(Bloomberg) -- Rob Arnott’s big bet on emerging markets is paying off this year and his team suggests the best is yet to come.

The 66-year-old investor said he’s piled more than half of his liquid investments into value stocks from the developing world, an even larger share than two years ago. That strategy has also benefited the $1.9 billion PIMCO RAE Emerging Markets Fund, which Arnott helps oversee. Its 24% return in 2021 is better than 99% of peers, according to data compiled by Bloomberg.

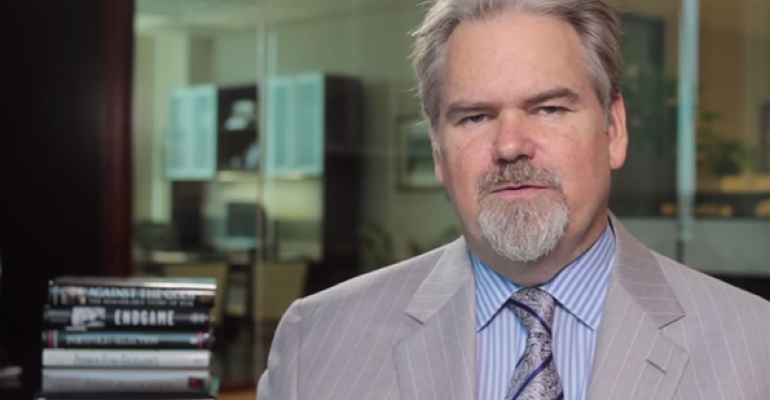

“EM value is cheap enough that I think it’s got a long way to run,” said Arnott, chairman of investment outfit Research Affiliates LLC. His firm’s models imply returns that might “double one’s money in five years.”

Emerging-market value stocks, which trade at low prices relative to their fundamentals, trailed growth peers in the initial rebound from the pandemic low, but are rallying faster than them in 2021. As the global economic recovery gains pace, value bulls are betting there’s more to come, as the investment style tends to benefit from faster inflation.

Research Affiliates, which Arnott founded in 2002, forecasts a world-leading 5.3% real return annually for emerging-market equities in the next decade. Investors can outmatch that by backing value shares, he said. The MSCI EM Index has rallied 43% in the past year, surging past its pre-pandemic high to fresh records.

For Arnott, it’s a big turnaround from early last year, when some of his funds were among the hardest hit during the initial stages of the Covid-19 pandemic. He warned clients in March 2020 that it would be “reckless” to bet on an imminent risk rally.

‘Lost Decade’

Backing emerging markets hasn’t always been a winning formula, says Arnott, calling it a “lost decade” until recently. But he’s turned more bullish over the past few years.

He boosted the share of developing-nation value stocks to more than one-third of his personal liquid portfolio in 2016, before increasing the allocation even more later, he said.

Money managers including Pacific Investment Management Co., Invesco Ltd. and Charles Schwab Corp. offer products that employ the methodology of Research Affiliates. In the PIMCO RAE Emerging Markets Fund, roughly half the portfolio is allocated to India, South Korea and Taiwan, data compiled by Bloomberg show.

The fund boosted bets in Thailand, Mexico and Brazil while reducing positions in Russia, China and Taiwan, according to its latest filing.

“This is mostly rebalancing, favoring underperforming markets and trimming outperforming markets,” Arnott said in an interview from Newport Beach, California.