You saw the breakout move made by gold this week, right? Bullion broke above its 200-day moving average for the first time since May. The May spike, to be sure, was shortlived. It lasted only three days. By that measure, gold isn’t out of the woods yet.

No matter. It sure wasn’t inflation fears that drove buyers into the gold market. The latest CPI numbers offer testimony to that. Nope, inflation is actually best metered by the price of oil. Oil, after all, is bought in some form or another by most citizens. Gold? Not so much.

The fundamentals for oil don’t look bullish. Inventory builds, combined with weak demand, are keeping a lid on crude prices. We seem to have entered a rangebound market with strong support at $40 a barrel and overhead resistance at $60.

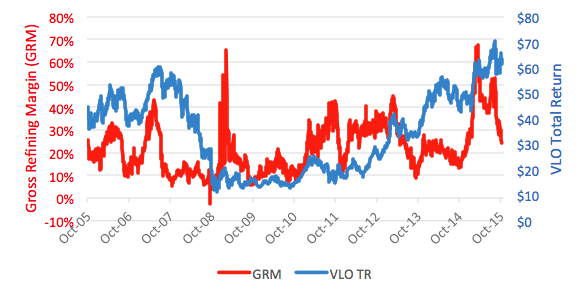

That, of course, has implications for oil refiners. Take Valero Energy Corp. (NYSE: VLO) as an example. Valero, an independent outfit based in San Antonio, is a bellwether of the refining business. Generally, Valero and other refiners do best when gross refining margins — the spread between the cost of crude oil inputs and the sale proceeds of distillate outputs — improve. Simply put, soft crude prices coupled with robust tariffs for refined products make for better bottom lines.

Well, crude prices are soft. At the very least, they’re now predictable. Product prices? Well, there’s the kicker. Wholesale gasoline and diesel prices typically soften at this time of the year. And that’s not good for refining margins.

Valero’s stock price, for the most part, correlates well with its gross margin. That margin’s been plummeting since March.

So, what’s the prospect for Valero? Well, Valero’s trading at the $63 level. On a long-term basis, the stock’s due to reach $75, but the wobble on Tuesday at $62 is worrisome.

Bottom line? Hold off ‘til early 2016 to buy refiners like Valero. It may be the best New Year’s resolution you make.

Brad Zigler is REP./WealthManagement's Alternative Investments Editor. Previously, he was the head of marketing, research and education for the Pacific Exchange's (now NYSE Arca) option market and the iShares complex of exchange traded funds.