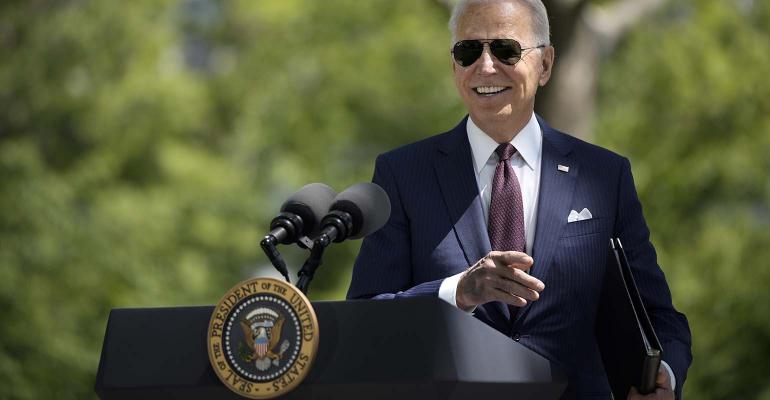

While the U.S. stock market during President Joe's Biden’s first 100 days in office has been buoyed by predictions for a post-COVID-19 economic surge, discerning long-term investors and their financial advisors would be wise to temper their bullish optimism and consider the increasingly fragile, if not perilous, foundation on which the markets sit.

After just a few short months in office, the Biden presidency has proposed what is in effect a punishing long-term rebuke to the stock market with sweeping tax increases on many individuals and the very corporations that make up the market’s valuation.

Moreover, the markets have become increasingly dependent on investor sentiment dictated by Washington, D.C., and federal spending enacted and proposed has reached unimaginable and unsustainable levels—effectively fueling eye-popping debt and artificially juicing short-term economic activity. Naturally, investors have become comfortable with what amounts to manufactured backstops created by artificially low interest rates, stimulus packages and quantitative easing. But today’s tail winds eventually become tomorrow’s head winds.

As has been reported, Biden’s budget affirmed his embrace of government spending and comes on the heels of a $1.9 trillion COVID-19 relief bill, a proposed $2.3 trillion infrastructure package and subsequent $2 trillion measure focused on issues like child care and college tuition. The $1.52 trillion budget request, up $118 billion from current levels, is 25 percent higher than discretionary spending was at the end of the Obama administration.

The Federal Reserve has kept the economy and the markets on life support, but have run out of ammunition, as they have cut rates to now near zero. Future recessions cannot be cured through a congressionally authorized bailout or central bankers because the money simply is not there. With more than $28 trillion in federal debt (that’s $85,000 for every American) on the books and no plan for repayment, the next bear market may be the most prolonged and painful one in a generation.

And it’s not just Republicans saying this. Rep. Jim Himes (D-Conn.), a former Goldman Sachs executive, said in March: “History shows us that when money is effectively free, crazy things happen. And we are starting to see lots of crazy things in the equity market, the high-yield bond market, SPACs and tokens. Oftentimes this kind of thing does not end well at all.” And President Bill Clinton’s former Treasury secretary, Lawrence Summers, said the U.S. is in the midst of the “least responsible fiscal macroeconomic policy we’ve had for the last 40 years.”

Investors are risk managers at heart, and they would be prudent and begin protecting their portfolios in anticipation of a dark future for their nest eggs in the stock market.

A natural question for investors today is how do I hedge my portfolio against such rampant, if not reckless, government debt? The long-held belief that market risk can be offset by simply diversifying across stocks and bonds is not the answer. In fact, that philosophy, known as modern portfolio theory, failed to help investors effectively limit the devastation unleashed by the dot.com bust, the recession of 2000–02 or in the global financial crisis of 2008.

The inevitable market fallout from the Biden administration economic policies will likely forever change how investors structure their portfolios. To provide risk management and portfolio protection, diversification requires investment in assets whose returns are truly noncorrelated. Unfortunately, many investors continue to pursue "false" diversification, slicing up the market into smaller and smaller pieces that have similar correlation patterns. In a bull market, investors are able to ride the wave of positive returns in these correlated asset classes. But as soon as a bear market hits, these investors will be unable to protect their assets.

As yet, the market has not priced in what will be the straw that likely breaks the market’s back—the Biden tax and spend plan. Investors will be rewarded for protecting their portfolios because Washington is not.

Randy Swan is the founder and chief investment officer of Swan Global Investments, based in Durango, Colo.