By John Tousley

We believe investors today are facing a new, more turbulent market environment where an emphasis on quality and income can help weather the storm.

Since the global financial crisis of 2007-08, U.S. equity markets have been experiencing more rapid declines and recoveries than before the crisis. Prior to 2008, the S&P 500 Index would take on average 37 days to correct between 5-10 percent — that figure today is 29 days. Recoveries from these declines, too, have shrunk on average to 30 days, from the prior 48 days.

These smaller time frames have been especially challenging for would-be market timers, for whom “bottom ticking” – always a challenging task – is now even more difficult. Politics in Europe and the U.S., China and energy are just a few of the catalysts we expect to contribute to these trends going forward.

For investors seeking new entry points, we would urge a fresh look at diversified approaches to income investing. A diversified income portfolio (DIP) as we see it incorporates a risk-aware selection of income-oriented equities and fixed income. This includes higher-quality stocks (e.g., those with stronger balance sheets) and relatively high-coupon, dividend-paying sectors such as Master Limited Partnerships (MLPs), Real Estate Investment Trusts (REITs), and high yield bonds.

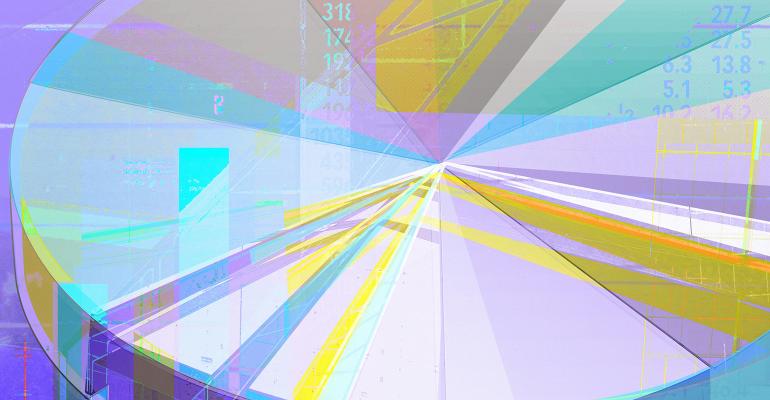

To see how the returns of this approach have stacked up versus the S&P 500 index during periods of market turbulence, we looked at three historical scenarios. Each covered 10 percent corrections in the S&P 500 Total Return Index from earliest index common inception to the present.

Scenario 1, which we call “Perfectly Timed,” shows what happened for those who invested in a diversified income portfolio on the exact day the 10 percent correction finished. Scenario 2, “Early,” shows what happened when investing halfway between the market peak and bottom. Scenario 3, “Late,” is defined as investing after the market bottomed, but only halfway to the prior peak.

As “perfect” timing is virtually impossible, we look to the “early” and “late” scenarios as more realistic. Here, the “early” entrant to a diversified income portfolio outperformed the S&P 500 Index by 11 percent, and with only 60 percent of the S&P 500 Index’s volatility. Similarly, the “late” investor’s returns equaled the S&P 500 Index, with less volatility.

There are important differences between the S&P 500 and an income-oriented approach, especially the smaller upside potential of many income-oriented investments in a strong bull market. But we think the tradeoffs are worth noting in today’s market environment. They suggest that the choice of investment strategy – diversified income -- trumps timing in turbulent periods.

We think blending income sources in a thoughtful way has the potential to rival or beat the performance of the broader equity market but, importantly for turbulent times, with the potential for lower volatility.

John Tousley is the head of US Market Strategy, Strategic Advisory Solutions, at Goldman Sachs Asset Management.

Views are as of 11/15/2016 and subject to change in the future.

This article originally appeared on the GSAM Connect blog.