Broad bond market strength in 2014 has left fixed income investors with slim pickings for investment opportunities. Low Treasury yields are not the only dilemma facing bond investors. The 2014 rally in corporate bond sectors, emerging market debt, high-yield bonds, and even municipal bonds has been impressive and has led to more expansive valuations. In many cases, Treasury price gains have failed to match the gains in these sectors. Broad-based strength, which has seen the broad Barclays Aggregate Bond Index rise nearly 3% year to date through Monday, May 12, 2014, has led to a dearth of opportunities.

The average yield advantage, or spread, of a particular bond sector relative to Treasuries is the easiest way to evaluate a bond sector’s attractiveness. A wide yield spread is indicative of a more attractive valuation while a narrow yield spread indicates a more expensive valuation. Investors are likely aware that low yields and the prospect of future interest rate hikes by the Federal Reserve (Fed) make Treasuries unappealing, but the lack of value has spread to other segments of the bond market.

Average yield spreads of several fixed income sectors are at the narrowest levels of the past four years [Figure 1]. Investment-grade and high-yield corporate bond yield spreads are at post-recession lows. Preferred security yield spreads are not far off post-recession lows, while emerging market debt (EMD), mortgage-backed securities (MBS), and high-yield municipals are in the bottom half of their respective ranges. MBS spreads narrowed dramatically in late 2012 following the announcement of expanded Fed bond purchases. Absent the 2012 spike lower, MBS spreads, which are at their lowest levels of the year, would be near a post-recession low as well. EMD spreads recently closed at 11-month lows and a full percentage point below the early 2014 peaks. We would argue that both sectors are expensive relative to recent history and contribute to the value dilemma facing bond investors.

High-yield municipal valuations appear the least overvalued in the group and have not reached an extreme relative to taxable high-yield bonds. However, the inclusion of Puerto Rico debt, which is now over 20% of the municipal high-yield index, has skewed the average valuation and yield spreads for the majority of the high-yield municipal bond market are much tighter.

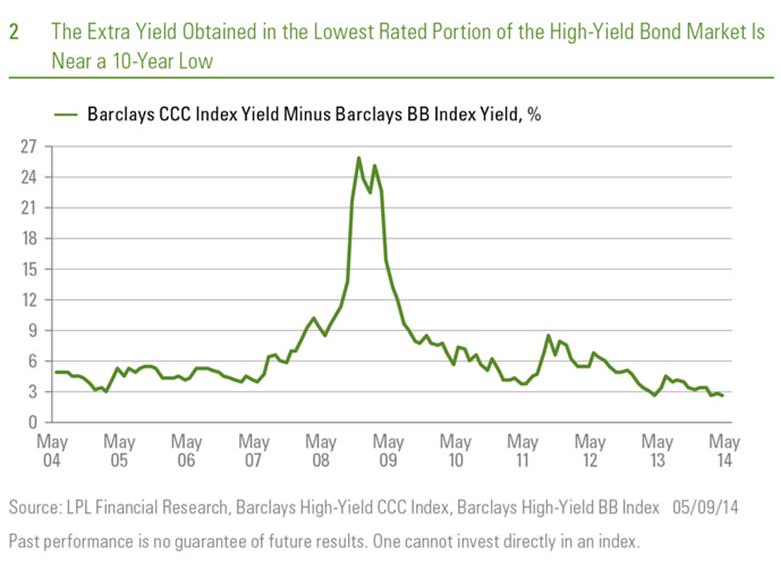

Not only are spreads narrow across the bond market but spreads are also compressed within sectors. The extra yield obtained by investing in the least creditworthy segment of the high-yield bond market has contracted considerably. Within the high-yield bond market, the yield differential between BB-rated bonds and bottom tier CCC-rated bonds has shrunk to the narrowest levels of the past 10 years [Figure 2]. Therefore finding pockets of value is more difficult and investors are compensated less for taking on extra risk.

Narrow yield spreads by themselves do not imply a pending market correction. Spreads can stay narrow for a long time and the typical credit cycle sees periods of narrow spreads that can last for years [Figure 3]. In the case of high-yield bonds, a low default environment and healthy corporate profitability suggest yield spreads may stay narrow for some time reflecting reduced risk. In the mid-1990s, a period of narrow yield spreads persisted for nearly six years, and in the mid-2000s, narrow yield spreads persisted for over three years. European debt fears led to periods of volatility in the high-yield market in recent years, but we estimate credit quality has been generally stable for two to three years now.

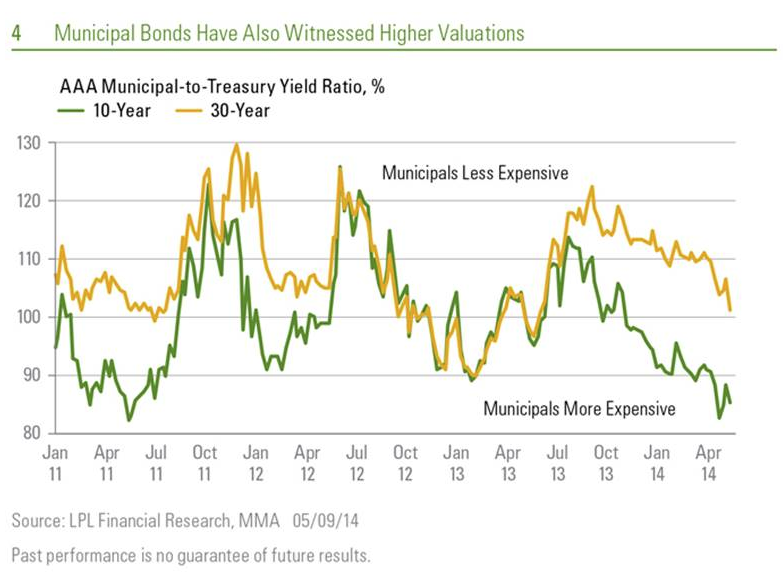

Higher valuations are not limited to the taxable bond market, as municipal bonds have also benefited from a narrower yield disparity with Treasuries [Figure 4]. Municipal bond prices have improved steadily from last year’s pullback and outpaced the gains in intermediate- and longer-term Treasuries, leading to lower municipal-to-Treasury yield ratios. The 10-year ratio in particular is near a three-year low and below the ratio prevalent at the start of May 2013 when the sell-off began.

Treasury yields remain low, but across the bond market yield differentials to Treasuries have narrowed dramatically leaving higher valuations and few opportunities. History suggests yield spreads can remain narrow for some time, but it does not eliminate limited opportunities. Higher valuations are likely to mean lower returns over the remainder of 2014 and beyond. The strength witnessed so far in 2014 is unlikely to be repeated and taking profits on bond market strength seems prudent. Even if bond prices do not weaken, now lower yields may likely translate into much lower returns.

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. All performance reference is historical and is no guarantee of future results. All indices are unmanaged and cannot be invested into directly. Index performance is not indicative of the performance of any investment.

This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax advisor.

The economic forecasts set forth in the presentation may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values and yields will decline as interest rates rise, and bonds are subject to availability and change in price.

Government bonds and Treasury bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

Municipal bonds are subject to availability, price, and to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rate rise. Interest income may be subject to the alternative minimum tax. Federally tax-free but other state and local taxes may apply.

Stock and mutual fund investing involves risk including loss of principal.

Mortgage backed security (MBS) is a type of asset-backed security that is secured by a mortgage or collection of mortgages. These securities must also be grouped in one of the top two ratings as determined by an accredited credit rating agency, and usually pay periodic payments that are similar to coupon payments. Furthermore, the mortgage must have originated from a regulated and authorized financial institution.

Preferred stock, also called preferred shares or simply preferreds, is a special equity security that has properties of both an equity and a debt instrument and is generally considered a hybrid instrument. Preferreds are senior (i.e. higher ranking) to common stock, but are subordinate to bonds. Similar to bonds, preferred stocks are rated by the major credit rating companies. The rating for preferreds is generally lower since preferred dividends do not carry the same guarantees as interest payments from bonds and they are junior to all creditors.

Yield Spread is the difference between yields on differing debt instruments, calculated by deducting the yield of one instrument from another. The higher the yield spread, the greater the difference between the yields offered by each instrument. The spread can be measured between debt instruments of differing maturities, credit ratings and risk.

The credit ratings are published rankings based on detailed financial analyses by a credit bureau specifically as it relates the bond issue’s ability to meet debt obligations. The highest rating is AAA, and the lowest is D. Securities with credit ratings of BBB and above are considered investment grade.

High-yield/junk bonds are not investment-grade securities, involve substantial risks, and generally should be part of the diversified portfolio of sophisticated investors.

Municipal bonds are subject to availability, price, and to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rate rise. Interest income may be subject to the alternative minimum tax. Federally tax-free but other state and local taxes may apply.

This research material has been prepared by LPL Financial.

Anthony Valeri, CFA, is an investment strategist for LPL Financial.