, the FFI will receive a global intermediary identification number (GIIN). Any branch of the registered FFI (including both participating FFIs and reporting Model 2 FFIs) that cannot satisfy all of the terms of the FFI Agreement will be treated as a “limited branch” subject to FATCA withholding as a nonparticipating FFI.

Rev. Proc. 2014-13

Rev. Proc. 2014-13 anticipates two sets of forthcoming temporary Treasury Regulations, which are expected to be published in early 2014. The first set will provide further clarifications and modifications to the final FATCA regulations that were released in January 2013. The second set will provide coordinating rules under chapters 3, 4, and 61 of the IRC.

Most significantly, Rev. Proc. 2014-13 finalizes the draft version of the FFI Agreement that was released in Notice 2013-69 in October 2013. Notable revisions to the draft FFI Agreement that appear in the final FFI Agreement include: (1) updated cross-references in the FFI Agreement and further clarifications corresponding to the two sets of forthcoming temporary regulations; (2) revisions to correct minor technical errors in the draft FFI Agreement; and (3) a two-year transition period during which a reporting Model 2 FFI may elect to apply the due diligence procedures set forth in the FFI Agreement or may utilize the procedures described in Annex I of the applicable Model 2 IGA (this election is made by the reporting Model 2 FFI, not the reporting Model 2 IGA jurisdiction).

This update is a very general overview of an extremely dense subject and is not intended to cover all of the detailed terms of the final FFI Agreement or provide an in-depth analysis of an FFI’s obligations under FATCA.