By Kwok Chern-Yeh

Japan is home to a plethora of world-class companies in spite of the harsh economic realities of recent years—making it fertile ground for global investors seeking returns.

The nation’s aging and shrinking population impedes policymakers in their efforts to effect economic growth. But we have found companies that have survived and thrived in this environment by making themselves leaner, more efficient and more productive. The best among them are leading players in their industries and are global. They have transcended borders.

If necessity is the mother of invention, Japan is at an advantage. Streamlining and restructuring can drive profitability in addition to top-line growth. Local companies have also had to look overseas for growth to lessen dependence on the domestic economy. Those with industry-leading positions have pricing power. Those with global production lines can benefit from risk diversification. It means Japanese companies can often be found operating in higher growth emerging markets.

One example of such companies is a maker of baby bottles and products, which is geared to the rising middle classes in China and Southeast Asia. Just 1 million babies are born in Japan each year, while 15 million were born in China last year, which is the company’s major market.

More broadly, Japanese companies have proven adept at building good consumer products with strong brands that have resonance across Asia. They have established a reputation for high quality—which means their products can be priced at a premium.

The tough domestic backdrop has also inspired a bold approach to innovation. Japan leads the world in certain automation technologies. Some are borne out of the country’s car industry, including firms that manufacture quality-control sensors, which cut down on costs and defects. But it is in robotics where Japan leads the world. There is unrelenting demand in countries such as China, where manufacturing automation is key to saving on rising labor costs and improving product quality.

Health care is another critical area. Japan’s population is aging—38% of Japanese are expected to be age 65 or over by 2065, making it the world’s leading “super-aged society." The social care bill is rising at a time when the working population is diminishing.

But again the best companies have not stood still. Among our favorite companies are firms that consistently invest in research and development to maintain a competitive edge, in areas such as medical equipment. What at first appears a demographic headwind in fact becomes a tailwind supportive of growth.

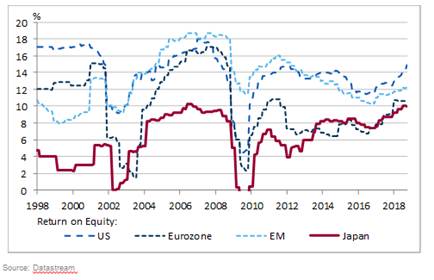

In view of the above, Japanese companies do not necessarily reflect the weakness in the domestic economy. They are also cash-rich, enabling them to withstand difficult times. While this has led to lower return on equity for some companies, it is an area we continue to engage them on—and we are seeing encouraging signs of improvement.

We believe that a focus on investing for the long term, and corporate engagement, will help company managers to do the right thing—including paying out excess capital on their balance sheets.

The government is trying to do something similar, encouraging compliance with its governance and stewardship codes. Greater recognition of the importance of governance among Japanese corporates should lead to improvements in capital efficiency. Because of the low starting point, the scope for improvement is vast. As more companies embrace an increasingly shareholder-friendly stance, investors stand to get a better deal.

We are strong advocates that shareholder returns can be improved, and we are seeing more companies raise payout ratios and/or carry out buybacks. Share buybacks at Japanese companies reached record levels last year. While the market has welcomed this, we have been more cautious. Buybacks have almost become a reflex. They make little sense when valuations have risen. We prefer companies to be more strategic and consider raising payouts or offering special dividends.

We want to invest in and engage the more progressive companies that will safeguard the interests of all shareholders. When a company improves capital management and governance, it can help to lower our investment risk.

Good governance, company performance and sound capital management are closely linked. It’s why we will continue to engage managements and boards to help improve returns. If we are confident that management will increase a company’s value over the long run, we have every reason to stay invested.

Kwok Chern-Yeh is manager of the Aberdeen Japan Equity Fund.