Legendary coach Bear Bryant once said, “Offense sells tickets, but defense wins championships.” It was a winning formula for Bryant’s college football team. It also holds the secret to success for the game of investing.

Bryant is best known as the longtime head coach of the University of Alabama football team. During his 25-year tenure, he and his team racked up six national championships and 13 conference championships.

Bryant was talking about what it takes to build a great football franchise. Fancy running plays and touchdowns thrill fans and fill stadiums, but it’s the disciplined and less glamorous efforts to prevent the opponent from scoring that win games.

The same can be said of investing. A spectacular stock pick or a prescient call ahead of a dramatic price movement will grab investors’ attention. But it’s the less glamorous efforts to not lose money that will build wealth over the long haul.

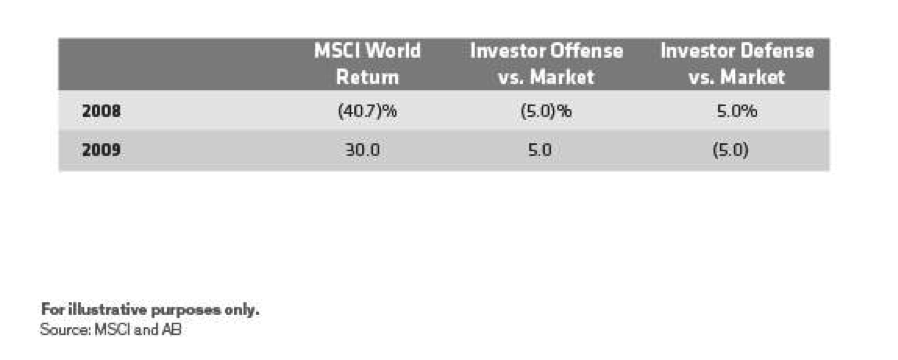

We’ll use recent experience to prove our point. Global stocks plunged by more than 40% in 2008 and then rebounded by 30% in 2009. Let’s say that “Investor Offense” underperformed the market by 5% in the 2008 crash and outperformed the market by 5% in the 2009 recovery, and that “Investor Defense” did the opposite.

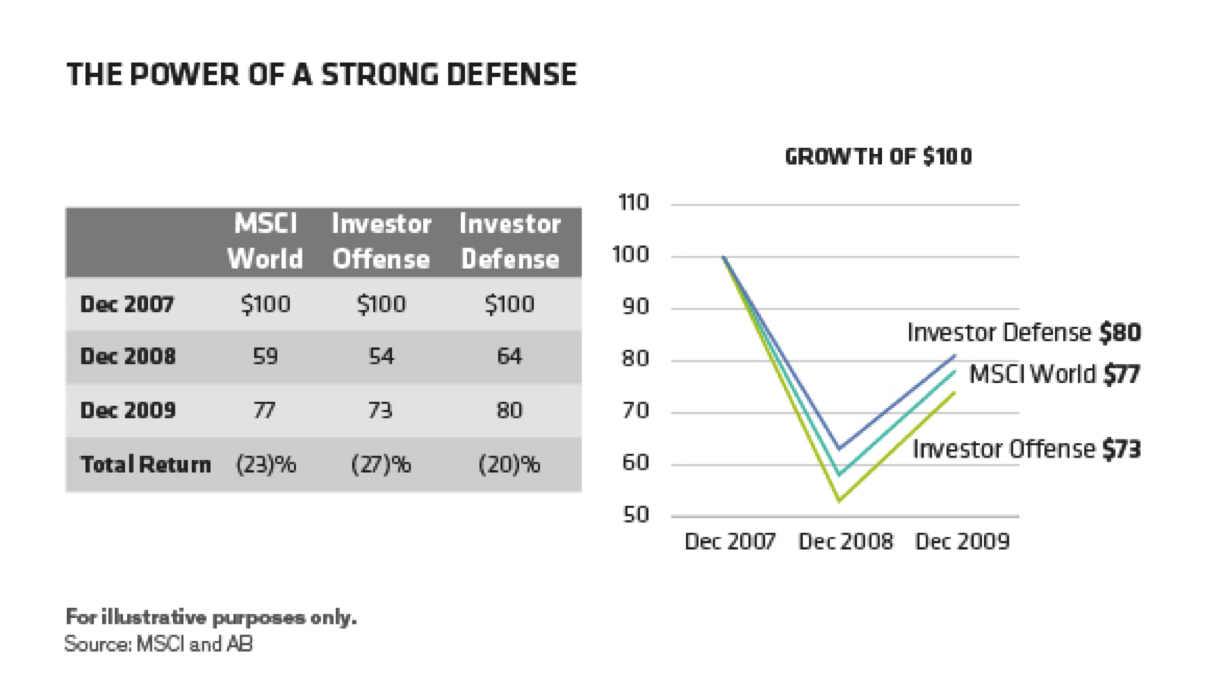

Because both Investor Offense and Investor Defense each beat and trailed the market by 5% in one of the two years, it may seem that they should have performed roughly in line with one another and with the benchmark over the full period. But that’s not how the math works.

As shown below, Investor Defense ended 2009 in much better shape than Investor Offense and the market. In fact, Investor Defense beat Investor Offense by a whopping $7, or 10%.

The Effects of Risk Drag

To use financial jargon, this outcome illustrates the effects of risk drag, or the depressing influence of too much volatility on performance. Put more simply, because Investor Defense’s portfolio lost less money in the market slump, it didn’t have to work as hard as Investor Offense’s to regain lost ground. So, even though the defensive portfolio lagged the market in the 2009 recovery, it was still ahead of the game in the end—and also positioned to compound off that higher base thereafter.

The takeaway: the pattern of return is essential to an investor’s ultimate wealth. We believe that a good defense matters more than a good offense in investing. Bear Bryant’s insights into championship football strategy apply to the investing world, too.

These insights may be even more relevant in the times ahead, given where we are in the economic cycle. For most of the past few years, markets have been fairly calm. But as macro uncertainties have risen, volatility has spiked and looks likely to remain high for some time. Against this backdrop, it will be increasingly important to pay attention to the pattern of returns—and to how and when investment strategies are likely to beat the market. In any event, investors will want to make sure to flank their portfolios with a strong defensive lineup to help them go the distance in meeting their long-term goals —or, might we say, to investing victory.

Sammy Suzuki is Portfolio Manager of Strategic Core Equities for AllianceBernstein.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

MSCI makes no express or implied warranties or representations, and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed or produced by MSCI.