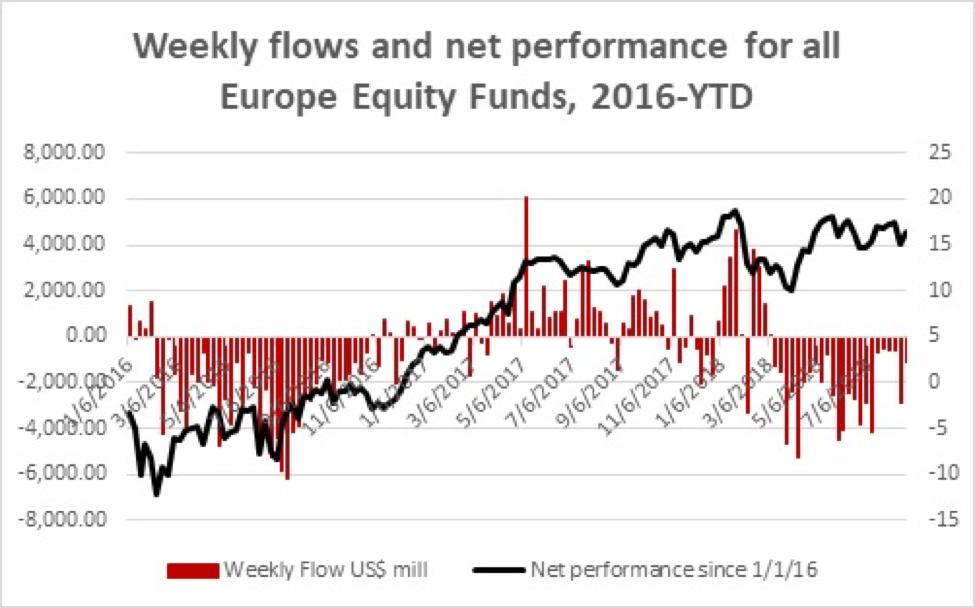

The last week of August saw Europe Equity Funds chalk up their 25th straight outflow, thereby extending their third longest redemption streak since EPFR started tracking this group weekly in 2000. In contrast to previous weeks, however, the outflows were driven by perceptions that the U.K. and the European Union may part ways at the end of 1Q19 without a workable divorce settlement rather than by the rhetoric emerging from Italy’s new, populist coalition government.

While continuing to distance themselves from the dangers they perceive in Europe, investors regained some of their appetite for riskier asset classes. Emerging Markets Equity Funds posted only their second inflow during the past 15 weeks, commitments to Alternative Funds jumped to a 19-week high, Emerging Markets Bond Funds snapped their latest outflow streak and High Yield Bond Funds recorded their fourth inflow since late July.

Overall, EPFR-tracked Bond Funds posted collective inflows of $788 million during the week ending August 29 while Equity Funds absorbed $7.6 billion—with Dividend Equity Funds recording only their third inflow so far this year—and Money Market Funds took in a net $97 million. Funds with U.S. and Chinese mandates remained popular despite the trade issues separating the world’s largest economies.

At the asset class and single country fund levels, Japan Bond Funds recorded their biggest inflow year-to-date, Turkey Equity Funds absorbed fresh money for the 19th time in the past 20 weeks and commitments to South Africa Equity Funds were the biggest in over 2 years. Municipal Bond Funds posted inflows for the 15th time in the past 16 weeks and Inflation Protected Bond Funds snapped a five-week run of outflows.

Cameron Brandt is Director of Research for EPFR Global, an Informa Financial Intelligence company.