Strong U.S. corporate earnings have buoyed equity markets, despite the ongoing trade tensions, while solid second-quarter economic data points to GDP growth reaching 4 percent for the quarter. U.S. Equity and Bond Funds attracted over $6 billion between them for the second straight week, as those investors turned to an economy that is diverging from other global economies.

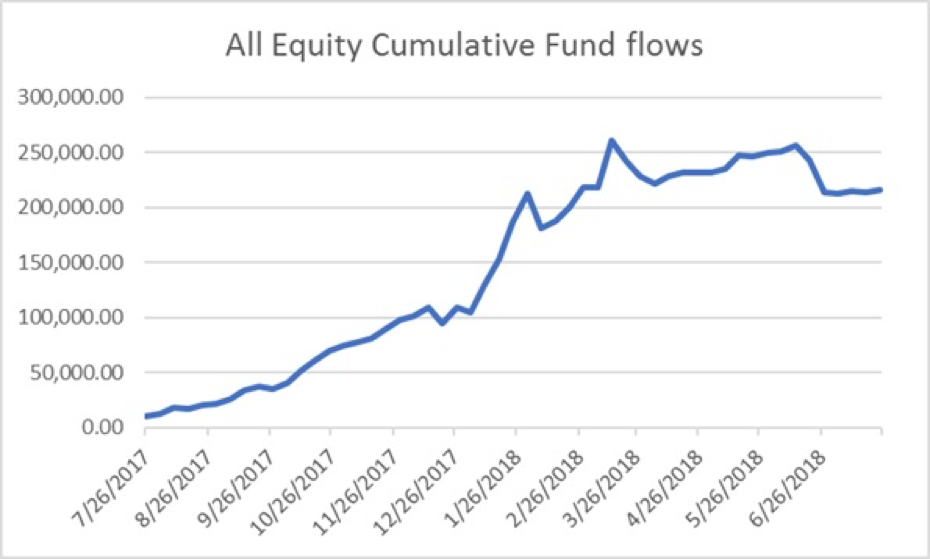

Overall, the week ending July 25 saw EPFR-tracked Bond Funds collectively absorb another $4 billion. Equity Funds brought in over $1.7 billion in fresh money, while $257 million flowed out of Alternative Funds, and over $4.8 billion out of Money Market Funds. Investors pulled out over $1.4 billion from dividend paying Equity Funds during the week.

At the single country and asset class fund levels, Switzerland Equity Funds posted outflows for the second straight week, France Equity Funds experienced inflows for the first time in 13 weeks and Thailand Bond Funds experienced their most outflows since the first week of June, while China Bond Funds posted redemptions, ending a two-week run of inflows. Municipal Bond Funds recorded inflows for the 11th time in the past 12 weeks and Inflation Protected Bond Funds experienced its largest redemptions since mid-March.

Emerging Markets Equity Funds

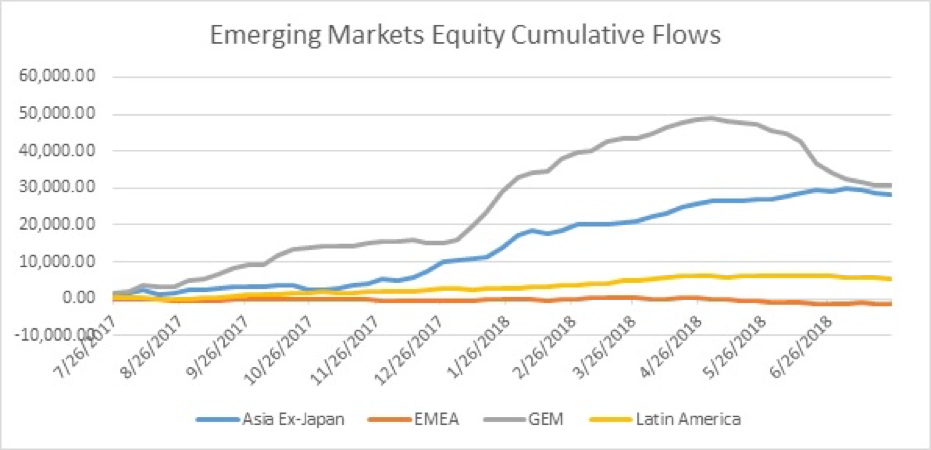

A combination of a strong U.S. dollar and escalating trade tensions continued to place pressure on Emerging Markets Equity Funds, as investors pulled money out of the region for the 10th straight week, with all four of the major regional fund groups experiencing net redemptions. Institutional investors were net redeemers for the third straight week, while retail investors pulled money out for the 11th straight week.

The major emerging regions continue to struggle, with BRIC (Brazil, Russia, India and China) Equity Funds and Asia Ex-Japan Funds posting outflows for four of the past five weeks, while Latin America Equity Funds experienced net redemptions for the ninth straight week.

The Chinese government moved to stimulate the economy, as investors risk appetite rose. The offshore yuan declined to its weakest level in more than a year due to an increase in funding to lenders by the People’s Bank of China. Despite the intervention, investors pulled money out of China Equity Funds for the second straight week after 16 straight weeks of inflows.

Despite Treasury Secretary Mnuchin announcing that a reworked NAFTA agreement may be finalized very soon, investors redeemed money from Mexico Equity Funds after five weeks of inflows.

Uncertainty about Brazil’s political direction ahead of its October presidential election and the unwillingness among the current slate of candidates to champion further economic reforms are taking their toll on investor sentiment towards Latin America’s largest economy, as outflows from Brazil Equity Funds continued for the sixth straight week.

Political uncertainty and populist economic policymaking are also keeping investors cool to EMEA Equity Funds, as investors pulled money from the group for the second straight week. Despite President Ergodan employing a heavy hand in Turkey’s monetary policies, Turkey Equity Funds have attracted inflows for 14 of the past 15 weeks.

Developed Markets Equity Funds

EPFR-tracked Developed Markets Equity Funds recorded overall inflows for the fourth straight week, with U.S. Equity Funds the biggest contributor to the headline number, as American companies continued to report solid second-quarter earnings. Outflows from Europe Equity Funds reached their 20th straight week, albeit, at a slowing pace. After four consecutive weeks of inflows, investors pulled money out of Japan Equity Funds during the week ending July 25.

At the country level, Spain Equity Funds experienced outflows for the ninth time in 10 weeks, as political uncertainty in the southern part of Europe picked back up. But the U.K.’s struggle to come up with a comprehensive agreement ahead of Brexit next March continues to weigh on U.K. Equity Funds, which have now recorded outflows 17 of the past 20 weeks.

After four weeks of net inflows, investors pulled money out of Japan Equity Funds. Despite the recent retail interest in dividend paying stocks as a way of hedging against trade and tariff risks, Japan Dividend Equity Funds recorded outflows for the second straight week.

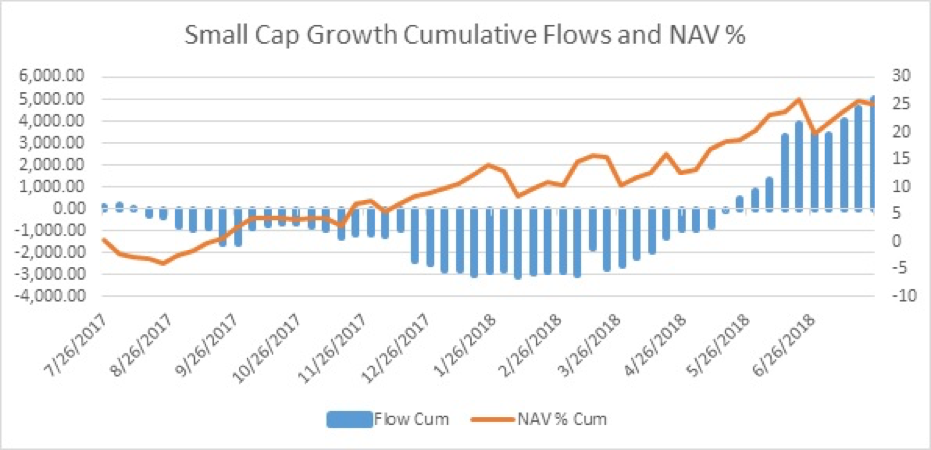

Investors continued to focus on U.S. Large Cap Growth Funds, as they recorded the biggest inflows, while Small Cap Growth Funds continued to attract money. U.S. equities remain well supported by solid corporate earnings and economic data that points to 4 percent GDP growth during the quarter.

Global Equity Funds, the largest of the diversified Developed Markets Equity Fund groups, attracted fresh money, as the group has experienced inflows 26 weeks year-to-date.

Sector Fund Flows

As U.S. corporate earnings season picks up speed, six of the 11 sectors experienced inflows during the week ending July 25. Health Care/Biotech Sector Funds recorded the largest inflows during the week, while Technology Sector Funds attracted inflows for the 13th straight week. For the second straight week, investors funneled money into Financial Sector Funds, as the group’s earnings continue to top estimates. After seven straight weeks of outflows, Commodities Sector Funds experienced net inflows, despite ongoing trade concerns and a strong dollar.

Investors pulled money from Real Estate Sector Funds, as rising mortgage and lumber costs combined with low inventory has put pressure on the housing market. Energy Sector Funds posted outflows as investors weighed conflicting supply and demand signals ranging from Saudi Arabian efforts to stabilize oil prices to the impact of renewed sanctions on Iran. Industrial Sector Funds posted modest outflows, as their input costs continue to rise due to steel and aluminum tariffs.

Bond Fund Flows

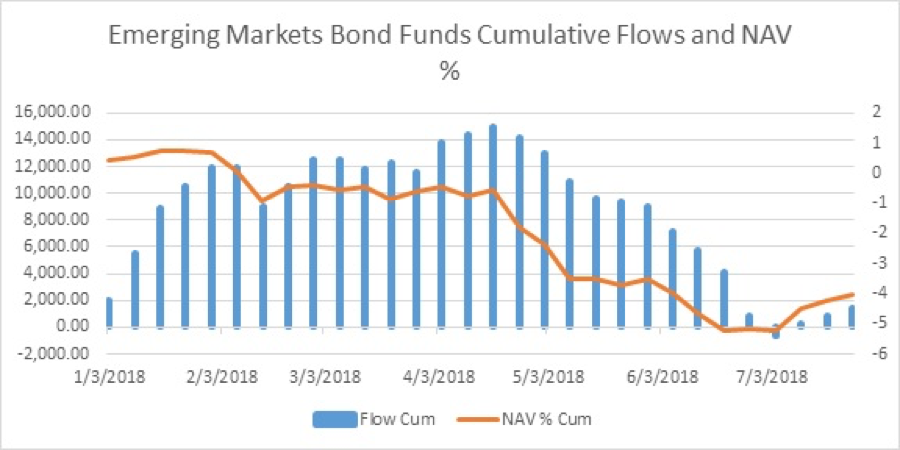

Global Bond Funds posted only their second straight inflow, while inflows into Emerging Markets Bond Funds continued for the third straight week. Municipal Bond Funds experienced inflows for the third straight week, as yield-hungry investors looked for alternatives to richly valued U.S. stocks or sought cover from the trade-related tensions roiling global markets.

At the asset class level, flows into Bank Loan Funds continued for the third straight week, and after four consecutive weeks of inflows, Mortgage Backed Funds posted outflows for the week. Inflation Protected Bond Funds posted outflows after four weeks of taking in new money, and a week after experiencing fresh money, investors pulled money out of Total Return Bond Funds. Outflows from High Yield Bond Funds continued for nine of the past 10 weeks.

Europe Bond Funds experienced inflows for the fourth time in five weeks, as The European Central Bank reaffirmed that it will trim its current quantitative easing program, which includes monthly purchases of up to $30 billion worth of Eurozone debt, again in October and end it in December. At the country level, France Bond Funds posted their largest inflow since the last week of November 2017, while Spain Bond Funds extended their streak of weekly outflows to 11 straight weeks.

Flows to U.S. Bond Funds favored those with intermediate-term mandates. Intermediate Term Mixed Funds recorded the biggest inflows, followed by Long Term Government Funds and Short Term Corporate Bond Funds, while Total Return Bonds Funds experienced the largest outflows during the week.

At the regional level, investors pulled money from Latin America Bond Funds for the second straight week. At the country level, China Bond Funds experienced their largest net redemptions since the middle of December 2017.

Cameron Brandt is Director of Research for EPFR Global, an Informa Financial Intelligence company.