By Sarah Kahl

As economists predicted, on June 13, the Federal Reserve raised its benchmark interest rate, the federal funds rate, to 2 percent. Chances are good we will see additional increases this year.

These rate hikes typically correspond to an increase in short-term Treasury yields. The Fed has signaled optimism about the state of the economy, so we’re also likely to see increases in interest rates for longer-term lending.

Why should estate planners care about higher interest rates? Because these short-term and long-term rate increases mean that the interest rates published by the Internal Revenue Service will also rise. Those published rates are a significant factor in the success of many estate planning techniques.

Around the 20th of each month, the IRS publishes the Applicable Federal Rate. There are short-term, mid-term, and long-term AFRs, each tracking different yields on outstanding marketable obligations of the United States for different terms. The publication also includes a rate known as the Section 7520 Rate, which is 120 percent of the mid-term AFR, rounded to the closest 0.2 percent.

Estate planners have to pay attention to the AFR and the Section 7520 Rate because many restrictions on wealth-shifting are based on these rates. For example, if a client lends money to a child without charging interest at AFR, then interest will be imputed, and there can be gift and income tax consequences. The good news when interest rates are low is that the interest the child must be charged is minimal.

When interest rates are on the way up, it’s a good idea to lock in today’s interest rates on family loans. The way to lock in today’s rate is to use a term loan, which is payable as of a set date, rather than a demand loan, which is payable whenever the lender requests. If you have older family loans outstanding, it may make sense to refinance them before interest rates rise any further. When refinancing, it’s also a good idea to consider the commercial reasonableness of the exchange in notes and consider offering the lender something in exchange for the lower rate, such as a principal payment or additional security.

Interest rates also have an impact on the value of annuities and income interests for gift tax purposes in estate planning transactions. When the Section 7520 Rate goes up, the value of an income interest also goes up, but the value of an annuity goes down. Therefore, the value of an income interest is likely to be higher in the near future and the value of an annuity is likely to be lower.

There are two common estate planning techniques that illustrate this point. The first is a grantor retained annuity trust known as GRAT, which works better when interest rates are low. The second is a qualified personal residence trust known as QPRT, which works better when interest rates are high.

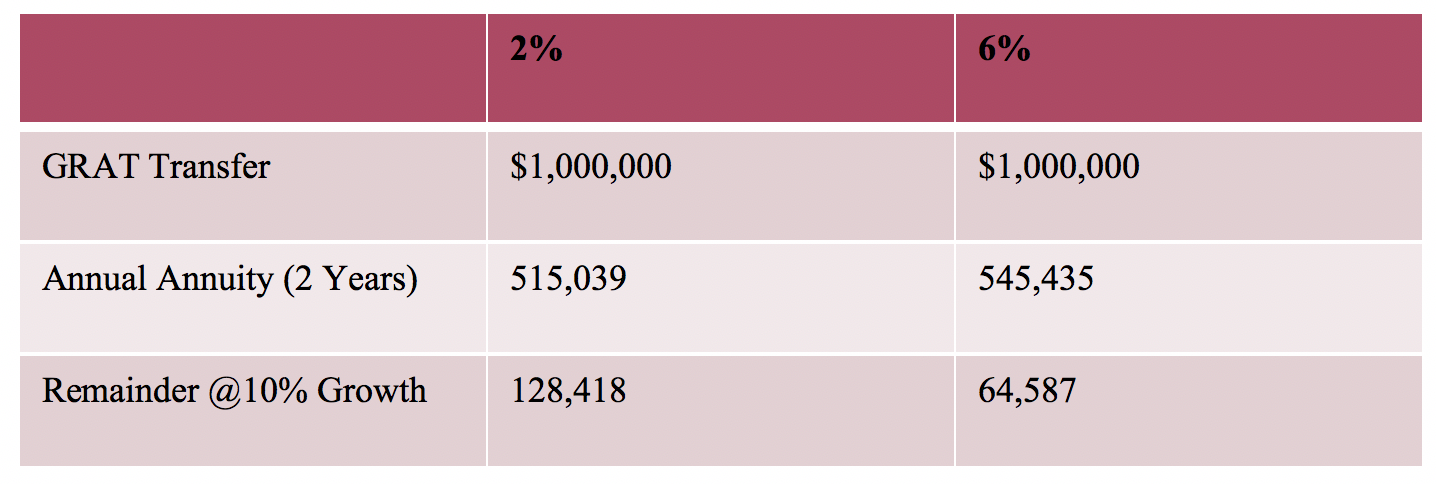

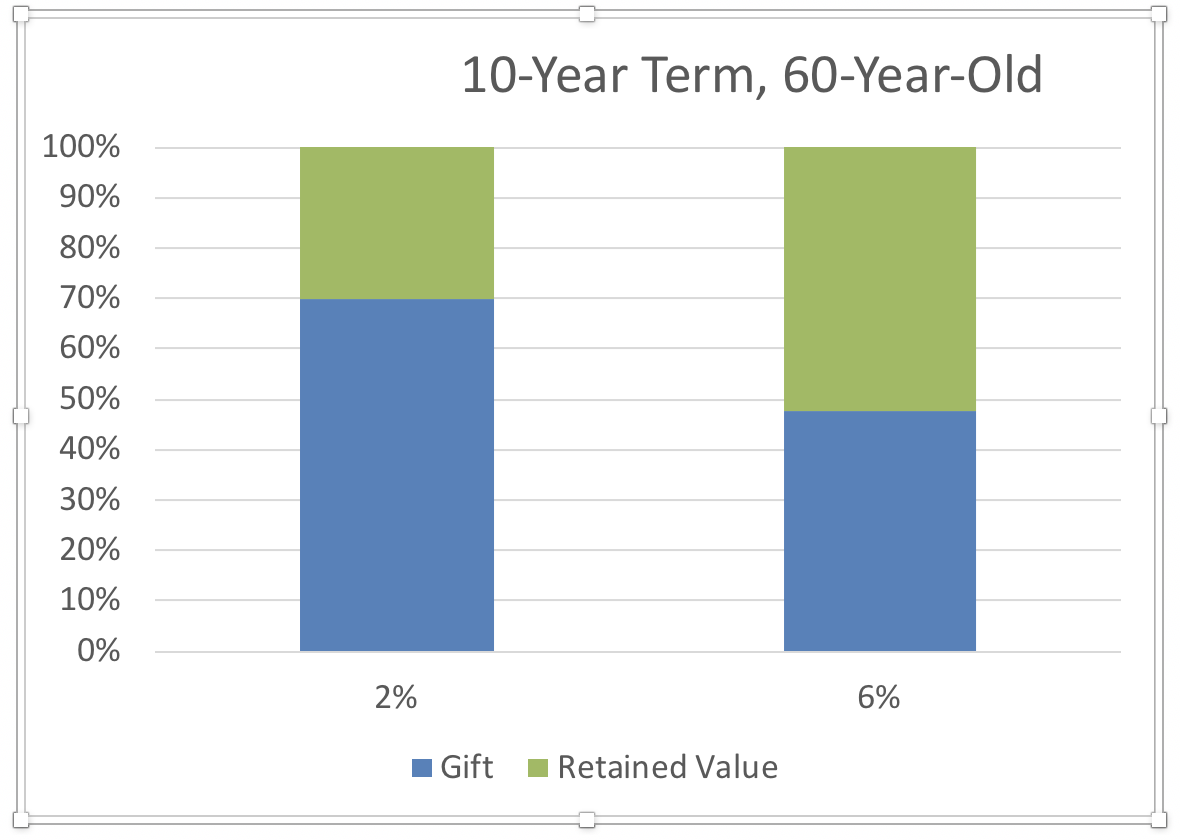

A GRAT is a gifting technique that involves the transfer of property to a trust. The grantor of the trust retains an annuity payment for a certain term of years, and, after the end of the term, the balance in the trust belongs to the gift recipient. The value of the gift is equal to the value of the property transferred, reduced by the value of the grantor’s retained annuity. Typically, the GRAT is structured so that the value of the annuity is almost as high as the value of the property transferred, so that the gift is nominal. When interest rates are lower, the value of the annuity is higher. Therefore, a smaller annuity is necessary to generate a nominal gift, and more property can be transferred to the gift recipient when interest rates are low.

In contrast, a QPRT is also a gifting technique where, instead of a retained annuity, there is a retained income interest. In a QPRT, the grantor transfers a residence but retains the right to live in the residence for a specified term of years. Sometimes the property also reverts to the grantor’s estate if the grantor dies during that term. At the end of the term, the residence belongs to the gift recipients. When the Section 7520 Rate is higher, the value of the retained use, which is the equivalent of an income interest, is also higher. Therefore, the gift portion of the transfer will be lower when interest rates are high.

As interest rates rise, think about locking in interest rates for existing family loans, and set up GRATs sooner rather than later. And take a fresh look at QPRTs, which will be more attractive as rates rise.

Sarah Kahl is Counsel in Venable LLP’s Tax and Wealth Planning Group. For more information, visit www.Venable.com.