In his 2005 book The World Is Flat: A Brief History of the Twenty-first Century, Thomas Friedman noted that the convergence of technology and events allowed India, China and many other countries to become part of the global supply chain for services and manufacturing, “flattening” the global economy. That flattening led to a significant increase in the correlation of returns of U.S. and international stocks.

From 1970 through 1989, the correlation of the S&P 500 Index to the MSCI EAFE Index was just 0.49. From 1990 through1999, the correlation increased slightly, to 0.54. Unfortunately, over the past 23 years (2000-2022), the correlation increased to 0.87. As the world became more integrated and technology benefits spread quickly, correlations among equity assets rose, reducing the benefits of global diversification.

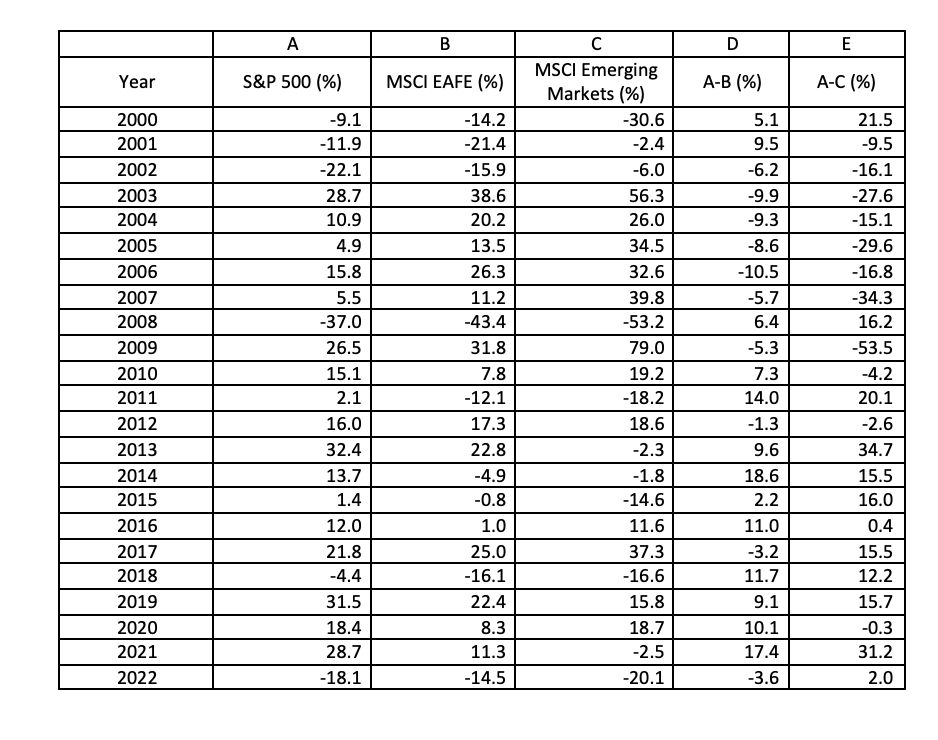

Another important point to consider is that in crises, such as the Great Recession and the COVID-19 pandemic, the correlation of all equity asset classes tends to rise toward 1. That leads many to believe that equity diversification no longer works. However, diversification benefits come not just from correlations but from the dispersion of returns as well. As seen in the table below, there has been a wide dispersion of returns in almost every year since 2000—demonstrating that there are still large diversification benefits.

The bottom line is that while there are still diversification benefits from investing internationally, the benefits have been reduced. That increases the importance of adding other unique sources of risk and return to your portfolio, as economic theory suggests, in order to reduce the potential dispersion of returns (cut the tail risk).

The empirical evidence, supported by economic theory, suggests that an investment strategy should be based on three key principles: First, markets are highly, though not perfectly, efficient. That leads to the conclusion that active management is a loser’s game. Second, if markets are efficient, it follows that you should believe that all unique sources of risk have similar risk-adjusted returns. Third, if all unique sources of risk have similar risk-adjusted returns, the logical conclusion is that portfolios should be diversified across as many unique/independent sources of risk and return (not just market beta risk) as you can identify that meet the criteria of persistence, pervasiveness, robustness to various definitions, implementability (survives transactions costs) and possessing intuitive risk- or behavioral-based explanations that provide reasons for believing the premium should persist in the future.

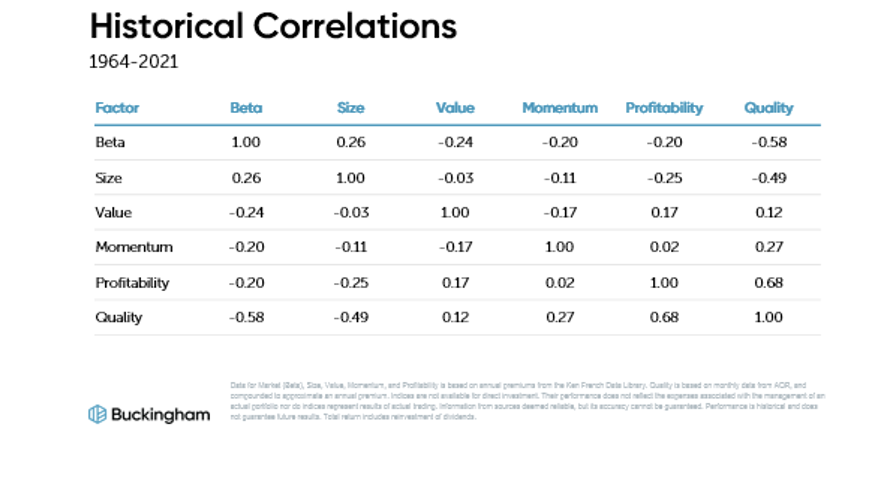

With these core principles in mind, there are several ways investors can add other unique sources of risk to their portfolios. They can increase their exposure to equity factors that have met all the established criteria: size, value, momentum and profitability/quality. The table below shows the correlation of returns of these factors.

Not only can investors diversify across factors, but through the use of long-short factor funds, such as AQR’s QRPRX and QSPRX, they can diversify across stocks, bonds, commodities and currencies as well, providing further diversification benefits.

The SEC’s approval of interval funds (with limited quarterly liquidity) has provided investors with the opportunity to invest in other unique sources of risk (including illiquidity risk), such as consumer loans (through such funds as Stone Ridge Asset Management’s LENDX), reinsurance (through such funds as Stone Ridge’s SRRIX and SHRIX and Pioneer Amundi’s XILSX) and the private debt of corporations (through such funds as Cliffwater’s CCLFX and CELFX).

Investor Takeaways

The flattening of the global economy has reduced, though not eliminated, the benefits of international diversification. Diversifying across other unique sources of risk factors and alternative investments allows investors to create more efficient portfolios—reducing volatility, narrowing the potential dispersion of returns and dramatically reducing the tail risk inherent in traditional 60/40 portfolios.

There really is nothing new here. The endowments of Harvard and Yale have been incorporating unique sources of risk in their portfolios for decades. And Bridgewater’s Ray Dalio has been touting the benefits of a “risk parity” approach for decades as well. Fortunately, today’s retail investors now have access to such strategies without having to pay the traditional 2 and 20 fees of hedge funds, which leave the fund sponsors with all the benefits. Nor do investors have to pay the high fees of active managers. Many low-cost ETFs now provide access to the aforementioned factors. And the SEC’s approval of interval funds has also brought more competition, significantly lowered fund expense ratios and eliminated performance fees.

The decreased diversification benefits of international equities and the still historically low yields available on the safest bonds, combined with increased access to lower-cost alternative investments that provide unique sources of risk and return, should cause investors to consider increasing their allocations to alternatives from the typical 10-15% to maybe 25-30%—which would still be well below the allocation to alternatives of, for example, the Yale and Harvard endowments.

Larry Swedroe has authored or co-authored 18 books on investing. His latest is “Your Essential Guide to Sustainable Investing.” All opinions expressed are solely his opinions and do not reflect the opinions of Buckingham Strategic Wealth or its affiliates. This information is provided for general information purposes only and should not be construed as financial, tax or legal advice. LSR-23-442