By Felice Maranz

(Bloomberg) --With just 11 days to go till the midterm elections, analysts have started considering the market impact of some less-likely outcomes. Specifically, what would happen if Republicans were to hold the U.S. House of Representatives and gain seats in the Senate.

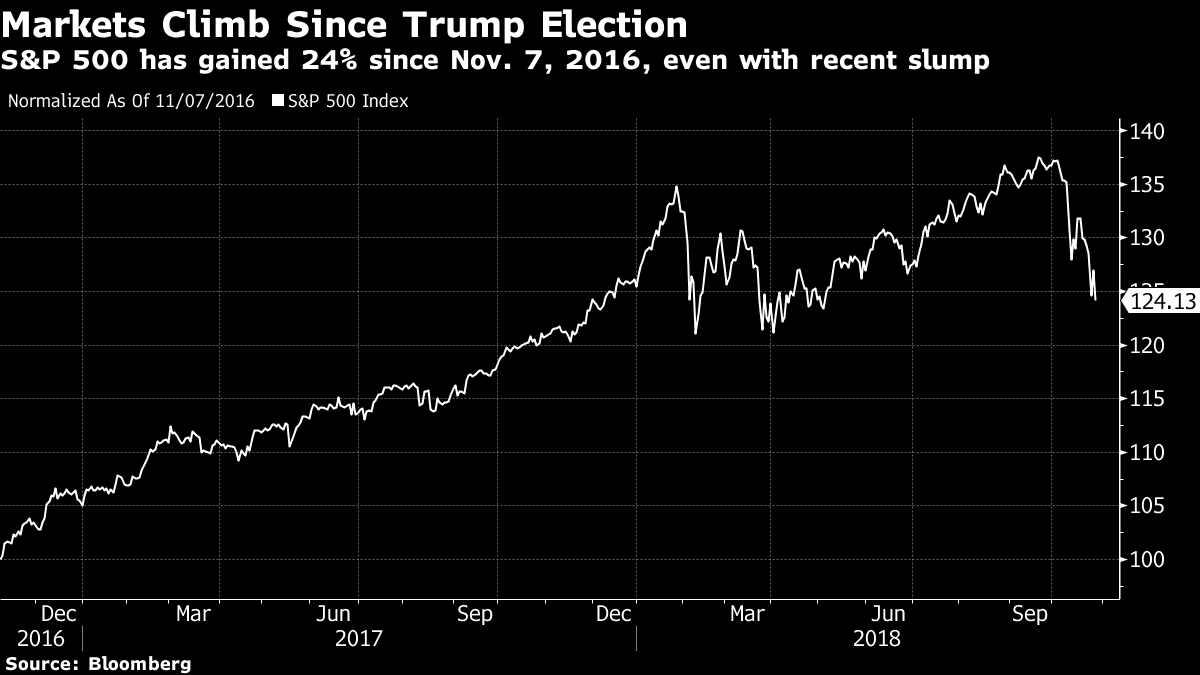

While polling suggests Democrats are likely to capture the House, some research firms are looking at what would happen if Republicans pull an upset and hold both legislative chambers. The S&P 500 Index has gained about 24 percent since U.S. President Donald Trump’s November 2016 election, though it’s down for the year, as a boost from tax cuts and deregulation has faded and the Federal Reserve has raised interest rates.

Redburn’s Melissa Kidd and Clemmie Elwes wrote in a note that the most significant consequence of a surprise “Trump Triumph” may be further presidential criticism of the Federal Reserve. That might push the Fed to try even harder to stay on its current tightening path, which would be “the major threat to risk assets moving into 2019, even as the underlying pace of economic expansion in the U.S. remains healthy.”

“Infrastructure spending might be harder to push through a Republican-led legislature than one led by Democrats more amenable to raising government spending,” they added. They see Trump as likely to persist with plans to raise tariffs on Chinese imports early next year, regardless of the midterm results, “but positive feedback from the electorate can only help.”

A combination of Republican retirements from Congress and demographic changes have put more than 60 House seats in play for the Nov. 6 election. Most of those have been in GOP control. David Wasserman, a House election specialist at the non-partisan Cook Political report, wrote in an analysis this week that the likeliest outcome is Democrats gaining between 25 and 35 seats.

Republicans have a stronger hold on the Senate as Democrats are having to defend 26 of the 35 seats on the ballot in 2018, including 10 in states where Trump won in 2016.

More Stimulus

A GOP sweep may mean an additional “round of stimulus which the market would (at least initially) view quite positively,” Jonathan Golub, Credit Suisse Group AG’s chief U.S. equity strategist, said in an email to Bloomberg. It might also eliminate an “investigation push” that could ensue if Democrats were to take the House.

If Republicans hold both chambers, Compass Point analyst Isaac Boltansky says the market might initially believe that “the GOP tax cuts are safe for another two years, which is market positive,” and that “the deregulatory agenda will continue apace,” which is also “market positive.” Trump may view the election “as an affirmation of his trade policies, which could lead to more trade uncertainty and volatility,” he said in an email.

“Prospects for the Democrats to win both House and Senate have dropped, amid evidence of a late awakening of GOP supporters, an immigration-related October surprise, and effective campaigning by the president,” Capital Alpha’s Charles Gabriel and Dustin Haygood wrote in a note. Their firm puts 35 percent odds on Republicans keeping the House, higher than the 30 percent odds they place on Democrats retaking the Senate.

“For investors, this more-competitive end game should belie any residual ‘black swan’ concerns about higher odds of impeachment attempts aimed at the president in the next Congress, or of consequential efforts to reverse his tax cuts or regulatory agenda,” Gabriel and Haygood wrote. Even so, they say a split decision, with a Democratic House and Republican Senate, “has been expected from the start, and will prove true.”

Rate Spike

On Thursday, Morgan Stanley equity strategist Mike Wilson told CNBC that the market may be starting to “sniff out a Republican sweep,” which might portend “more fiscal stimulus, more funding, and that would cause rates to spike up.” Wilson argued that the stock market may take a Republican win positively initially, but would then sell, CNBC reported, adding that Wilson said Morgan Stanley believes Democrats will win the House and Republicans will retain the Senate.

Separately on Thursday, Daniel Clifton of Strategas wrote that the odds of a Republican sweep were hitting a new high in the betting markets, though his firm’s Democratic sweep portfolio continued to outperform the firm’s Republican portfolio. “Stocks may not believe the Republican momentum is real and/or that Democrats will use the debt ceiling to claw back some of the tax cut. And this re-pricing is taking place at a time of Fed and China trade uncertainty,” Strategas said.