By Lewis Krauskopf, Sinead Carew and April Joyner

NEW YORK, Dec 1 (Reuters) - A proposal driven by President Donald Trump to overhaul the country's tax system is moving through U.S. Congress, lifting the overall stock market and raising hopes that corporate earnings will get a boost.

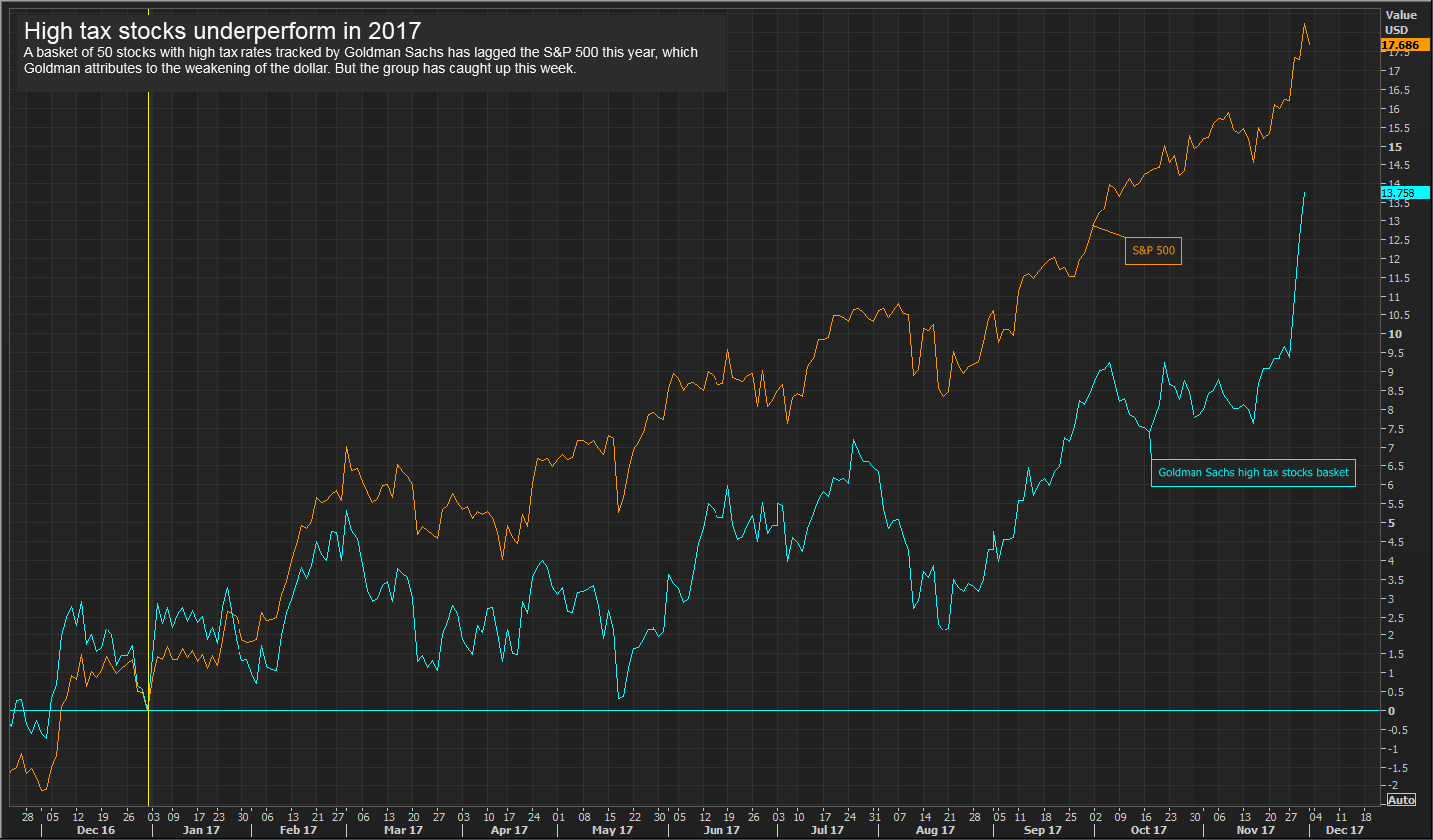

The S&P 500 rallied this week as the drive to push sweeping tax legislation through the U.S. Senate gained momentum, although gains were tempered by a report that former national security adviser Michael Flynn was prepared to testify that before taking office Trump had directed him to make contact with Russians.

Early Saturday, the Senate voted to pass a sweeping tax overhaul, cutting the the corporate tax rate to as low as 20 percent from 35 percent.

UBS strategists project that overall S&P 500 earnings would rise by 6.5 percent should the corporate tax rate fall to 25 percent and increase by 9.5 percent should the rate go to 20 percent.

But certain stocks could benefit more than others from the Republican-led plans.

"It will be favorable to companies with primarily domestic business that are paying close to the full tax rate," said John Carey, portfolio manager at Amundi Pioneer Asset Management in Boston.

Investors appear to have already rotated into some of these tax-sensitive areas. Some market watchers caution about generalizing winners, noting big differences in effective rates between companies in the same sectors.

But strategists point to industries with a concentration of companies poised to benefit, particularly from a lower corporate tax rate.

Banks

Of the major S&P sectors, financials pay the highest effective tax rate at 27.5 percent, according to a Wells Fargo analysis of historical tax rates.

Brian Klock, managing director in equity research at Keefe, Bruyette & Woods who covers large regional banks, expects tax cuts to add 16 percent to median bank earnings in 2018 and 18 percent in 2019.

"We're assuming whatever the benefit is will drop right to the bottom line," Klock said. "They won't give up on loan pricing or put any big investments in. With the increased capital they'll return it to shareholders."

Among large regional banks, Zions Bancorp, M&T Bank Corp and Comerica Inc stand to benefit the most, Klock said.

Transports

Transportation ranks among the top industries expected to receive a big earnings boost from a lower corporate tax rate, according to UBS.

U.S. railroads such as Union Pacific Corp and CSX Corp are almost entirely exposed to the U.S. statutory rates, said Morningstar analyst Keith Schoonmaker.

Railroads would benefit from provisions allowing them to expense their capital expenditures in one year as opposed to over time, lowering their taxable income, Schoonmaker said.

“We’ll see what comes out as far as the ability to depreciate immediately, but that certainly would be beneficial because they are all big capital spenders,” Schoonmaker said, noting that railroads spend 18 percent to 20 percent of revenue on capital expenditures.

Airlines stand to gain from lower tax rates, analysts said, with UBS pointing to Alaska Air Group Inc and Southwest Airlines Co as possible winners.

Healthcare Services

Domestically geared healthcare companies that focus on services would likely benefit more from tax rate reductions than pharmaceutical and medical device companies that sell their products overseas.

"Healthcare services is one of the most taxed industries and would be a big beneficiary of reductions in corporate tax rates," Lance Wilkes, an analyst at Bernstein, said in a recent note.

The S&P 500 healthcare providers and services index , which includes health insurers such as Anthem Inc , drug wholesalers like AmerisourceBergen Corp, and hospital operators such as HCA Healthcare inc, has gained 5.4 percent this week.

According to Leerink analyst Ana Gupte, a corporate tax rate cut to 20 percent could boost health insurer earnings by about 20 percent to 40 percent, but some of those gains would be expected to be passed through to employer and individual customers.

Other potential big winners include home health services company Almost Family Inc, lab-testing company Quest Diagnostics Inc and pharmacy benefit manger Express Scripts Holding, according to Jefferies analyst Brian Tanquilut.

Retail

Department stores head the list of retailers that will benefit because they have among the heaviest U.S. exposure, said Bridget Weishaar, senior equity analyst at Morningstar.

Weishaar points to Macy's Inc, Nordstrom Inc and Kohls Corp as potential winners among department stores, as well as Victoria's Secret owner L Brands and apparel retailer Ross Stores.

“Retail companies will benefit from paying a lower tax rate," Weishaar said. "Consumers hopefully will have additional cash, which will help consumer discretionary spending."

Telecommunications

Telecom companies, including AT&T Inc and Verizon Communications Inc, also stand to gain.

"They're domestically focused companies with a very high percentage of their employee base in the U.S. and significant amounts of investments in U.S. infrastructure," said Amir Rozwadowski, telecom equity analyst at Barclays. "Therefore they're predisposed to benefit from tax reform."

AT&T has climbed 4.9 percent this week, while Verizon has surged 9 percent.

(Reporting by Lewis Krauskopf; Editing by Meredith Mazzilli)