EPFR Global-tracked Developed Markets Equity Funds posted their second largest outflow of the year during the week ending May 3 as redemptions from U.S. Equity Funds substantially offset flows into Global, Europe and Japan Equity Funds.

The outflows from U.S. Equity Fund groups occurred across all capitalizations, with Large Cap Blend Funds hit hardest in cash terms and Small Cap Blend Funds in flows as a percentage of AUM terms. Some mixed earning reports at the tail end of what has been a generally good earnings season, the impending Fed meeting and further pressure on the energy sector from weak oil prices prompted investors to tap the brakes and book some of the previous week’s gains.

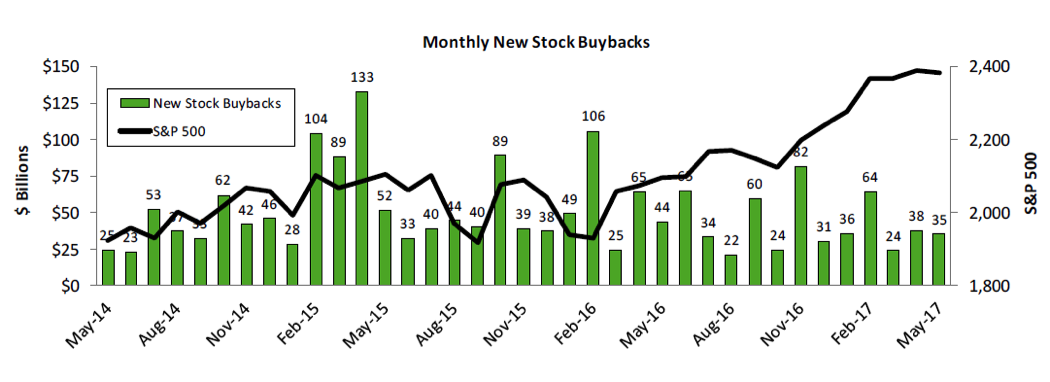

Two source of support for U.S. equities—stock buybacks and margin borrowing—are kicking into higher gear, according to EPFR Global sister company, TrimTabs. In recent reports, TrimTabs CEO David Santschi noted that “Margin debt at New York Stock Exchange member firms soared to a record high for the third consecutive month [in March]. Margin borrowing rose $8.8 billion, or 1.7 percent, to $536.9 billion. This uptrend bodes well for U.S. equities because margin debt tends to be a good longer-term indicator.”

Santschi added that a pickup in stock buyback volume is “encouraging because buybacks have been in a two-year downtrend.” Interim peaks have continued to decline since the volume reached a record $133 billion in April 2015.

Flows into Europe Equity Funds were well off the previous week’s pace as investors stopped celebrating the result from the first round of French presidential election and looked ahead to the second round on May 7. Flows into Germany Equity Funds hit a 70-week high, with one ETF family accounting for the bulk of the headline number. The biggest redemptions from France Equity Funds since early October centered on three ETFs.

Japan Equity Funds eked out their third inflow in the past eight weeks on the back of foreign flows, which hit their highest level since early March.

The largest of the diversified Developed Markets Equity Fund groups, Global Equity Funds, have posted inflows every week so far this year. The latest week saw the biggest retail commitment since late February as the year-to-date total for this fund group moved past the $44 billion mark.

Cameron Brandt is Director of Research for EPFR Global, an Informa Financial Intelligence company.