The final week of July saw eight of the 11 major Sector Fund groups tracked by EPFR record inflows as the 2Q18 earnings season neared its peak in the U.S. and gathered momentum in Europe and Japan. Overall flows again had a defensive tinge, with Consumer Goods, Utilities and Telecoms all attracting fresh money and Gold Funds accounting for the lion’s share of the headline number for all Commodities Sector Funds. But Technology Sector Funds also pulled in over $800 million, despite Facebook’s earnings stumble, and Real Estate Sector Funds snapped a two-week run of outflows.

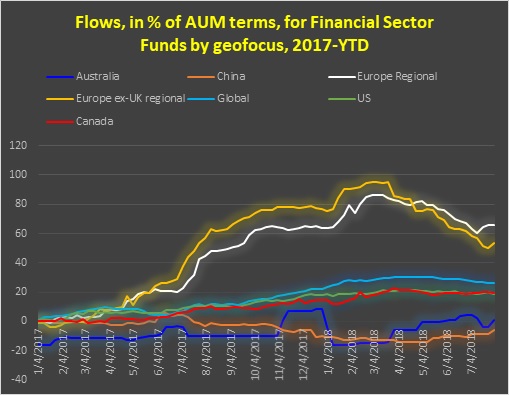

Of the three groups experiencing net redemptions, Financial Sector Funds posted the biggest number with investors pulling over $1 billion out of this group. Redemptions from U.S. Financial Sector Funds jumped to a six-week high despite a good 2Q18 earnings season for this sector. But flows into Europe ex-U.K. Regional Funds hit levels last seen in January during a week when Deutsche Bank confirmed it has moved a significant chunk of its euro clearing activities from London to Frankfurt in anticipation of next year’s Brexit.

Although oil prices continue to hold around $70 a barrel, earnings reports from major energy plays have generally fallen short of expectations, and Energy Sector Funds posted their fourth outflow in the past six weeks. Funds with Master Limited Partnership mandates did snap a four-week run of outflows, but the outlook for these vehicles for funding U.S. mid-stream assets remains clouded by changes in the federal tax code and the shifting needs of the shale oil and gas industry.

Year-to-date, Technology Sector Funds top the list of Sector Fund groups in both flow and performance terms, with Commodities Sector Funds recording the second largest net inflow and Healthcare/Biotechnology Sector Funds the second best collective performance. At the other end of the scale, Real Estate Sector Funds have experienced the heaviest redemptions and Telecoms Sector Funds turned in the weakest performance.

Cameron Brandt is Director of Research for EPFR Global, an Informa Financial Intelligence company.