In the past year, governments worldwide pumped huge amounts of emergency funds into their local economies to counter the devastation caused by the COVID-19 pandemic. In the United States alone, the Trump and Biden administrations trained a bazooka at the problem, spending a combined $2 trillion to help support millions of households and small businesses.

There’s just one problem: Hardly any of the stimulus made its way into the real economy. According to the U.S. Federal Reserve, most households stowed it away into savings—only about 25% of the stimulus checks have been spent so far. J.P. Morgan reports that U.S. households in the bottom-income quartile were the only ones to have actually used the financial assistance for daily needs. That means U.S. banks are holding a record level of cash in checking accounts. If this wall of cash suddenly returns to the economy, the rate of inflation could accelerate. Supply chain bottlenecks and rising commodity prices don’t help.

Inflation is keeping investors worried, and many are trying to protect their portfolios by investing in cyclical stocks, including financials, industrials and commodities, which are considered the best defense against inflation. However, investors should rather look for quality stocks. Below are three points to keep in mind.

1. Wall Street talking heads are recommending that investors pile into cyclical stocks. In some ways it makes sense: Banks make more money lending at higher rates and energy companies do, too, when the price of oil goes higher. In the short term, inflation will be a tail wind for cyclical companies, and for those who believe they can time the market, we agree that the so-called reflationary trade still has life left in it. However, if you take a long-term view, what matters for stock appreciation is real, not nominal earnings growth.

2. The case for investing in cyclical businesses. First, take banks. Banks are a bridge between the present and the future. They make money when their customers do well. We agree that if the Fed decides to raise rates to fight inflation, in the short term banks may turn more profitable from the spread between long- and short-term rates. In the longer term, this dynamic is not sustainable. In a scenario of higher inflation, customers will struggle to pay off debt and nonperforming loans (NPLs) will rise. Furthermore, banks will also face increasing costs to run the business in the form of higher wages and higher depreciation expenses to upgrade their infrastructure.

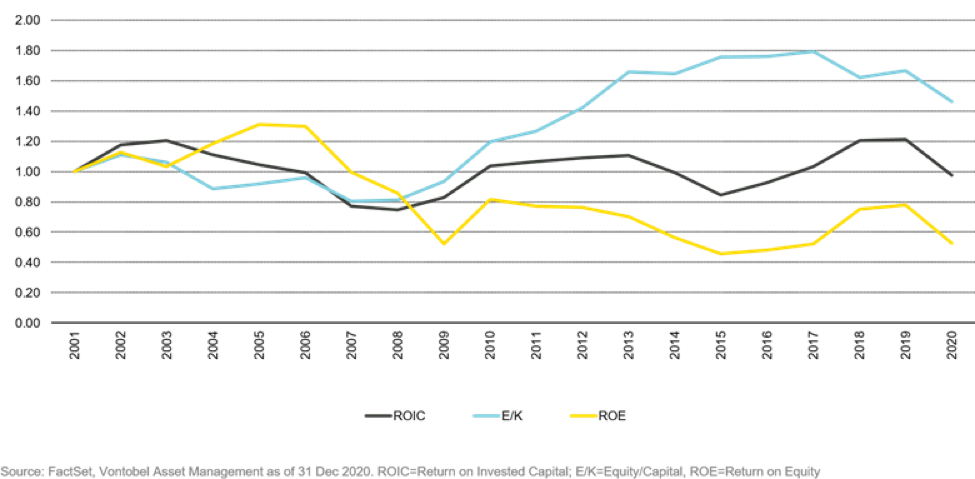

Conventional wisdom says that banks thrive under higher rates, but the argument does not hold water. Since banks offer commoditized products with barely a difference between a mortgage from Bank A and Bank B, customers ultimately just look for the lowest rate. Case in Point: M&T Bank is considered one of the best managed banks in the United States because it has maintained a relatively stable ROA regardless of the level of interest rates. ROEs, however, moved up and down over time because of changes in the leverage ratio–not interest rates (Figure 1).

Figure 1: M&T Bank

3. Energy companies thrive under a goldilocks scenario when demand for oil grows gradually with global GDP and prices move up in line with affordability. Like in our bank discussion above, energy companies may benefit in the short term as the price of oil rises with inflation. Over the long term, these companies are walking in place when prices go up in nominal terms and volume growth is muted. Moreover, energy is a capital-intensive industry and when inflation increases, while management may delay maintenance capex to embellish the bottom line, eventually, they will have to reinvest in the business, increasing depreciation and pressuring margins.

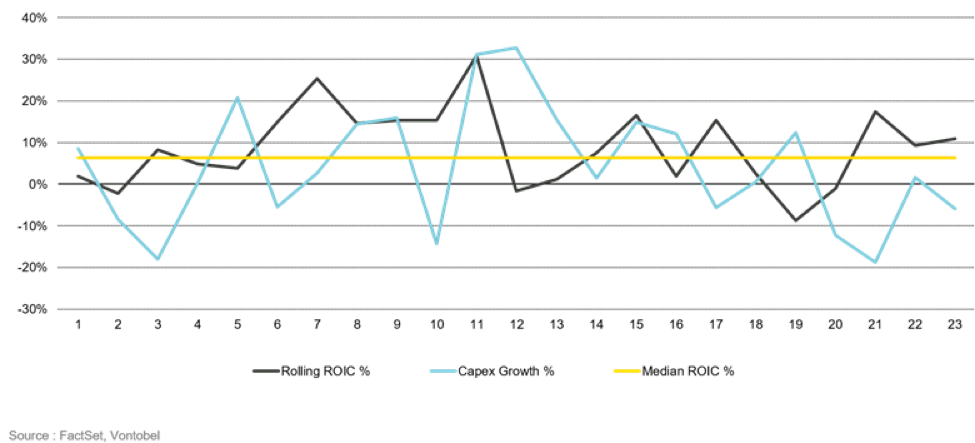

Investors should consider the historical returns of Royal Dutch Shell over the past 30 years in periods with high and low oil prices. It is difficult to get excited about a business when capital allocation depends on forecasting the price of oil. In the chart below, we can see that Shell tends to accelerate investment at the peak and vice versa. In the world of asset management, the equivalent is buying high and selling low. The net result is unimpressive. Over the long run, Shell achieved return on capital of mid-single digits, not much better than a regulated utility but with more volatile earnings (Figure 2).

Figure 2: Royal Dutch Shell – Rolling 5-Year Performance from 1993 to 2020

Why Quality Can Help Protect Against Inflation

As we discussed above, a scenario of high inflation is not conducive to economic growth. Inflation transfers wealth from low-income households to those in a position to invest their money in assets linked to inflation.

The same applies to corporations. In the bigger-is-better world of supply chain management, those with leverage will squeeze their suppliers and protect against inflation. The weaker ones will eat through their margins. As an investor, where do you want to be?

In a scenario of high inflation, at a minimum, investors should consider companies that can protect against it. It is even better if you can invest in companies that can actually thrive under inflation, such as those that have one or more of the following characteristics:

- A unique product/service that customers rely on or cannot switch to a cheaper version,

- Revenues that are linked to inflation,

- Scale and market leadership to influence prices.

Inflation or not, those are the businesses we think investors should focus on. Here are a few examples:

Ferrari is a premium brand accessible to an exclusive group of high-net-worth individuals, with an entry price of $200K for the Ferrari Roma, its low-end model. Customers do not typically buy a Ferrari as a means of transportation, in fact, a typical customer drives a Ferrari less than 50 miles per week. They buy a Ferrari for its history, its drivability and as a status symbol. Ferrari operates a controlled supply business model with production of less than 15,000 cars per year and a waiting list of 12-18 months. This is part of the company’s philosophy coming down from its iconic founder, Enzo Ferrari, who said: “We will always sell one less Ferrari than the market wants.” Ferrari has successfully increased prices of new cars in the mid-single-digit range over the long run and the brand protected the value of its cars in the secondary market.

Mastercard, in my view, is at the sweet spot of volume growth and pricing power. I would have guessed, based on all the Amazon boxes piling up outside people’s homes in the past 18 months, that cards finally account for most purchases these days. But cash is still king, accounting for more than half of global transactions as online shopping—for as big and as fast growing as it is—still lags purchases in the real world with a global e-commerce penetration in the low teens. In addition, businesses are still in the dark ages when it comes to payment acceptance, relying mostly on checks and wire transfers. Cash loses value faster when inflation is high, and a scenario of high inflation will further accelerate the shift from cash to cards (more likely via mobile transactions). Mastercard charges a percentage on every transaction and revenues are automatically linked to inflation. Thus, Mastercard’s fortunes ride along with inflation. Even better, given that it is mostly a fixed-cost business, inflation also bolsters operating leverage.

Finally, when it comes to inflation, companies in emerging markets have a lot of experience in dealing with it. For example, Asian Paints has been operating in India since 1942, before the country’s independence. Despite all the turbulence in India’s politics and economy during the past almost 80 years, Asian Paints not only protected against volatility, it thrived to become a $38 billion company with revenues of more than $3 billion. Asian Paint is the largest decorative painting company in India with a 40% share of the market, more than three times the size of the second competitor. Asian Paints manages an exclusive network of third-party distributors, which gives it influence on prices at the retail level. Paint is a heavy product with a large content of water, making it uneconomical to transport over long distances, which protects it against imports. Furthermore, Asian Paint enjoys a tremendous amount of brand recognition among professionals. Even in India where labor cost is relatively cheap, paint accounts for less than 30% of the total cost of a job. For professionals, quality is more important than price. It improves productivity, it yields a nice finishing that minimizes repainting and improves customer satisfaction.

Investors should not make long-term investment decisions based on short-term headline news. We understand that it is hard to go against the crowd. Today, inflation is the center of attention, but economic cycles come and go, as do the scaremongers. Shifting tactics to low-quality cyclicals might work for a time, but ultimately stock prices tend to follow earnings and we think a portfolio of quality growth stocks can stack the odds in your favor.

David Souccar has been a portfolio manager for Vontobel’s Quality Growth Boutique since 2016. He joined Vontobel Asset Management in April 2007 as senior research analyst and was promoted to portfolio manager on the firm’s international equity strategy in June 2016. In addition to his portfolio management responsibilities, he continues to conduct research analysis on individual stocks, which may be included in the firm’s other strategies, primarily focusing on the energy, industrials and utilities sectors.