The escalating trade war between the U.S. and China is casting a growing shadow over the global economy. But funds dedicated to the two protagonists sailed above the fray during the third week of August, as investors in both countries tuned out the political noise and focused on strong domestic stories.

Flows into EPFR-tracked China Equity Funds hit a nine-week high, U.S. Equity and China Bond Funds posted inflows for the 14th and 16th time, respectively, since the start of the second quarter. U.S. Bond Funds also took in fresh money for the ninth week running.

With the rest of the world in line to be trampled by this confrontation between the world’s two economic superpowers, investors continued to bail out of funds with global, emerging markets and European mandates. Redemptions from Emerging Markets Bond Funds climbed to an eight-week high, money flowed out of Emerging Markets Equity Funds for the 13th time in the past 14 weeks, Europe Equity Funds posted their 24th straight outflow, Europe Bond Funds recorded consecutive weekly outflows for the first time since mid-June and both Global Equity and Bond Funds experienced net redemptions.

Overall flows remained in the summer doldrums. For the week ending August 22, EPFR-tracked Bond Funds posted collective net outflows of $543 million while Equity Funds took in a modest $2.5 billion and Money Market Funds nearly $18 billion.

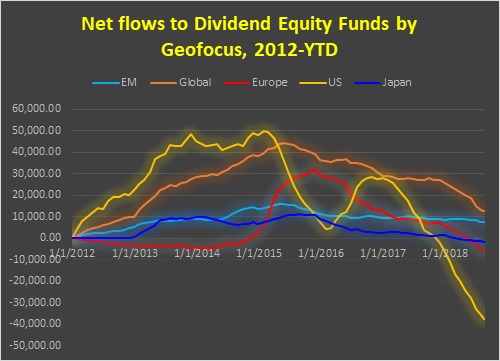

With yields on U.S. Treasurys currently exceeding the average dividend yield for the companies in the S&P 500 Index, investors continue to pull out of Dividend Equity Funds. Collectively, these funds have recorded outflows 31 of the 34 weeks year-to-date with total redemptions now north of the $60 billion mark.

At the single country fund levels, South Africa Bond Funds posted their biggest outflow on record while redemptions from Austria Bond Funds hit levels last seen in middle of the second quarter in 2017. Argentina Equity Funds extended their longest run of outflows in over 7 years and investors pulled money out of Brazil Equity Funds for the eighth week running.

Cameron Brandt is Director of Research for EPFR Global, an Informa Financial Intelligence company.