Traditional asset pricing theory assumes investors are “economically rational.” Perhaps unsurprisingly, research from the field of behavioral finance shows that is not fully the case. Instead, investors are “psychologically rational.” For example, salience theory suggests that decision-makers exaggerate the probability of extreme events if they are aware of their possibility, giving rise to subjective probability distributions that undermine conventional rationality.

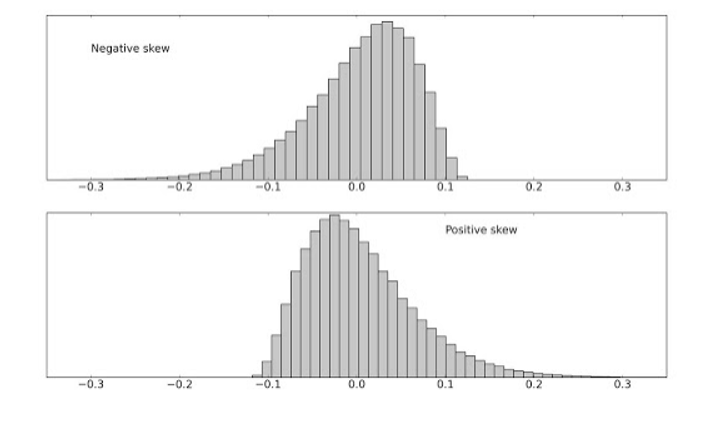

Salience theory (ST) explains well-documented investor skewness preferences—the overpricing of assets with a positive skew (larger right tails, like lottery tickets) and the underpricing of assets with a negative skew (larger left tails). And the presence of limits to arbitrage (including the risk and costs of shorting) prevents sophisticated investors from fully correcting mispricings. The result, for example, is that small growth stocks with high investment and low profitability have positively skewed expected returns and historically been overpriced relative to small value stocks. On the other side, disaster risk should pay an excessive premium, and short volatility strategies in times of fear of large drawdowns for the underlying asset should have positive expected value.

Salience theory predicts that probabilities of the most salient (extremely favorable) outcomes are inflated, while probabilities of less salient (greater downside risk) outcomes are underweighted. The result is that the excess demand for the most salient stocks results in their overvaluation and lower future returns, while stocks with salient downsides become undervalued and earn higher subsequent returns.

Mathijs Cosemans and Rik Frehen, authors of the 2020 study Salience Theory and Stock Prices: Empirical Evidence, covering U.S. stocks over the period 1926-2015, found that when a stock’s highest past returns stand out, ST is positive and investors actively seek risk and accept a negative risk premium. When a stock’s lowest past returns stand out, ST is negative and investors overemphasize its downside risk, exhibiting risk-averse behavior, and demand a larger risk premium for holding the stock. They found that stocks with salient upsides earned lower returns over the next month than stocks with salient downsides—the return difference between stocks in the highest and lowest ST deciles was statistically significant, economically large and could not be explained by standard market, size, value, momentum, investment, profitability and liquidity factors. Unsurprisingly, the authors found a stronger cross-sectional relation between ST and future returns among stocks with higher retail ownership and greater limits to arbitrage. They also found that the predictive power of ST was stronger during high-sentiment periods, when unsophisticated investors are more likely to participate in the market.

New Research

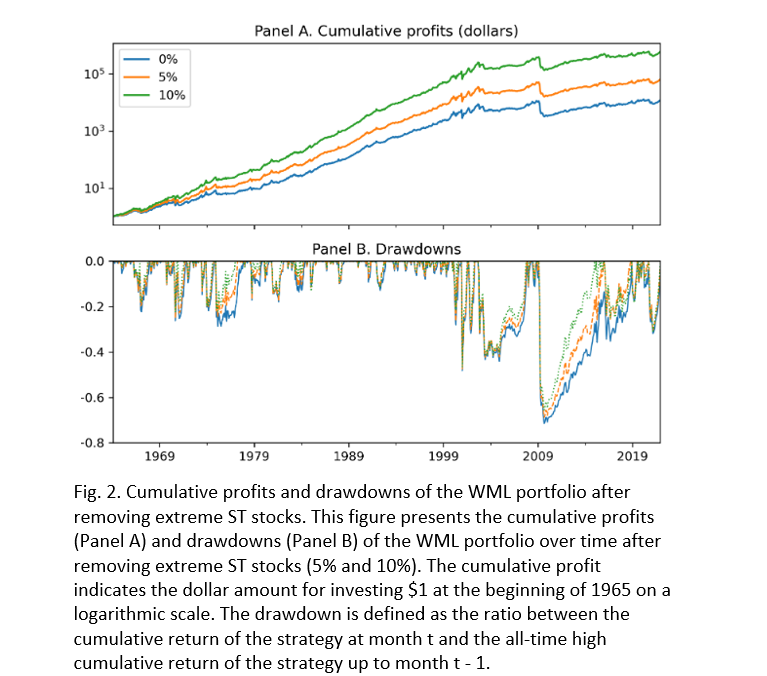

Myounghwa Sim and Hee-Eun Kim, authors of the study “Salience Theory and Enhancing Momentum Profits,” published in the December 2022 issue of Finance Research Letters, investigated an enhanced momentum strategy that excluded stocks with extremely salient payoffs (those with the most extreme returns) to determine if high ST stocks reduce the profitability of the momentum strategy. Their data sample consisted of U.S. stocks over the period 1965-2021. They constructed decile portfolios based on the cumulative returns from the traditional momentum strategy (t - 12 to t - 2) and sequentially excluded stocks with salient payoffs—removing 5%, for example, of the highest ST stocks from the top decile (winner) portfolio and the lowest ST stocks from the bottom decile (loser) portfolio. To mitigate the market microstructure effects, they excluded stocks with a closing price of less than $1 per share at the end of the previous month. Here is a summary of their key findings:

Stocks with the highest ST tended to earn lower subsequent returns, whereas those with the lowest ST tended to earn higher subsequent returns. Past winners with a high ST and past losers with a low ST were more likely to have subsequent return reversals, thus attenuating the profitability of the momentum strategy.

Removing the highest and lowest 5% of ST stocks, the five-factor alpha of the winner-minus-loser (WML) portfolio increased from 1.64% to 1.75% per month, and the Sharpe ratio increased from 0.85 to 0.93. The performance improvement was more prominent for losers than winners—stock overpricing is more prevalent than underpricing in the presence of limits to arbitrage (short-sale constraints).

Their findings led Sim and Kim to conclude: “We find that our approach of excluding stocks with extreme ST better captures the inherent momentum effect, particularly for loser portfolios.”

Investor Takeaway

Cosemans and Frehen demonstrated that because of the salience-induced distortions in attention allocation, investors are attracted to stocks with salient upsides. The excess demand for these stocks leads to their overvaluation and thus lower future returns. On the other hand, stocks with salient downsides become undervalued and earn higher subsequent returns.

Sim and Kim demonstrated that salience theory contributes valuable insight for momentum strategies, as excluding stocks with extreme salience values enhances the basic return effect established in the literature on momentum. Focusing on the extremity of returns and how investors perceive it clarifies the fundamentals that drive short-term return reversals. It will be interesting to see if asset managers incorporate their findings. In the meantime, the takeaway is to learn to ignore extreme recent performance and not become subject to the irrational behavior predicted by salience theory. This lesson becomes particularly important during periods of high investor sentiment. Forewarned is forearmed.

Larry Swedroe has authored or co-authored 18 books on investing. His latest is Your Essential Guide to Sustainable Investing. All opinions expressed are solely his opinions and do not reflect the opinions of Buckingham Strategic Wealth or its affiliates. This information is provided for general information purposes only and should not be construed as financial, tax or legal advice.